Recent years have taught us that the official responses to crises will ultimately help Wall Street and the markets, while leaving real people behind again, writes Nomi Prins.

Hartsfield-Jackson Atlanta International Airport, March 6, 2020. (Chad Davis, Flickr, CC BY-SA 2.0, Wikimedia Commons)

Whether you’re invested in the stock market or not, you’ve likely noticed that it’s been on a roller coaster lately. The White House and most of the D.C. Beltway crowd tend to equate the performance of the stock market with that of the broader economy. To President Donald Trump’s extreme chagrin, $3.18 trillion in stock market value vaporized during the last week of February. Stock markets around the world also fell dramatically. When all was said and done, $6 trillion had been at least temporarily erased from them. It was the worst week for the markets since the financial crisis of 2008 and it would only get worse from there.

Whether you’re invested in the stock market or not, you’ve likely noticed that it’s been on a roller coaster lately. The White House and most of the D.C. Beltway crowd tend to equate the performance of the stock market with that of the broader economy. To President Donald Trump’s extreme chagrin, $3.18 trillion in stock market value vaporized during the last week of February. Stock markets around the world also fell dramatically. When all was said and done, $6 trillion had been at least temporarily erased from them. It was the worst week for the markets since the financial crisis of 2008 and it would only get worse from there.

In the wake of that, the Federal Reserve kicked into gear. By the first week of March, after high-level coordination among the Group of Seven (G-7) countries and their financial elites, the Fed acted as it largely had since the financial crisis, but with more intensity, giving the markets a brief shot in the arm.

In a move that Wall Street and the White House had clamored for, the Fed cut the level of interest rates by half a percentage point. The markets reacted by doing exactly the opposite of what the Fed hoped and, after having briefly soared, the Dow then tanked nearly 1,000 points that day. The next day, it rose 1,173 points (also partially attributed to Wall Street’s embrace of Joe Biden’s Super Tuesday results), only to plunge again soon after. Then, this Monday, within a few minutes of opening, the markets dropped more than 7 percent, triggering a halt in trading.

Dizzy yet? Okay. Let’s take a step back.

Wall Street doesn’t like uncertainty. Worries about the outbreak of, and economic fallout from, the coronavirus have stoked fears globally, only compounded by the start of an oil-price war. Big Finance doesn’t deal well when its money is on the line. What’s referred to as a liquidity shortage (or lack of free-flowing money) is Wall Street’s deepest fear. That’s what happened during the financial crisis of 2008. Under those circumstances, banks stop lending — both to each other, to corporations, and to real people — and look to external forces like its “lender of last resort,” the Federal Reserve, and to the government to bail them out.

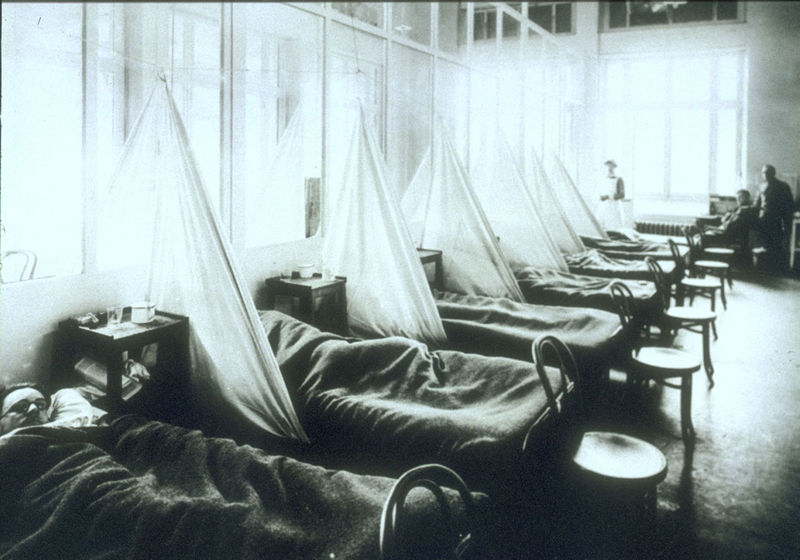

That’s why what’s transpired with the coronavirus is so illuminating. It’s not like the financial crisis, but central bank reactions are similar. There is a known chain of events that underscores the transmission of diseases: close contact, shared food, a stray cough or sneeze. What’s unknown with a novel virus is how long and far and deep that transmission will go into any society, how it might still mutate, and how disastrous — as in the case of the Spanish Flu of 1918 — the consequences could be.

American Expeditionary Force victims of the Spanish flu at U.S. Army Camp Hospital no. 45 in Aix-les-Bains, France, 1918. (U.S. Army Medical Corps photo via National Museum of Health & Medicine website, Wikimedia Commons)

On our globalized planet, the constant movement of people across borders has made the world smaller and more connected than ever. This means that it’s made diseases ever more communicable and its ability to throw a monkey wrench into a globalized economic system and financial markets so much greater. People of various ages from varied cultures, religions, and economic statuses have the ability to intermingle in transit, whether at an airport, in a grocery store, or on a subway platform.

