The post-Great Recession economic “recovery” was largely reserved for participants in financial markets, not the majority working longer hours and multiple jobs, writes Nomi Prins.

Inequality Worsens Around the Planet

As we head into 2019, a major question remains about the state of Main Street, not just in the U.S. but across the planet. If the global economy really is booming, as many politicians claim, why are leaders and their parties around the world continuing to get booted out of office in such a sweeping fashion?

One obvious answer: the post-Great Recession economic “recovery” was largely reserved for the few who could participate in the rising financial markets of those years, not the majority who continued to work longer hours, sometimes at multiple jobs, to stay afloat. In other words, the good times have left out so many people, like those struggling to keep even a few hundred dollars in their bank accounts to cover an emergency or the 80 percent of U.S. workers who live paycheck to paycheck.

In today’s global economy, financial security is increasingly the property of the 1 percent. No surprise, then, that, as a sense of economic instability continued to grow over the past decade, angst turned to anger, a transition that—from the U.S. to the Philippines, Hungary to Brazil, Poland to Mexico—has provoked a plethora of voter upheavals. In the process, a 1930s-style brew of rising nationalism and blaming the “other” — whether that other was an immigrant, a religious group, a country, or the rest of the world—emerged.

This phenomenon offered a series of Trumpian figures, including of course The Donald himself, an opening to ride a wave of “populism” to the heights of the political system. That the backgrounds and records of none of them—whether you’re talking about Donald Trump, Viktor Orbán, Rodrigo Duterte, or Jair Bolsonaro (among others)—reflected the daily concerns of the “common people,” as the classic definition of populism might have it, hardly mattered. Even a billionaire could, it turned out, exploit economic insecurity effectively and use it to rise to ultimate power.

Ironically, as that American master at evoking the fears of apprentices everywhere showed, to assume the highest office in the land was only to begin a process of creating yet more fear and insecurity. Trump’s trade wars, for instance, have typically infused the world with increased anxiety and distrust toward the U.S., even as they thwarted the ability of domestic business leaders and ordinary people to plan for the future. Meanwhile, just under the surface of the reputed good times, the damage to that future only intensified. In other words, the groundwork has already been laid for what could be a frightening transformation, both domestically and globally.

That Old Financial Crisis

To understand how we got here, let’s take a step back. Only a decade ago, the world experienced a genuine global financial crisis, a meltdown of the first order. Economic growth ended; shrinking economies threatened to collapse; countless jobs were cut; homes were foreclosed upon and lives wrecked. For regular people, access to credit suddenly disappeared. No wonder fears rose. No wonder for so many a brighter tomorrow ceased to exist.

The details of just why the Great Recession happened have since been glossed over by time and partisan spin. This September, when the 10th anniversary of the collapse of the global financial services firm Lehman Brothers came around, major business news channels considered whether the world might be at risk of another such crisis. However, coverage of such fears, like so many other topics, was quickly tossed aside in favor of paying yet more attention to Donald Trump’s latest tweets, complaints, insults, and lies. Why? Because such a crisis was so 2008 in a year in which, it was claimed, we were enjoying a first class economic high and edging toward the longest bull-market in Wall Street history. When it came to “boom versus gloom,” boom won hands down.

None of that changed one thing, though: most people still feel left behind both in the U.S. and globally. Thanks to the massive accumulation of wealth by a 1 percent skilled at gaming the system, the roots of a crisis that didn’t end with the end of the Great Recession have spread across the planet, while the dividing line between the “have-nots” and the “have-a-lots” only sharpened and widened.

Though the media hasn’t been paying much attention to the resulting inequality, the statistics (when you see them) on that ever-widening wealth gap are mind-boggling. According to Inequality.org, for instance, those with at least $30 million in wealth globally had the fastest growth rate of any group between 2016 and 2017. The size of that club rose by more than 25 percent during those years, to 174,800 members. Or if you really want to grasp what’s been happening, consider that, between 2009 and 2017, the number of billionaires whose combined wealth was greater than that of the world’s poorest 50 percent fell from 380 to just eight. And by the way, despite claims by the president that every other country is screwing America, the U.S. leads the pack when it comes to the growth of inequality. As Inequality.org notes, it has “much greater shares of national wealth and income going to the richest 1 percent than any other country.”

