The levy would target high-frequency trading and is projected to generate $777 billion over a 10-year period.

(Gerd Altmann from Pixabay)

By Bilal Baydoun and Sean McElwee

The Appeal

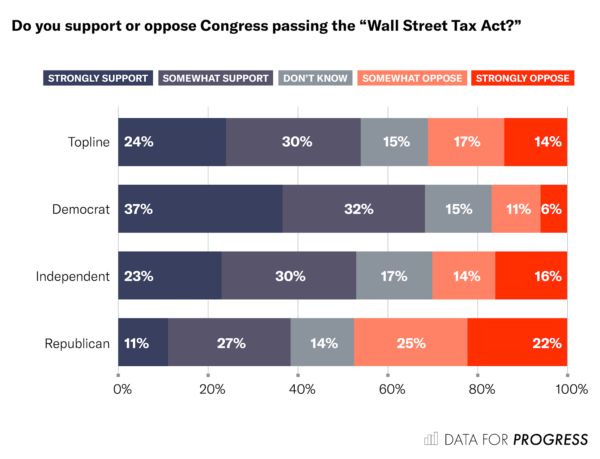

A February poll from Data for Progress and The Lab, a policy vertical of The Appeal, shows that a majority of likely voters want Congress to pass the “Wall Street Tax Act,” federal legislation that would promote equity, fairness, and raise revenue through a tax on trades of certain financial instruments. The results show that:

Fifty four percent of overall voters — including 69 percent of Democrats and 53 percent of independents — support passage of the measure, which would generate an estimated $777 billion in new revenue over a 10-year period.

The proposed measure would tax sales of stocks, bonds and derivatives at a rate of 0.1 percent — the equivalent of 10 cents per $100 sold. In addition to raising new revenue, the tax is designed to target a practice known as high-frequency trading (HFT), which often involves complex algorithms that execute a slew of trades in milliseconds based on miniscule shifts in prices. It would largely exempt long-term assets such as employee retirement accounts, according to Rep. Peter DeFazio, the bill’s primary sponsor.

This type of tax, known as a financial transaction tax (FTT), is progressive given that the wealthiest 1- percent of American families own over 80 percent of overall equities, according to the Federal Reserve Board.

Polling & Findings

In a national survey of likely voters, we provided respondents with the following background on the Wall Street Tax Act: federal lawmakers were considering a bill that would place a tax of 0.1 percent on trades for $100 sold, and would primarily impact “high-frequency” trading, not long-term investments such as employee retirement accounts. High frequency trading involves buying and selling a high volume of shares within a short period of time. It is estimated that this tax could raise $777 billion in new revenue over a 10-year period.

Polling Methodology

From Feb. 5 to Feb. 7, 2021, Data for Progress conducted a survey of 1213 likely voters nationally using web panel respondents. The sample was weighted to be representative of likely voters by age, gender, education, race, and voting history. The survey was conducted in English. The margin of error is ± 2.8 percentage points.

This article is from The Appeal, a non-profit media organization that produces news and commentary on how policy, politics, and the legal system affect America’s most vulnerable people.

“Federal legislation that would promote equity, fairness, and raise revenue”…when will the Federal Government ever halt with being happy by living with their fair share? When does it stop? What is the limit? Can we please just do the flat tax on everyone, on gross income with no exemptions so everyone has skin in the game and the government has to live on those results?

“When the preferences of economic elites and the stands of organized interest groups are controlled for, the preferences of the average American appear to have only a minuscule, near-zero, statistically non-significant impact upon public policy, …”

(2014 study by Gilens and Page)

see: theatlantic.com/magazine/archive/2018/03/america-is-not-a-democracy/550931/

This legislation was introduced in 2019 and quickly shelved.

Don’t hold your breath waiting for this to happen. Wall St. owns D.C.

Check the article from the 17th: “Taxes on the Rich: One-Sixth of What They Used to Be”.

It will certainly be revealing to see the way the financial casino culture of Wall Street pushes Congress to defeat this proposed tax. It is hard to imagine that many people in Congress will vote against the masters that fund them. But I hope it passes. It is long over due.

But why .1% when I pay 7% for a cup of coffee at Starbucks? Why is the tax on commodities ordinary citizens buy 70 times greater than the tax Wall Street investors pay of the commodities they buy. I understand the problem of high volume computer trading in which millions of transactions are made every second. I don’t buy millions of cups of coffee every second. But that’s not a legitimate basis for determining a tax rate. Rather .1% is just a corrupt effort to find a tax that is low enough so that some in the investor class will pay it. At 7% or better the 8.875% of New York City, the proposed bill would be crushed before it could even be introduced.

Taxing stock and investment transactions is long over due. I would like to see it coupled with a reduction of taxes on the working class.

Given that Wall Street benefited from all the helicopter money printed since the 2008 debacle they should pony up and contribute to paying back the debt

This issue has regularly come up through the years. The rich don’t want a penny to trickle down to the middle class, who don’t want a penny to trickle down to the poor. Now look at those in power.

The most telling aspect of this story is that almost half of this supposedly representative sample were opposed to this measure!

“None so blind as those who will not see”

Biden’s Donors don’t support so it is a dead issue.