Several passengers with the coronavirus, initially confined to a cruise ship off the coast of Japan, for instance, led to fatalities and contagion elsewhere and were among the many catalysts in the spread of that disease and of associated economic problems to a distinctly globalized and previously profitable travel industry. The coronavirus threat soon impacted that industry’s workers, food and drink suppliers, entertainers, crews, cleaners, and all associated family members. As a result, with other cruise ships experiencing similar problems and airlines in crisis, the travel industry was crippled, while the demand for the goods and services associated with it shrank. It even undoubtedly cost the Trump Organization, in part a travel and resort business, a penny or two.

Now, bear with me for a brief, deep dive into economics. Consider the commonly used economic term “supply chain.” It’s just a chain of people or businesses that interact with each other where money, goods, and services are exchanged along the way. The more interactions that take place around the world, the more global it obviously is. That’s why trade wars, though initiated by leaders (and their giant egos), impact the economic lives of so many from the top down.

In a world that’s seen a dramatic rise in isolationist politicians and policies, the coronavirus reminds us that we still share a planet where not everything is controllable by brute force or posturing. Medical, climate, and financial crises can spread ever more rapidly in this distinctly globalized world of ours for a variety of reasons. That’s why the old adage an ounce of prevention is worth a pound of cure still holds.

The reality is that an economy based on a kind of inequality once unknown to Americans is at a crossroads and the coronavirus seems to have infected it. So even with the cards stacked in their favor, the unseemly wealthy and the denizens of Wall Street can’t prevent real people from taking the brunt of the blowback. Nor will the Fed, whatever its rate cuts, nor Donald Trump, whatever his tweets, be able to prevent the majority of Americans from taking a significant hit in what’s sure to be a global economic storm. Maybe they can temporarily assuage stock market concerns, but there are no guarantees.

Even if the extreme inequality of the present moment has its obvious precedents, the volatility that’s now whipsawing across the world is only likely to continue to widen that great divide, possibly to the breaking point.

President Donald Trump delivering a statement about the Covid-19 pandemic, March 11, 2020. (Screenshot)

This Time, Inequality Is Different

The prescription for the last major financial crisis went something like this: The biggest Wall Street banks faced a subprime loan abyss of their own making, but one that would come to hurt everyone else. They had crafted trillions of dollars’ worth of toxic assets based on the assumption — bizarre in retrospect — that there would be more incoming subprime loan payments than there had been subprime loans to begin with. When the subprime mortgage crisis began and payments became delinquent or morphed into defaults, the toxic assets of those banks went belly-up. Having used other people’s money to gamble on risk and having created complex assets to make their bets, they lost money themselves big time, but it was others who truly paid the price.

Some of those big banks, like two of my former employers Bear Stearns and Lehman Brothers, had borrowed too much from other big banks. When they couldn’t repay the money they had borrowed to bet on those toxic assets, they went bankrupt.

The surviving big lenders and politically well-connected banks like JPMorgan Chase and Goldman Sachs played it differently. They extracted an epic level of support from the Obama administration (read: us taxpayers) and the Federal Reserve and so survived before, of course, going on to thrive. Other major central banks followed the Fed’s lead in lowering rates, while purchasing assets from troubled banks in return for cash.

By December 2008, the federal funds rates (the interest rates by which banks lend money to each other based on what they have on reserve at the Fed) had been pushed down to zero and they’ve remained at historically low levels ever since. According to a 2011 Government Accountability Office report, the Fed extended $16 trillion in loans in the wake of the financial crisis, most of which went to the financial industry. Over time, it also created more than $4.5 trillion to purchase Treasury and mortgage bonds from Wall Street firms, most of which it now houses on its own books.

During the financial crisis of those years, the world’s major central banks, mostly in G-7 countries like Germany and Japan, created what was supposed to be an “emergency” policy, which soon enough became a new normal that’s lasted 12 years. They kept the average cost of money flowing to those endangered banks, their largest corporate clients, and the markets at near zero percent or even, in some instances, at negative rates. This policy subsidized or socialized losses and eventually sent stock markets to all-time highs.

The prevailing narrative then (and now) was that this “cheap money” would incentivize banks to lend and that companies would use those loans to invest in the future and in their workers, a grand experiment, it was claimed, to spur economic growth for real people. Think of it as a classic case of a trickle-down economic theory on steroids.

What happened in practice was a staggering increase in global inequality. In effect, the major central banks became centralized ATM machines for the world’s banking system and financial markets. The amount of debt created by their respective governments — because the rates and cost of borrowing that debt were so low — skyrocketed. The value of financial assets like stocks, as well as government and corporate bonds, ballooned, creating what even major business news channels would characterize as a “bubble.”