That, in part, is due to an institution many in the U.S. normally pay little attention to: the U.S. central bank, the Federal Reserve. It helped spark that increase in wealth disparity domestically and globally by adopting a post-crisis monetary policy in which electronically fabricated money (via a program called quantitative easing) was offered to banks and corporations at significantly cheaper rates than to ordinary Americans.

Pumped into financial markets, that money sent stock prices soaring, which naturally ballooned the wealth of the small percentage of the population that actually owned stocks. According to economist Stephen Roach, considering the Fed’s Survey of Consumer Finances, “It is hardly a stretch to conclude that [quantitative easing] exacerbated America’s already severe income disparities.”

Wall Street, Central Banks, and Everyday People

What has since taken place around the world seems right out of the 1930s. At that time, as the world was emerging from the Great Depression, a sense of broad economic security was slow to return. Instead, fascism and other forms of nationalism gained steam as people turned on the usual cast of politicians, on other countries, and on each other. (If that sounds faintly Trumpian to you, it should.)

In our post-2008 era, people have witnessed trillions of dollars flowing into bank bailouts and other financial subsidies, not just from governments but from the world’s major central banks. Theoretically, private banks, as a result, would have more money and pay less interest to get it. They would then lend that money to Main Street. Businesses, big and small, would tap into those funds and, in turn, produce real economic growth through expansion, hiring sprees, and wage increases. People would then have more dollars in their pockets and, feeling more financially secure, would spend that money driving the economy to new heights—and all, of course, would then be well.

That fairy tale was pitched around the globe. In fact, cheap money also pushed debt to epic levels, while the share prices of banks rose, as did those of all sorts of other firms, to record-shattering heights.

Even in the U.S., however, where a magnificent recovery was supposed to have been in place for years, actual economic growth simply didn’t materialize at the levels promised. At 2 percent per year, the average growth of the American gross domestic product over the past decade, for instance, has been half the average of 4 percent before the 2008 crisis. Similar numbers were repeated throughout the developed world and most emerging markets. In the meantime, total global debt hit $247 trillion in the first quarter of 2018. As the Institute of International Finance found, countries were, on average, borrowing about three dollars for every dollar of goods or services created.

Global Consequences

What the Fed (along with central banks from Europe to Japan) ignited, in fact, was a disproportionate rise in the stock and bond markets with the money they created. That capital sought higher and faster returns than could be achieved in crucial infrastructure or social strengthening projects like building roads, high-speed railways, hospitals, or schools.

What followed was anything but fair. As former Federal Reserve Chair Janet Yellen noted four years ago, “It is no secret that the past few decades of widening inequality can be summed up as significant income and wealth gains for those at the very top and stagnant living standards for the majority.” And, of course, continuing to pour money into the highest levels of the private banking system was anything but a formula for walking that back.

Instead, as more citizens fell behind, a sense of disenfranchisement and bitterness with existing governments only grew. In the U.S., that meant Donald Trump. In the United Kingdom, similar discontent was reflected in the June 2016 Brexit vote to leave the European Union, which those who felt economically squeezed to death clearly meant as a slap at both the establishment domestically and EU leaders abroad.

Since then, multiple governments in the European Union, too, have shifted toward the populist right. In Germany, recent elections swung both right and left just six years after, in July 2012, European Central Bank head Mario Draghi exuded optimism over the ability of such banks to protect the financial system, the Euro, and generally hold things together.

Like the Fed in the U.S., the ECB went on to manufacture money, adding another $3 trillion to its books that would be deployed to buy bonds from favored countries and companies. That artificial stimulus, too, only increased inequality within and between countries in Europe. Meanwhile, Brexit negotiations remain ruinously divisive, threatening to rip Great Britain apart.

Nor was such a story the captive of the North Atlantic. In Brazil, where left-wing president Dilma Rouseff was ousted from power in 2016, her successor Michel Temer oversaw plummeting economic growth and escalating unemployment. That, in turn, led to the election of that country’s own Donald Trump, nationalistic far-right candidate Jair Bolsonaro who won a striking 55.2 percent of the vote against a backdrop of popular discontent. In true Trumpian style, he is disposed against both the very idea of climate change and multilateral trade agreements.

In Mexico, dissatisfied voters similarly rejected the political known, but by swinging left for the first time in 70 years. New president Andrés Manuel López Obrador, popularly known by his initials AMLO, promised to put the needs of ordinary Mexicans first. However, he has the U.S.—and the whims of Donald Trump and his “great wall” —to contend with, which could hamper those efforts.

