Supply-side economics fuels inequality, finds a new analysis of 18 countries over the past 50 years. Those who benefit are the super-rich.

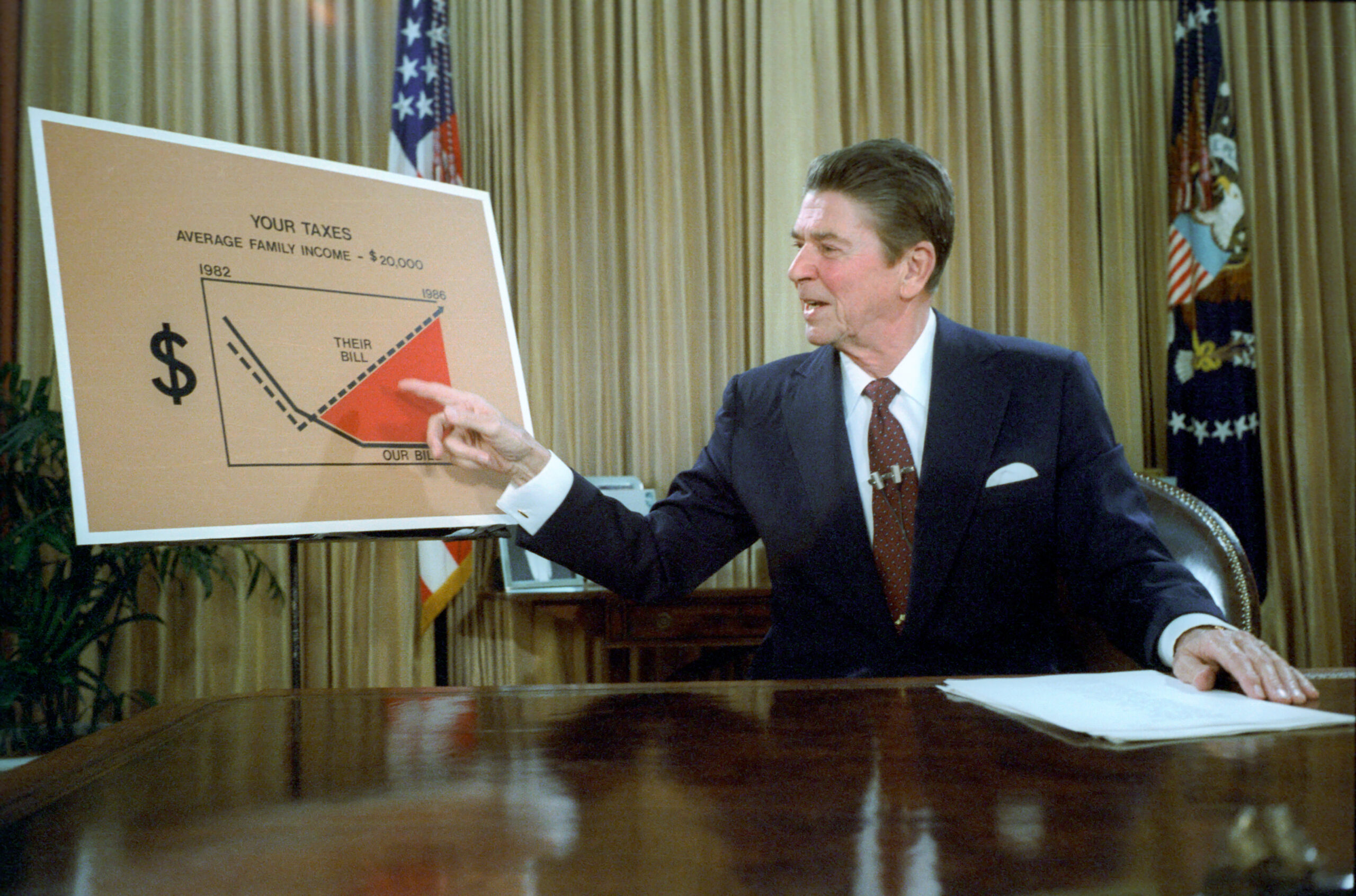

President Ronald Reagan’s economic policies, dubbed “Reaganomics,” were characterized as trickle-down economics. In this picture he is outlining plan for cutting taxes in a televised address in July 1981. (Reagan White House Photographs, Wikimedia Commons)

By Kenny Stancil

Common Dreams

Neoliberal gospel says that cutting taxes on the wealthy will eventually benefit everyone by boosting economic growth and reducing unemployment, but a new analysis of fiscal policies in 18 countries over the last 50 years reveals that progressive critics of “trickle down” theory have been right all along: supply-side economics fuels inequality, and the real beneficiaries of the right-wing approach to taxation are the super-rich.