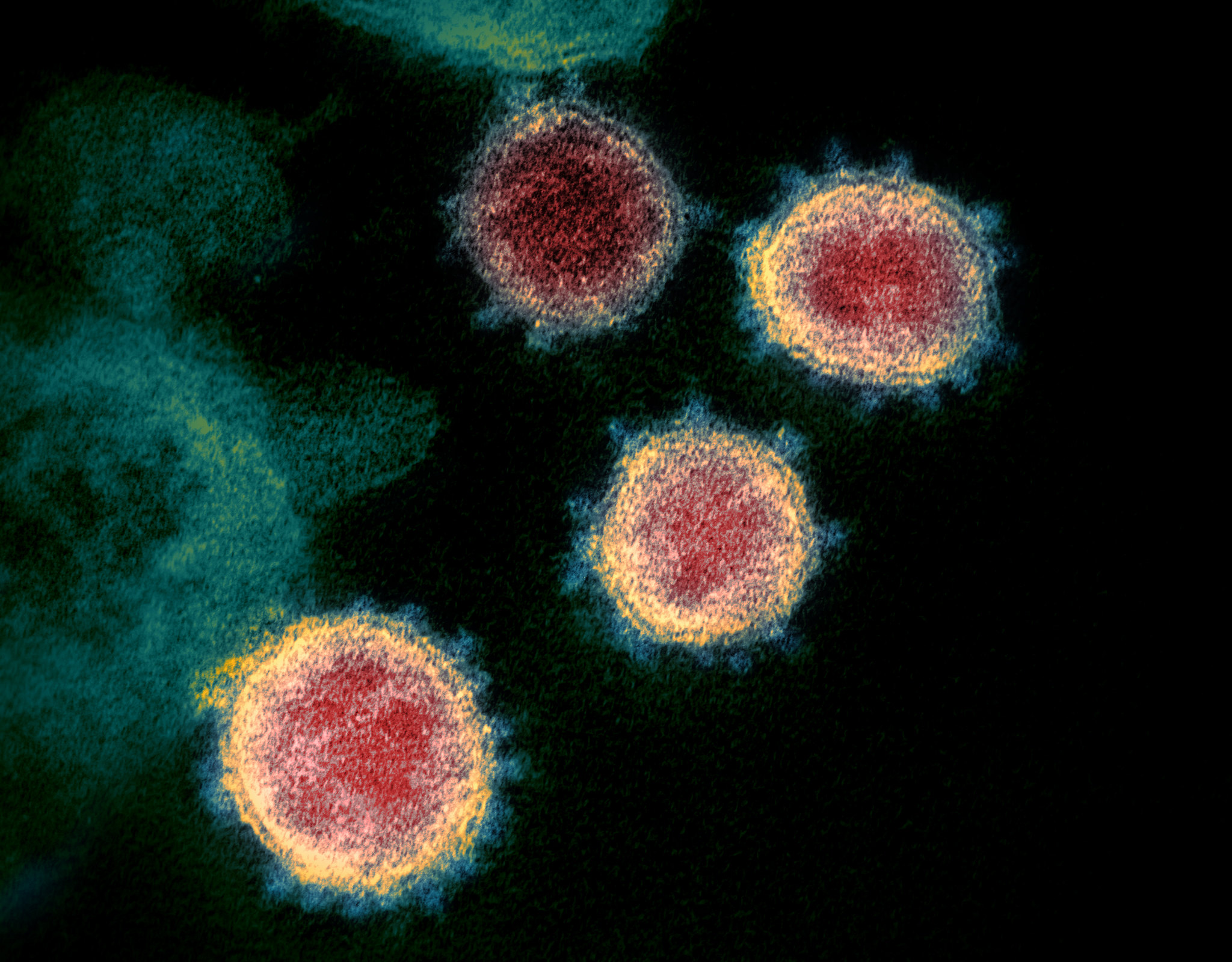

Microscopic image of the virus that causes COVID-19. Spikes on the outer edge give coronaviruses their name, crown-like. (NIAID Rocky Mountain Laboratories, NIH, Wikimedia Commons)

Central bank leaders and politicians embraced the idea that the ongoing “emergency” creation of cheap money was for the good of the economy. And every time the markets got skittish, central banks turned to the same money-creating well to help them.

Like Dr. Frankenstein, the experiment became the monster. The byproduct of making lots of money available to a sliver of society was, of course, that it flowed to the top, only exacerbating the already significant inequality on this planet. That’s why there’s something the same and yet so different about today’s inequality.