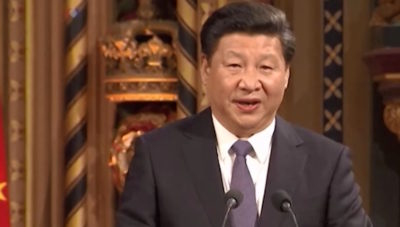

As AMLO took office on Dec. 1, the G20 summit of world leaders was unfolding in Argentina. There, amid a glittering backdrop of power and influence, the trade war between the U.S. and the world’s rising superpower, China, came even more clearly into focus. While its president, Xi Jinping, having fully consolidated power amid a wave of Chinese nationalism, could become his country’s longest serving leader, he faces an international landscape that would have amazed and befuddled Mao Zedong.

Though Trump declared his meeting with Xi a success because the two sides agreed on a 90-day tariff truce, his prompt appointment of an anti-Chinese hardliner, Robert Lighthizer, to head negotiations, a tweet in which he referred to himself in superhero fashion as a “Tariff Man,” and news that the U.S. had requested that Canada arrest and extradite an executive of a key Chinese tech company, caused the Dow to take its fourth largest plunge in history and then fluctuate wildly as economic fears of a future “Great Something” rose. More uncertainty and distrust were the true product of that meeting.

In fact, we are now in a world whose key leaders, especially the president of the United States, remain willfully oblivious to its long-term problems, putting policies like deregulation, fake nationalist solutions, and profits for the already grotesquely wealthy ahead of the future lives of the mass of citizens. Consider the yellow-vest protests that have broken out in France, where protestors identifying with left and right political parties are calling for the resignation of neoliberal French President Emmanuel Macron. Many of them, from financially starved provincial towns, are angry that their purchasing power has dropped so low they can barely make ends meet.

Ultimately, what transcends geography and geopolitics is an underlying level of economic discontent sparked by twenty-first-century economics and a resulting Grand Canyon-sized global inequality gap that is still widening. Whether the protests go left or right, what continues to lie at the heart of the matter is the way failed policies and stop-gap measures put in place around the world are no longer working, not when it comes to the non-1 percent anyway. People from Washington to Paris, London to Beijing, increasingly grasp that their economic circumstances are not getting better and are not likely to in any presently imaginable future, given those now in power.

A Dangerous Recipe

The financial crisis of 2008 initially fostered a policy of bailing out banks with cheap money that went not into Main Street economies but into markets enriching the few. As a result, large numbers of people increasingly felt that they were being left behind and so turned against their leaders and sometimes each other as well.

This situation was then exploited by a set of self-appointed politicians of the people, including a billionaire TV personality who capitalized on an increasingly widespread fear of a future at risk. Their promises of economic prosperity were wrapped in populist platitudes, normally (but not always) of a right-wing sort. Lost in this shift away from previously dominant political parties and the systems that went with them was a true form of populism, which would genuinely put the needs of the majority of people over the elite few, build real things including infrastructure, foster organic wealth distribution, and stabilize economies above financial markets.

In the meantime, what we have is, of course, a recipe for an increasingly unstable and vicious world.

Nomi Prins is a TomDispatch regular. Her latest book is “Collusion: How Central Bankers Rigged the World” (Nation Books). Of her six other books, the most recent is “All the Presidents’ Bankers: The Hidden Alliances That Drive American Power.” She is a former Wall Street executive. Special thanks go to researcher Craig Wilson for his superb work on this piece.

Dear Old Mario Draghi –

1 st January 1999 the euro came into being.

Never did the European Banking system have so much money.

The euro – handled correctly – could have become a Reserve Currency like the US dollar.

But & alas – the ECB & their buddies had never had so much money & so much power over all of it.

And like an excited lotto winner they went on a celebratory splurge of mammoth proportions.

The 2008 GFC hit & the EU & all its elite brain power

PANICKED

&

KNEE JERKED the 28 member nations of the EU into AUSTERITY –

A looting of the 28 member nations & the personal wealth of the people.

It is 11 years now & there is no end of suffering & the ever increasing poverty they created in sight.

A FOOL & THEIR NATIONS MONEY …

That was so well written that even though I hate both subjects, corrupt banks and corrupt politicians, I read this as though the information were filleted, cooked and served exactly to my liking… sister, you write like a man and I mean that with the highest intentions of regard! This piece was sublime in the content was completely unbiased, fully factual or strongly provable and consistent. It was as if the hammer to drive your story home was pounding to the beat of the heart… wow.