“The Economic Consequences of Major Tax Cuts for the Rich” (pdf), a working paper published this month by the International Inequalities Institute at the London School of Economics and written by LSE’s David Hope and Julian Limberg of King’s College London, examines data from nearly 20 OECD countries, including the U.K. and the U.S., and finds that the past five decades have been characterized by “falling taxes on the rich in the advanced economies,” with “major tax cuts… particularly clustered in the late 1980s.”

Please Contribute to Consortium News

During its 2020 Winter Fund Drive

But, according to Hope and Limberg, the vast majority of the populations in those countries have little to show for it, as the benefits of slashing taxes on the wealthy are concentrated among a handful of super-rich individuals—not widely shared across society in the form of improved job creation or prosperity, as “trickle down” theorists alleged would happen.

“Our research shows that the economic case for keeping taxes on the rich low is weak,” Hope said Wednesday. “Major tax cuts for the rich since the 1980s have increased income inequality, with all the problems that brings, without any offsetting gains in economic performance.”

No surprise that this argument by lobbyists for the rich proves bogus.

Reduce taxes on rich and you get richer rich, not stronger growth. https://t.co/UXILu5O5wW

— Sheldon Whitehouse (@SenWhitehouse) December 16, 2020

(paper) David Hope, LSE and Julian Limberg, King’s College London: #tax cuts for rich people breed #inequality without providing much of a boon to anyone else @economics https://t.co/dQfv1cW1Id pic.twitter.com/BqI9hmP9CN

— ACEMAXX ANALYTICS (@acemaxx) December 16, 2020

In their study, the pair of political economists note that “economic performance, as measured by real GDP per capita and the unemployment rate, is not significantly affected by major tax cuts for the rich.” However, they add, “major tax cuts for the rich increase the top 1% share of pre-tax national income in the years following the reform” by a magnitude of nearly 1 percent.

The researchers continue:

“Our findings on the effects of growth and unemployment provide evidence against supply-side theories that suggest lower taxes on the rich will induce labour supply responses from high-income individuals (more hours of work, more effort etc.) that boost economic activity. They are, in fact, more in line with recent empirical research showing that income tax holidays and windfall gains do not lead individuals to significantly alter the amount they work.

“Our results have important implications for current debates around the economic consequences of taxing the rich, as they provide causal evidence that supports the growing pool of evidence from correlational studies that cutting taxes on the rich increases top income shares, but has little effect on economic performance.”

Limberg is hopeful that the research could bolster the case for increasing taxes on the wealthy to fund a just recovery from the coronavirus pandemic and ensuing economic fallout.

“Our results,” he said Wednesday, “might be welcome news for governments as they seek to repair the public finances after the Covid-19 crisis, as they imply that they should not be unduly concerned about the economic consequences of higher taxes on the rich.”

Progressives have argued that America’s disastrous handling of the ongoing catastrophe is attributable to several decades of “free-market” ideology and associated policies that exacerbated vulnerabilities and undermined the government’s capacity to respond effectively.

Perhaps the fact that billionaire wealth is exploding while breadlines form across the nation is an indicator that trickle-down economics is a sham?

— Robert Reich (@RBReich) December 11, 2020

According to social justice advocates, taxing billionaires’ surging wealth — akin to the “Millionaire’s Tax” passed earlier this month in Argentina — could contribute to reversing the trend of intensifying inequality plaguing the nation.

This article is from Common Dreams.

Please Contribute to Consortium News’ Winter Fund Drive

It didn’t take a study to prove this. Simply ask some working stiff who is 65 years old right now what they think about it.

Something so vital to successful realization of the American Dream as fair wages went to the wayside. I know who did it and so do you, if you are old enough.

Remember the old method of determining the consumer price index? They used the debasing of that more accurate reflection of what living costs were by changing the variables in the formula and some other low handed maneuvers. One including the method used to determine unemployment.

For instance disposal goods, shelter and a reliable method of transportation – for get about health care, sickness has created pauper after pauper for decades, these things were stolen from citizens under Ron Reagan.