In Wall Street-speak, today’s level of inequality globally is the “trend.” After all, over the past three decades, the gap between the haves and have-nots has hit historic highs, especially in the United States. According to Daan Struyven, senior economist at Goldman Sachs (another of my former employers), “The wealthiest 0.1 percent and 1 percent of households [in the U.S.] now own respectively about 17 percent and 50 percent of total household equities, up significantly from 13 percent and 39 percent in the late 1980s.” And just over half of Americans “own” stocks in some fashion, if you include those with 401(k) plans, shares in an equity mutual fund, or an IRA. So when the market pops up, inequality doesn’t shrink. It only grows.

Yet, on the other hand, there’s something dramatically different about this particular period of inequality. In quant speak, that’s the genuine outlier. During this post-2008 crisis period, much of that low-interest-rate money unleashed by the central banks and its benefits have gone disproportionally to the top 1 percent

The Fed, the Money & the Inequality

In countries where central banks intervened the most, the increase in the total value of stock markets outpaced economic growth. Yet Fed Chairman Jerome Powell claimed that “there is nothing about this economy that is out of kilter or imbalanced.”

In fact, the speculation and investing in these years flies in the face of that explanation. If it’s cheap and easy to access money and someone wants to grow that money, investing has long been considered the go-to option. The stock market is an avenue where money can push up the value of share prices by the force of its mere presence. In the world of big finance and markets, however, what goes up can plummet down even faster.

The natural question then becomes: How did a soaring stock market, propelled by cheap money, create yet more inequality? As a start, of course, the increase in stock market values has gone predominantly to the relative few who are significantly invested in those markets. That’s because, in terms of wealth, the top 10 percent of Americans own 84 percent of the stock market, up from an already staggering 77 percent in 2001. In addition, as Fortune Magazine put it recently, “The top 1 percent continues to increase their stranglehold on wealth in this country, while the middle and lower class are losing ground.”

Rally to demand accountability from the financial institutions and legal action against bankers, Minneapolis, May 21, 2013. (Fibonnaci Blue, Flickr)

We’re talking, of course, about the wealthiest people and companies in society, including corporate executives who get paid in shares and stock options and are often capable of pushing up the price of their own shares by deploying money to buy them back. If stock markets are floating on that cheap money, what happens if (or rather when) it goes away? What happens when serious trouble builds requiring something other than the ability of central banks to combat it with more cheap money? The answer could be a massive, even historic, stock market crash.

Finally, if cheap money can inflate financial assets more than the real economy and the wealthy possess more of it than most people, won’t that simply increase inequality to yet greater heights? The answer is: yes. “So in some sense the source of higher inequality is Fed policies, which pushed stock prices and home prices higher,“ as Deutsche Bank’s chief economist Torsten Sløk noted.

The Election & Inequality

If we learned anything from the 2016 election (and from where the 2020 election is headed so far), it’s that Americans, whether on the left or right, don’t like having the deck stacked against them. Trump struck a populist, anti-establishment chord in his voters in 2016 (despite being a billionaire), including among workers who had once voted Democratic yet were feeling ever more economically insecure when it came to their future and that of their children.

Trump has taken aim at Fed Chairman Powell both for raising rates in 2018 and for not lowering them enough in response to the recent coronavirus dive. In tweets, he implied that Powell was the enemy of all that’s good (for Trump) by being unwilling to bend fully to White House pressure on monetary policy. In the wake of Powell’s recent lowering of those rates, the president tweeted, “As usual, Jay Powell and the Federal Reserve are slow to act. Germany and others are pumping money into their economies. Other Central Banks are much more aggressive.”

Trump’s policies — notably the trade war with China that has hurt American farmers and manufacturers — have placed workers in an ever more economically vulnerable position. At the same time, the administration’s tax cuts for major U.S. corporations (and billionaires) haven’t done the poor or working class any favors either.

But Trump knows that cheap money, if it flows anywhere quickly, will flow to a stock market that he’s repeatedly touted as being up big under his administration. And until a couple of weeks ago, the Dow had indeed rallied by as much as 61 percent since the 2016 election. In comparison, the average annual growth in gross domestic product has been stuck around 2.5 percent per year.

If the coronavirus has shown us anything, it’s that unforeseen factors can crush the market and, by extension, the economy and American workers. This will incite the Fed and central banks elsewhere to intervene under the guise of helping the economy. March’s emergency rate-cut was the first since the financial crisis of 2008. It was also a clear sign that the Fed is deeply concerned about the dangers a potential global pandemic can inflict on a thoroughly globalized economy and its banking systems.

If recent years have taught us anything, it’s that the official responses to crises will ultimately help Wall Street and the markets, while leaving real people behind again. It’s a vicious cycle that will only stoke inequality further until, of course, whether thanks to the coronavirus or some unknown future development, it all comes tumbling down.

Only creating a more level playing field and a new, sustainable, more equal path forward could alter this fate — and count on one thing: that won’t come from central bank interventions or from the Trump administration. You would need the sort of systemic overhaul that would result in real policies that could stimulate economies from the ground up. For the present, wash your hands, don’t touch your face, and hold your breath.