And by the way, despite claims by the president that every other country is screwing America, the U.S. leads the pack when it comes to the growth of inequality.

First off, this comment is meaningless in the context of the story. Just because the US has a broad income disparity, doesn’t mean that other countries are not getting the better of us in trade deals.

Income inequality skyrocketed under Obama with his use of QE to prop up the stock market. He essentially used a credit card to keep us afloat to the tune of $10 trillion dollars during his presidency. We are now paying that off with interest. And who gained the most during that time? Yeah, mostly the wealthy invested in the stock market. What did he do to improve working conditions in the inner cities? Not much. Trump’s policies have helped citizens in those areas to start businesses or get jobs at companies who are flourishing.

Short sighted people can’t perceive the end results of these tariffs. Since the US imports far more than it exports, the pain is felt far more by those sell to the US than the other way around. There has been a growing body of voices in China who are worried that their govt. underestimated Trump and are now faced with having to capitulate to more of his demands. They’ve already lowered tariffs on some US automobiles, and they’ve purchased some soybeans.

China and other trade partners like Canada, Mexico, the EU, are so used to pushover US political parties and presidents who are addicted to campaign money flowing from large multinational companies who profit from these lopsided trade deals

Tariffs will work eventually, we just need to give them time to work and the US will be better off in the long run.

Maybe I am wrong on our but Dislike think many do.

Get hold of your professional memorial prayer card designer this morning!

A successful home-based business needs time to work and perseverance to get bigger. http://r4icardsuk.com/10-causes-why-you-ought-to-pay-for-search-engine-optimization/

Don’t even get me started.

Economically, a ready solution has long been presented in the form of a “TRANSACTION TAX”. The unbelievable simplicity and equality of it leaves most people incredulous and ——- unbelieving. The 1% ers of course, resent and resist the equality of it.

I do believe however that there are other causes of major discontent, not related to finance or standard of living. “Inequality” in the battle between the sexes is probably the biggest. Who is happy with the rapid shifts in policy or “say”in that realm? For some, not rapid enough, and for many, enough is enough!

Proposed EU FINANCIAL TRANSACTION TAX on derivatives trading on unregulated exchanges lost momentum when the British bankers objected. FTT tax a factor in BREXIT referendum; a cause of concern for financial horse-traders rigging the market.

Never answered how LEHMANS in 2008 leveraged at 33 to 1 USD on their books. Moral hazard? Interesting why Malaysian government lawsuit for fraud against GS gets no attention in the media; only billions lost. Rerun of missing billions of LIBYA by Wall Street. Thomas Picketty French economist warned in his book about rampant inequality destabilizing society; and it is….in France.

Guillotines and gulags are not far off for the neoliberal and their neoconservative counterparts. Donald Trump: Jail. Hillary Clinton: Jail. Barack Obama: Jail. George Bush: Jail. Dick Cheney: Jail. Bill Clinton: Jail. Jamie Dimon: Jail. Henry Paulson: Jail. Jerome Powell: Jail. Janet Yellen: Jail. Alan Greenspan: Jail. Steve Mnuchin: Jail. Jacob Lew: Jail. Timothy Geithner: Jail. And the list goes on. But instead we arrest people for weed. There will be a revolution if these people don’t smarten up. Both Roosevelts realized that this kind of economic system cannot exist if capitalism is to win out. These fools in charge now won’t realize it until they’re in handcuffs.

50% of the reason for this tyranny is that 95-97% of the tyrannized, the oppressed, impoverished, and murdered, which compose 99.999999% of humanity–ALLOW IT. The other 50% of the reason is that a handful of monied-interests groups, bankers, clergy, industrislists, and individuals have usurped governments, the main ones at least, into mere vehicles or enforcement mechanisms, for their sole use to concentrate and control all wealth and power,resources, opportunities, for their benefit, and to the detriment and death of everyone else. There’s an outside hope that the ONLY thing that still could and can happen to save mankind, is a possibility, as proven many times by history. It only takes 3-5% of any given population, the determined few, to violently eradicate even the most powerful enemy. Using primarily guerilla warfare tactics, the most powerful government(s) can be eradicated; not overthrown-ERADICATED!

Another excellent article from Prins, however, she continues the nonsense that is primarily promoted by the Democrats to distract from the real issues.