This was about the time all things economic went south for that middle class. Look at the data.

IMHO building gallows instead of bleachers for an inauguration is sounding better and better.

Thanks CN

Oh, for god’s sake. It should be intuitively obvious to the most casual of observers of human behavior that we need to bring back the 91% top marginal tax rate for total incomes > say $10M/yr. An individual can only spend so much money. We have (a ridiculously low) minimum wage but there’s no maximum wage. A review of the data for CEO compensation post St. Ronnie tax cuts shows that corporate earnings have increasingly gone to the top wage earners. You effectively offer these bozos a choice – either flatten the wage slope and pay your people better or give it to the government because we aren’t going to let you keep it all to yourself.

Yup!

All societies are hierarchical. Correct me if I am wrong, oh yee learned anthropologists, but I remember reading that in Mongolia in centuries past – perhaps even in to this day – the ‘lords’ of the plains lived in ‘lavish’ gels – yurts in Turkic. As in all cultures, they imbibed a substance, perhaps fermented horse milk, that transported them just a bit from the travails of this world. i.e. they got drunk or high or however you wish to describe the cessation of an otherwise (o)pressing reality. But they did not share this bounty with the lowest caste who, as everywhere, did all the real, soiled hands on work. However, when the inebriated lords stepped out of a gel to piss, those poor, grovelling minions held out their bowls so that said lord might piss into it and thus share, however slightly, his buzz. And that, my friends, is Trickle Down Theory in a piss bowl!

This has remained a solidly bipartisan effort. This isn’t the first time that the US went through a period of massive upward wealth redistribution, to the great harm of the country. Each time in the past, the “masses”ultimately united to push back, for the common good. That’s not going to happen this time. As our govt. effectively redistributed several trillion dollars upward since Reagan, years of work went into dividing and conquering the masses, middle class vs. poor,workers vs.those left jobless. This ensured that there can be no people’s push-back this time.

And just today the fed. ok’d the big banks that got covid bailouts to use the money to invest buybacks of their own stock…trickle-down does not exist!

In the words of George W. Bush, “Mission Accomplished”. The Powell Memorandum recommended a course of action by the 1% to combat and reverse the “excess of democracy” which had, gasp, actually allowed the people to have a say in how the affairs of their Country were conducted. The reversal of the improvement of the lot of the middle class began in a small way under Carter, but exploded, as designed, under Ronald Reagan. I am a retired tax attorney was teaching corporate income tax in a law school at the time of Reagan’s “Trickle Down Economics”, a big part of which was the destruction of the progressive income tax system. While studying the tsunami of huge tax law changes which accomplished this task, I read a great article, which included a succinct judgment on the false claim made by the supporters of this new system. The judgment of the author (whose name I cannot recall) was to the effect that if the trickle down economic program had been presented as a security offering, all the promoters would be in jail. I think that summed it up very well. The program was designed to (1) give almost all of the enormous tax cuts to the 1%; (2) by drastically cutting revenues, create a huge deficit, which was accomplished in dramatic style; and (3) to use this manufactured “budget crisis” as a pretext for cutting, with a goal of eliminating altogether, the social welfare and safety net programs. Of course, the war budget was treated as sacred; anyone who even suggested a cut was denounced as unpatriotic and a threat to national security. As the author says, the result has been disastrous for everyone except for the very wealthy. The standard of living for the rest of us has been drastically reduced. Contrary to the claims of the proponents. this was always the intended result of these policies. It was put forth in bad faith as a deception, supported, as always, by the mainstream media. The proponents were then able to cement in the continuation of their victory by orchestrating the legalized bribery system which is called our electoral system. So the people have almost no say in which candidates are placed on the ballots. The 1% makes sure that the candidates of both of the major parties are vetted well, thereby insuring that, regardless of which one wins, the winner will in fact adopt policies which favor the 1%. More cement. In closing I will admit that the trickle down policies did create some new jobs. Specifically, it created a flood of money out of this Country to foreign tax havens, where many new jobs were necessary to service this red hot business. Bank, financial planners, tax planners (to make sure that none of the new minted money would ever be subjected to U.S. tax) and related jobs. I am sure that the folks in those tax havens are appropriately grateful for this Country largesse.

Trickle-down is better described as ‘splatter-off’ (?)