Nomi Prins, a former Wall Street executive, is a TomDispatch regular. Her latest book is “Collusion: How Central Bankers Rigged the World” (Nation Books). She is also the author of “All the Presidents’ Bankers: The Hidden Alliances That Drive American Power” and five other books. Special thanks go to researcher Craig Wilson for his superb work on this piece.

The views expressed are solely those of the author and may or may not reflect those of Consortium News.

Please Donate to Consortium News.

Before commenting please read Robert Parry’s Comment Policy. Allegations unsupported by facts, gross or misleading factual errors and ad hominem attacks, and abusive or rude language toward other commenters or our writers will not be published. If your comment does not immediately appear, please be patient as it is manually reviewed. For security reasons, please refrain from inserting links in your comments, which should not be longer than 300 words.

It takes a whole lot of coincidences for disasters of epic proportions to take place.

You would have to be a fool to believe the official narrative that, while we knew this was coming as all the world was watching China, the lack of unpreparedness on the part of CDC and medical community was the result of mere “bad decisions” and incompetence.

It’s almost like the medical illness industry’s “invisible hand” of free market was wishing for this epidemic to grow into a chaotic situation of high demand that can be exploited for high profit. Obviously, no one in the medical profession is going to say outwardly that they wished for this. But given the reality of a medical system that is based on exploitation of consumers for profit, it’s foolhardy to think that there was no profit motive on the part of medical illness profession for this epidemic to take hold and spread.

“CORONAVIRUS- Lies for the sake of profit?

-Respiratory viruses are transmitted via contact, droplets or aerosols.

-Most studies on inter-human transmission routes are inconclusive.

-The relative importance of respiratory virus transmission routes is not known.

-Modern detection methods can advance transmission experiments.

-Knowledge on inter-human virus transmission will improve intervention strategies

Respiratory tract infections can be caused by a wide variety of viruses. Airborne transmission via droplets and aerosols enables some of these viruses to spread efficiently among humans, causing outbreaks that are difficult to control. Many outbreaks have been investigated retrospectively to study the possible routes of inter-human virus transmission. The results of these studies are often inconclusive and at the same time data from controlled experiments is sparse. Therefore, fundamental knowledge on transmission routes that could be used to improve intervention strategies is still missing. We here present an overview of the available data from experimental and observational studies on the transmission routes of respiratory viruses between humans, identify knowledge gaps, and discuss how the available knowledge is currently implemented in isolation guidelines in health care settings.” SCIENCE DIRECT, 2018

i hope everyone gets well and this epidemic soon ends. peace and love.

CN, can you find anyone who is researching this KEY question… Why did the CDC refuse the WHO’s offer of accurate, working test kits in January and instead say they’d make their own, then roll out defective, inaccurate test kits that took MANY weeks to rectify, losing critically valuable time in this pandemic? I want to know the deep machinations behind this bone-headed decision. I am pretty sure it involved a profit motive as the USA’s true motto is “Profit Over People,” but I’d like someone to take a deep dive into why this decision was made. It will spell the deaths of many, many thousands of people in this country before it’s all over with. Does anyone know the details and the names??? I’d like to recommend Tomas Pueyo’s recent supremely important article on Covid-19. Everyone should read his piece. Everyone. Stay safe, CN fellow humans. Wash those mitts of yours and keep them away from your face at all costs, while out in public. To all the most vulnerable, please stay home more. Cheers, ML

The giant Ponzi scheme which the market became is based on smoke and mirrors. The FED printed money for 12 years, which was poured into the stock market, not the economy. People didn’t grow. Now chickens have come home to roost. All that cheap money will vaporize into the mist. And with it the world economy also. It’s a $75 trillion credit bubble now, and it got popped. And yes, the little people will be the ones to suffer.

It sounds like another historical bankster scam bubble is running into physical reality. I’d like to see the Bernie Madoff solution. Put the banksters in prison, and claw back all their ill-gotten gains. Then nationalize the Fed, as per the U.S. Constitution, so the American people own all the newly created money, instead of a gang of sophisticated criminals. That will eliminate a lot of our major problems at the root. Ellen Brown’s work in The Web of Debt is very good on this. Also, a useful sketch of the taproot is at

tinyurl[dot]com/rf28ssz

Everyone is talking about “Debt” but we must recognize that the U.S. does not know how large its debt is …….

The “Economic System” itself is a “Myth” propagated by “Magicians” who afforded themselves the costs of a higher education and “Purchased” a PHD or an SH?T after their names. The same way that a Christian Preacher attends a religious institution and leaves with a “Certificate Of Christendom”.

Economists perform the same tasks and for the same reason for which magicians played their essential roles during olden times with Kings and Queens.

Economists are like the Court Magicians of Olden Times and where the Queens and Kings gave them a special place in the Royal Court.