“a 1930s-style brew of rising nationalism and blaming the “other”

We continue to hear that our open borders and the approximately 20 million illegal immigrants have nothing to do with the stagnant working wages for the last 30 years. The Europeans are rightly angry at the flood of immigrants that will not assimilate. The destruction of Libya and Syria were not accidents but long planned efforts by the real “other”, the neoliberal globalists and financial cabal.

It’s the neoliberal globalist agenda that the population is rebelling against. Angela Merkel recently clearly stated the goal of the globalists:

“Nation states must today be prepared to give up their sovereignty”, according to German Chancellor Angela Merkel, who told an audience in Berlin that sovereign nation states must not listen to the will of their citizens when it comes to questions of immigration, borders, or even sovereignty.

“none of them…reflected the daily concerns of the “common people”

Nonsense! The people being elected (Trump, Bolsonaro, Orbán, etc.) may be opportunists and unlikely to fulfill their campaign promises but, unlike the parties in power, their promises do reflect the concerns of the “common people”. Trump campaigned against unnecessary wars, the flood of unskilled illegal immigrants and the corrupt politicians like Hillary. Hillary’s campaign slogan was “America is already Great”, talk about being out of touch.

Nationalism is not a dirty word and Prins and the media should not constantly wrongly associate it with the Nazis. We need more Nationalism to fight the globalists’ agenda.

Nationalism is just a few degrees less dangerous to human liberty than globslism. Patriotism, is a brainwashed mechanism the few in power have devised to manipulate braindead masses into going along with an agenda that benefits a few rich maggots and oppresses, impoverishes, and murders evedybody else. If you want to get rid of being ruled and manipulated, and tyrannized–you will need to violently eradicate governments. Government is the primary tool that your masters use to enslave you. The determined few, that have integrity, principles, a moral-imperative, will have to violently eradicate government, by first annihilating the police/military personnel of said state.

Nationalism simply means devotion to your country.

Chauvinism entails a “national” sense of superiority over other countries and cultures and often generates animosity against them.

As someone who has lived in many places around the world, I haven’t seen a culture that didn’t feel superior…

The US is not a single culture; the only thing that has been holding it together was its foundation script that, borrowing a phrase from Cluborlov, has become just about as relevant as an old copy of Pravda in an abandoned Siberian outhouse.

No culture and social setup can survive without a prevalent ideology that convinces the disempowered that they either deserve to always draw the short straw or they can get out of their predicament in a jiffy. Those buying elections for their lackeys don’t care for the country anymore, so they don’t even maintain a credible ideology; social mobility surpassed the level of the US even in Europe by 2005! Orban in Hungary allowed the discontent to leave, although counting them among the”employed,” and revived Christianity as the prevalent ideology). They care for generating profits by lending their privately printed dollars to the taxpayer who also becomes responsible for the debt accrued by endless and useless military involvements and the ever-increasing surveillance system used for keeping it in check.

Chances are the “order out of chaos” strategy is working just fine. The one percent is only the ones riding on the beast in a world where a five-minute market manipulation (“accidents” and the like provide copious advantages, but those are not even needed in a market in which machines trade assets based on an insider algorithm that uses insider information) generates more profit than an old-time mob-style construction scheme.

Some argument can be made for the others, but Bolsonaro is not a nationalist. He is a lot worse than Lula & Dilma & the Workers Party, forced out of power and prevented from being elected by corrupt machinations. Bolsonaro does literally wave a flag – the US flag. He is an anti-nationalist. (for Brazil at least)

I see a confusion between Nationalism and Sovereignty here.

Sovereignty and a ‘national’ economic program for the 100%, and the right for a country to print its own money, the new Modern Monetary Theory (especially the EU).

not as NPrins rightly describes as the ‘nationalism’ of an oligarch inciting hate of one group against the other to mask neoliberalism and it’s inequalities.

A brilliant clear no-nonsense summation of some the themes of her recent books.

Thank you Nomi Prins.

There’s an important point that needs to be underscored, Donald Trump did not act alone. The Democratic party and corporate media pushed Donald Trump into the lime light. They wanted Hillary Clinton to run against Trump.

That strategy backfired because Clinton’s campaign had a tone deaf attitude towards main street. Clinton said everything was fine and even chastised Trump when he said it wasn’t. Clinton wanted to continue the status quo when people wanted change. Faced with someone who wanted to keep everything the same versus someone who talked about change, who do you think the voters would vote for. The candidate that looks like they are listening to you is the one that will get the votes.

To underscore another point. Had main street recovered, had the 99% been doing better and improving, Clinton would have won.

The pied piper thing was Hillary’s idea and she told the media to focus on Trump’s campaign because she was afraid that because she was such a weak candidate that republicans like Bush would beat her. Funny how that turned out for her.

But she thought that in today’s economy no one would care that she gave her paid speeches to the banks. Talk about being tone deaf.

“To underscore another point. Had main street recovered, had the 99% been doing better and improving, Clinton would have won.”

This is spot on and if Obama had kept even half of his campaign promises she would be president. Instead Trump is Obama’s legacy.

Good solid piece of analysis. Concise clear and on point. I would like to add that the longer neo-liberal elitist economic and political policies continue to be pursued the more likely that political and economic instability and viciousness will continue to grow. This means that so too will be the prospect for conflict with all that entails. Will the neo-liberal elites realize the error of their ways? I don’t know. But the 19th century political economist and historian Lord Acton may have summed it up best when he said: “Never underestimate the influence of stupidity on history.

I have a problem -I read this kind of stuff from Nomi Prins and others and a lot of it makes sense. Rescuing the too big too fail finance sector but leaving everyone elseto eat the losses inevitably exacerbates inequality. Above all the income of everyone except the rich is stagnates or falls so many of us have a desperate time trying to cope practically, day to day.

But where in this is an explanation for why growth has been falling over the long term – what explains so called “secular stagnation”? Is it that the inequality is itself the cause of falling growth? Or is there something else going on? Nomi Prins doesn’t say…and neither do many commentators who decry the inequality and the corruption of the elite. I sympathize with their denunciations but I lack insights with what is going on. It’s important because this incomplete analysis leaves us floundering as to what policies or approaches are appropriate to address the crisis. Nomi Prins gives us a description but not prescription of what to do.

For myself the crisis requires an bio-phyical analysis that ecological economists give. We are entering a period of limits to economic growth – this relates to pollution damages to the planetary eco-system (particularly climate change) but also the effects of resource depletion and, in particular, the depletion of energy minerals, above all oil. Modern economies consists of powered machines and infrastructures for production, transport, communications and computing – and the power comes overwhelmingly from fossil fuels. Sure, there are now wind turbines, solar panels, hydro power, nuclear power – but these are still a small proportion of overall energy input. Rising energy costs are therefore a big deal since energy in various forms is THE necessary input for motivating all equipment and machinery.

Yet depletion of energy minerals means more energy resources must be used to extract energy resources leaving a lower net energy yield from the extraction process. Energy extraction or energy generation costs are drifing upwards. That does not mean however that energy prices – the oil and gas price or the price for electricity from wind or solar – can simply be increased to recoup the extra costs. People and companies cannot afford higher prices to pay for the higher extraction/generation costs – to the extent that they devote more of their income to pay for higher energy they they must cut other expenditures. This is deflationary and prevents energy prices rising too high. It is no accident that the fracking companies in the USA have not in general made any money. They can extract the oil but not sell it at a price that allows companies to cover their costs and service their debts.

2008 was a crisis of the financial system and an energy crisis. People paying for energy at $140 a barrel which was the case at that time could not also service their debts.

As this situation will get worse we need a deeper analysis than Nomi Prins gives. This problem is not going away. It will get worse. Growth will give way to stagnation and decline and a central issue is indeed who eats the losses. It is also true that with climate change the overwhelming majority of carbon emissions, arising from fossil energy use, arise from the consumption of the most wealthy. The reduction therefore has to come from the rich otherwise it is not going to happen. So there is indeed an issue of distribution to solve the climate crisis too.

Above all the issue comes down to equitable contraction – and sharing much more. Sharing as in publlic transport, sharing as in libraries and resource centres of tools and equipment, sharing as in sharing domestic facilities in co-housing, sharing as in food growing together like community gardens and community supported agriculture….

That is so far away from the way most people think…particularly most Americans I am not hopeful for the future but please, this is a great website but it has NO ecological awareness at all. None. That’s quite a gap.

http://www.feasta.org/2017/04/18/limits-to-economic-growth/

https://ourfiniteworld.com/2017/12/19/the-depression-of-the-1930s-was-an-energy-crisis/

They actually do and it’s not hard to understand. Read about the financialization of the economy. Mike Konczal has written articles about it. You can also read Dr. Richard D. Wolff and his criticisms of capitalism.