Nobody knew or understood the magic just as nobody really knows or understands the magic of economics.

The magicians even dressed differently than other members of the Royal Court, just as the bankers today wear a suit and tie.

With critical supply chains now snaking through China and the Far East, even if the COV-19 does not infect 70 million people at a 1% fatality rate with 700,000 deaths in the US alone (worst case scenario, unlikely unless the US screws up their response even more), the economic effects will continue until supply chains are restored (three months?) In most cases American businesses are totally dependent on Asian vendors for parts, chemicals and products. Do we have enough medicines (90% from China)? Do we have enough pulmonary ventilators (which Italian physicians said “were gold” in saving lives there– China sent 10,000 when other EU countries refused to help)? Maybe our MIC will lose its production (hopefully they are stupid enough to base their weapons on materials from a foreign “adversary”?)

The US learned NOTHING from the H1N1 pandemic that killed over 500,000 globally in 2009, unlikely we’ll learn anything from this one.

As a contrarian and with money available at almost zero rates, with fear and panic in the markets, these dips are great buying opportunities. Place your buying limits on the stocks you always wanted to buy.

In a few weeks the corona bad news will turn into better news and the market will start to realise Trump will be re-elected. So on a time frame of another 4 years expect the market to retrace all of its losses.

This is just my personal opinion based on 40 years of market trading experience. ( DJ drinking club)

The rather glamourous couple in your lead photograph are wearing masks yet are holding fast food/fastest method of getting infected, unwashed hands, food to mouth. They won’t die because there young but they are at an airport doing their best to spread the infection as far as possible so that people who are susceptible can catch it.

Maybe the masks are so they can’t be identified ; l

What Trump & his Federal Reserve doesn’t understand is you can’t print your way out of a Worldwide Pandemic? Printing fake money at $1.5 Trillion dollars, every second day, to infinity is the last gasp attempt to rearrange the deck chairs on the US Economic Titanic? The Coronovirus doesn’t differentiate between rich or poor or the Powerful or powerless? Coronavirus has provided the pin that’s going to pop this huge American Ponzi scheme, Neoliberal Economic system & its deathcult Healthcare system that cares more about profits over the wellbeing of its own Citizens? And the laziest, most dishonest POTUS ever in Trump will not be able to BS his way out of this crisis, America is going down in a screaming heap of DEBT? Nomi Prins is spot on with her analysis of the current situation but is short on solutions, stating that REAL people will pay the price, yet again? I would suggest that there must be a bailout for the REAL PEOPLE in order to control the virus spreading? Recall the Military & stop funding ridiculous Military spending & allocate those resources to fighting the virus, not imaginary enemies? Give Bailout Payments to the Citizenry so they can pay their Rents & Mortgages, provide Food & free Healthcare must be implemented so people can afford to self isolate? To hell with bailing out Big Banks or Corporations or propping up the failing, flailing Stock Market? NATIONALISE them all if it comes to that, no more Socialist bailouts for them only for REAL people! Impose a Debt Jubilee to wipe out all Consumer Debt & College Loans etc? People must be the priority now & saving as many as possible from the Coronovirus , & stop this obsession with fake money and endless growth profiteering! Will this happen in America or the West? Not on your life, they would rather see the whole World collapse into a massive depression rather than help the Citizenry!

The new Corona strain is an excellent agent to use as justification for a new round of inter agency, governmental “dry run” drill(s). This pandemic now assumes the shape of Presidential Declarations, more intrusion into privacy, the raison d’ etat for releasing additional helicopter monies for “emergencies” AKA a sudden jolt of higher inflation without anyone to blame. This scenario is now coupled with that faint odor of marshal law or should I say, getting the general public accustomed to drastic government edicts. A similar episode occurred during Katrina, where local citizens in the New Orleans metro areas were subject to lethal force used by paramilitaries to protect private property again, with the Imperial President issuing Emergency Funding authorized by then, Bush Jr. I’m suggesting that if an epidemic equivalent to the Spanish flu occurs, monies may be released into the hands of private policing corporations aided with drones hovering over our citizenry. The excuse for this maneuver will be contrived along the lines that most of our troops are busy, permanently stationed abroad..

I hope CONSORTIUMNEWS readers have not forgotten the 1993 World Trade Center bombing, a prelude to 911? What might this COVD-19 be a prelude to? Has bio-warfare been taken off the shelf? by what element, group or body?

Recent Zerohedge articles written by Tyler Durden (2/13/2020) and similar inquires by journalists such as Spiro Skouras, suggest that deliberate genetic manipulation may be at the root of this new outbreak. Visit those interviews of Dr. Francis Boyle, a bio-weapons expert. He speculated that this particular COVID-19 strain may be a direct result of an accidental release from a biological BSL 3 and or 4 level research lab in Wuhan China, where previous corona virus strains were manipulated for “gain of function” thus, given attributes that can only increase viral lethality.

Can this Corona outbreak be in part, blamed on paper currency handling? identified as one of several fomites (vectors) that contribute to transmission? Could COVID 19 be just the excuse that blasts another government edict onto MSM TV viewers, ordering the immediate implementation of bank issued crypto-currency? and banning fiat paper and precious metal coinage altogether? The possibility has been suggested by Gerald Celente of Trends (in the news) Mag…

Wall Streets solution for the public is for the borrower to refinance their debt again and again and then some. Forget the pay raise and never expect a price decrease like with your healthcare because you… no we are all on the conveyor belt of debt unless you get a tax break or something which you don’t. It’s not a matter of paying down the national debt in as much as it is to only make that huge debt get bigger and bigger… think of what 1% of a lot of trillions will yield the already hidden elite and there you may find your answer to this plutocracy of finance. The worst part is is that this system controlled by the continuous money lenders is so interwoven and so very complex by design as it puzzles one to no end to how you would even begin to unravel it… truly a difficult task if ever there was one. The best thing you can do is to stay the most you can out of any serious hard to pay debt burden… the next time maybe I’ll tell you how if our family business were located in Canada with a public healthcare system as theirs we in our little firm here in the US for the 1% could save close to 30% in fixed expenses ..but then that would make us commies if we were too advocate for such a pinko thing.

“It all comes tumbling down” is a very vague description. How can we stop poor people from WISHING they were rich? Turning the tables or changing places, actually maintains the status quo.

Naomi Prins is very good, but except for the final two paragraphs, this is all familiar, almost redundant except for those not paying any attention. At the end, which is where we are now, Prins says we need a “systemic overhaul that would stimulate economies from the ground up.”

The order of that will be reversed because we have an emergency at hand and do NOT have agreement on the systemic overhaul. Meanwhile, in 2020 some tens of millions of people, who have been just keeping up financially, will incur expenses they are unable to pay. To prevent utter collapse in 2020 while we contemplate systemic change … I propose a campaign for immediate action. It can be carried while we all are increasingly confined to telephone, website forums, email, social media, and limited public events: DEBT RELIEF FOR ALL. A payment of $10,000 to every U.S. citizen over the age of one would cost less than $3.5 trillion, less than the Fed has pumped into the banks in recent weeks. The first $1,000 could be applied to household debt to placate bankers and their pals.

Health care for all NOW

Debt relief for all NOW

NOW not next year!

NOW not next year!

Great comment. Makes entirely too much sense.

Thanks for publishing this piece by Nomi Prins. I read her work in conjunction with that by Jim Rickards. She’s super smart concerning big money, and writes well.

We shall see how this plays out. After the US markets closed on Friday, I was surprised how much gold tanked. One would think it would be rallying. Rickards describes three separate ways in which the gold markets are manipulated. Makes one wonder if it’s a flush out.

I too have been reading Nomi’s work through Jim Rickards newsletter and she has my respect for how she has chosen her path in life to depart from the Goldman Sachs (the Vampire Squid) and all that that company represents.

This is possibly the best article that I have ever read that sums up where the world is at financially in 2020 with an explanation of how we got here since 2008, especially as regards the clear-as-day explanation of how the 1% has expanded its grip and power. Very well done to Nomi.

The one thing that is not needed is more liquidity. The big Wall-Street and London -centered banks don’t need to be bailed out, they need to be broken up. Any bailouts would, like in 2008, be passed on to the hedge funds, investment units, speculative units, etc and would never reach the real economy. There is only one action which would, at this point, prevent a disorderly meltdown, and protect the legitimate assets of our commercial banks such as mortgages, and pension funds: That is restoring the Glass-Steagall Act in its original 1933 version and making its rules effective within a very short period, forcing then to sell off these speculative units, stop lending to them an let them fail -as they will most certainly do. Only then can new lending go out, either through a nationalized Fed or an investment vehicle modeled on FDR’s Reconstruction Finance Corporation to meet the needs of infrastructure, perhaps beginning with the health care industry, such as new hospitals, more beds, more ICUs, electrical power and water requirements etc. before addressing the larger needs of the nation .

JDD, great comment. The concentration of communications and finance ownership is a real problem that has been ignored for obvious reasons.

The Fed pumps $1.5 trillion into the parasites on Wall Street but, oh yeah, that’s right, we can’t afford student debt cancellation or Medicare for All.

Meanwhile, the empire takes this moment in time to launch airstrikes against Iranian supported forces in Iraq.

The priorities of our elites have never been clearer.