The simple answer is investors are sucking profits out of companies, preventing businesses from reinvesting those profits into the business. More and more profits are devoted to stock buy backs and investor payout in order to placate Wall Street. In order to realize greater growth businesses are forced into merging, which eliminates competition, decreases the job pool and causes unemployment. More people compete for fewer jobs which lowers wages.

So no it is not because we are entering a period of limit of economic growth, nor has it to do with mineral depletion.

Brian, your bafflement about stagnation in the economy surprises me. – If the WORKING people are deprived of the resources (money) with which to work, production slows or stops.

As for your concerns about climate change, I am convinced we must see it as an ongoing DEBATE, not a closed fact. My quest for the truth in this debate is spurred by the simple question, “Who benefits most from simple acceptance of the narrative?” – Not surprisingly, it is clearly the .1% !

Thank you for the links, Brian. It’s abundantly clear that we cannot continue as we are, consuming the planet’s natural resources at rates far beyond its capacity to regenerate them. This remarkably simple insight appears to be missing from most of our discussions about the economy.

Nomi Prins,

#1 Nomi Prins…….For Secretary of Treasury.

#2 Take over Federal Reserve.

#3 Audit Federal Reserve…Sue current and past executives for…dereliction of duty to the American people…$ Now worth 5 cents compared to 1913 $.

#4 Shut down the Fed.

#5 Implement….President Kennedy’s Executive Order 11110…Take back control of currency from the Fed to the US Government/people.

#6 Each state…. Establish Public Bank…..e.g Bank of North Dakota(est.1917?)……..as per Ellen Brown.

#7 Read your book “Collusion”….Right on……..very well done.

Thank you,

Ed Meyers

[email protected]

Well said. You didn’t go far enough though. We have indeed been here before. Both times it ended in disastrous war. It will do so again except that this time the US won’t be spared the destruction of the wars that we were last century.

This is inevitable with a debt-based monetary system whether administered directly by the government or a private banking cartel. It requires continuous inflation and encourages malinvestment, speculation and ultimately, bubbles and depressions. Insiders get get preferential treatment.

Dec 30, 2018 Pack Mentality: Tool of Tyrants

The “divide and conquer” tactics of every tyrant, and every ruling class, only work when people are stuck in pack mentality.

https://youtu.be/Ra0gDv2Yy_c

Nomi Prins is a wonderful resource for economic takes. Love all of her stuff!

Here’s are some more wonderful resources:

A History of Neoliberalism: Chris Hedges, David Harvey, and Michael Hudson

(1) All private ownership of land must be abolished immediately without compensation.

(2) All landowners’ estates and all land belonging to the Federal Government, to monasteries, church lands with all their livestock and inventoried property, buildings and all appurtenances must be transferred to the disposition of the poverty stricken and their specifically elected representatives who are accountable to them and not to the corporate duopoly.

Peace! Bread! Land!

We are witnessing the great unraveling. Such a state leaves any analysis confused. Do we need more growth on a finite planet? What’s the difference between a president who is “oblivious” to what’s occurring to one who is not oblivious but doesn’t care enough to fight the important fight? Trump vs. Obama.

The human devised economic systems are dying. It appears the landing will be harsh and severe. This essay could have ended: We are lost.

A more honest assessment requires a verbatim text of Steve Bannon’s 30 minute speech to ” BAFBF” (black Americans for a better future) as seen on YouTube, to serve as counterpoint and as complimentary, to the assertions in this article. One can consider Mr. Bannon as “Trump’s brain”. His brand of populism is convincingly presented as “civic/economic nationalism” not unlike what JFK was offering. The “civic” part is very appealing to Bernie bros such as myself,and is what will draw many of the left-populists to Steve’s side of the aisle. His Burkean conservatism is, IMO, the only respectable kind of conservatism, starting with humanity as it is in reality; the main failure of leftism being the need to “rebuild, reeducate”, build a new “Soviet Man” for the New System being proffered. It is futile to think entrepreneurs, and capitalism itself, will be snuffed out; that’s where the idea of civics comes in to regulate it and direct it towards the general welfare. I can see where right-populism/nationalism seems threatening in Europe, as their Nations are outgrowths of tribal enclaves (Austria for the Ostrogoths, France for the super tribe of the Franks, Belgium a co-op of Flemish and Waloons, Germany a collection of princely estates formed of Germanic tribes, etc…). For them it literally is “blood and soil” and populists must proceed carefully over there. Here in America it’s quite different, being a nation of immigrants, bound together ONLY by The Law (itself a creation as antidote to hoary old customs and specious “divine rights” of thoroughly corrupt ruling classes) and civic-mindedness that was distilled from the customs and morals of various regious backgrounds. Nationalism, over here, beckons to things spoken of, by JFK, FDR, Lincoln, not of swastikas and “Aryan brotherhoods” and Fasces.