Meanwhile, the Fed itself is not a publicly owned institution, but a privately owned one. Yet another instance of private hands using public, i.e. lowly taxpayer monies (there are no taxpayers who are not “lowly,” the “highly” paying all but no taxes via one route or another). Of course, those monies are all debt loaded onto the the shoulders of future gens of the “lowly.” Who won’t – if the DC-Wallstreet crowd have any say, and they have ALL the say – get what pretty much every other western nation “lowly” person has: free-at point-of-service medical care, free or very cheap tertiary education etc. etc.

But as you write – somehow we can “afford” to devastate other peoples homes, lives, livelihoods, countries, and do so with apparent glee, much rubbing of hands (in such quarters as make oodles of boodle from the murderous slaughter of millions and/or profit politically from it) at the profiteering prospects.

Pork barrel politics, pig trough profiteering (warmaking *and* medico-pharma), and an apparently endless supply of sinecured politicos who believe in American “purity of intention,” “exceptionalism,” “indispensability.” At least insofar as their own sinecures, future revolving doors, bank balances go, anyway. The Imperium at its very best.

We, the hoi polloi, are not even faintly on the horizon of our political “representatives.”

And as during the Vietnam War – the push should be for the maintenance of MIC to HAVE to hold BAKE SALES to buy a bomber or, nowadays, a drone and all the rest….

Good call

Thanks

I guess there was a provision in the TARP fiasco of ‘09 that has allowed for this without going back to Congress. Not that. Ingress wouldn’t have “folded” anyway. The Gods of Money control the money supply, thus controlling wealth itself, manipulating the entire charade of current events.

$0.25 trillion could be used to give $1000 every American adult (over 18).

This is based on a total population of 330 million, about 75% of which are over 18 (247 million).

Re: AnneR

March 14, 2020 at 07:39

“Pork barrel politics, pig trough profiteering (warmaking *and* medico-pharma), and an apparently endless supply of sinecured politicos who believe in American “purity of intention,” “exceptionalism,” “indispensability.” At least insofar as their own sinecures, future revolving doors, bank balances go, anyway. ”

In varying assay that is/was a constituent of all class based societies through time, as is/was in varying assay benefits to “we the people….” to encourage complicity, which “we the people..” sought/seek to deny and/or represent as not significant through usage of “the other” who are not “we the people..”.

From concocting “We the people hold these truths to be self-evident…” onwards “politicos who believe in American “purity of intention,” “exceptionalism,” “indispensability.” have believed that “belief in American “purity of intention,” “exceptionalism,” “indispensability.” is for “we the people…” and “indispensable tools” to facilitate “The United States of America”.

The designated “founding fathers” had contempt for “we the people…” as do present politicos – “The Imperium at its very best.” where “we the people” simultaneously continue to be human shields and food sources through “we the people..” complicity.

Some “we the people..” hold the designated “founding fathers” in veneration, some “we the people..” get angry and dissipate their energies through emotional self-absorption/indulgence, whilst some others deemed not to constitute “we the people” are amused by their chutzpah and engaged in opportunities facilitated by their chutzpah to transcend them.

Among the more immediate things that might be noticed, as the coronavirus spreads, we should take in the fact that money, as we know it, is not working.

Money is fictional–not unreal or nonexistent, not by any means non-influential, but a real fiction: a media object, a tale that is told about value. The particular story of the day, “The Dollar,” wields influence because of faith: people believe that the dollar will serve when their friends and acquaintances will not–“til that eagle grins.”

Given the opacity of the Fed and related institutions, the enormity of the known discrepancies in accounting, the persistent bloodthirstiness of ruling classes most everywhere, it would seem high time that more immediately satisfying arrangements be made.

bardamu, nice and accurate comment. The dollar economy a fiction, I like it. It is hard to get to that point without some study about exactly what an Economy is, and then realize that it is only real if great numbers of people accept it as real, so thanks. And, Drew Hankins, as usual, adds perspective to student loans too, all pointing to why Consortiumnews has become the go to site for accurate reporting and commentary. Thanks to all…

@badamu: Hit the nail on the head. But it’s SO hard for people to even imagine a system without money, much less consider it. Having been conditioned for so many centuries to believe human- existence is impossible without it, poses a challenge so huge that words cannot describe it. The best(in my opinion) so far of these concepts have been explored through the work of Jacque Frescoe and Peter Joseph, the Natural-Law Resource-Based Economy, which in essence is by design an emergent-system that aims to put our species back in balance with nature and it’s resources, ultimately making money and all the distorted incentives it creates obsolete. It cannot be imposed from the “top-down”, but voluntarily from the “bottom-up”, and would genuinely adhere to all of the ideals and principles so many claim they prefer but don’t actually live in. For more details on the NLRBE you can download a free book from the website TheZeitgeistMovement.com. Doubtful we will see any implementation of any new system in our lifetime, but the seeds of potential and possibility must be planted, as Frescoe particularly, as a brilliant architect/engineer/futurist far-ahead of his time has done his whole life. May his life’s work not have been done in-vain.

Setup for a cheap buy back ?