As even Ben Bernanke once said “Monetary policy is not a panacea.” Evidently, not. So, the obvious solution is to switch to a strong fiscal policy for public purpose to drive up aggregate demand, which has always been the solution. The world can no longer suffer the intellectual immaturity of libertarian ideology. Unfettered, “self-regulating” capital is just one of the many myths upon which neoliberalism is founded. This economic policy of doublespeak has weakened the edifice of every industry.

Everything is fraud! Once belief in something vanishes, as it has with corporate media, austerity as a practical solution and the recent revelations about MIC fraud in this series (https://therealnews.com/series/reality-asserts-itself-lester-earnest), so too does the power it once held. The 40+ yr. capitalist revolt against the nation-state has only proven to the world that sovereignty, control of one’s own currency and destiny, is still important and essential to keeping democracy alive. As the EU experiment continues to crumble, the world returns to sanity.

Haven’t people heard the news? The bankers all gave interviews,

Employment’s up and crime is down, ignore those rumors of meltdown.

Old Pat Buchanan said it straight, “Entitlements could wreck our fate!”

Ron Reagan gave us trickle down, instead of yellow, we got brown!

We’d send our bad jobs overseas to screw those low-paid Red Chinese,

Those factories moved way offshore make cleaner air and save the trees,

There’s legal dope with no regrets, good thing we outlawed cigarettes!

Social programs run by commies fostered lots of welfare mommies.

Planned Parenthood cost lots of tax, they say those moms drive Cadillacs!

The union busters acted smartly, wrecking labor with Taft-Hartley,

Keeping wages down real low prevents inflation, don’t you know?

Pretend it’s not the interest rates that central banking theft creates-

If debt exceeds the cash supply, then growth can never satisfy,

The debt will always grow and grow, so we must pay to print more dough!

The bankers take a solemn oath to swear the culprit must be growth:

The workers don’t work hard enough, they must use debt to buy their stuff,

The corporations want less tax because the workers are so lax,

The stocks must pay out dividends, so labor cuts improve their trends.

Growth is slowed, production lags, they buy back stocks as value sags,

The banks provide more cash cocaine, that money meth will ease the pain,

As long as rates stay good and low, the markets always grow and grow.

Involuntary servitude feeds unemployed with prison food,

They catch them sleeping on the streets, both veterans and old deadbeats,

Then off to jail, the Chinese fate, in camps where guards re-educate.

New Deal programs posed a threat, they could reduce the public debt,

Prosperity caused consternation, it could even cause deflation,

Profit margins could collapse, free money for the rich would lapse,

They had to prove that it would fail, no social programs could prevail.

So NGOs they sent abroad, to prop up every fascist fraud.

With currency manipulation, artificial debt creation, sowing social agitation,

Every up and coming nation fell to war and forced migration,

Agents and collaborators riled willing demonstrators infiltrating legislatures,

Back at home laws overturned and all the New Deal progress spurned!

It couldn’t work they made quite clear, in all the Western hemisphere

But one remains to scoff the heel of Neoliberal Achilles:

That debt-free nation still remains, The Pearl of The Antilles!

This is certainly the time to address our National and International Banking dilemma. There are excellent and well informed people who have been studying this subject for many years and I’m convinced that workable solutions exist. I have been particularly impressed by the Public Banking alternative described very adequately by Ellen Brown which I will link below. Clearly the investment community Must be separate from every-day savings and lending for the public good. It really isn’t Rocket Science…

https://www.globalresearch.ca/radical-plan-fund-green-new-deal-just-might-work/5663229?utm_campaign=magnet&utm_source=article_page&utm_medium=related_articles

Here is Jill Stein from her campaign:

“Stein goes even further than Sanders on several key issues, and one of them is her economic platform. She has proposed a “Power to the People Plan” that guarantees basic economic human rights, including access to food, water, housing, and utilities; living-wage jobs for every American who needs to work; an improved “Medicare for All” single-payer public health insurance program; tuition-free public education through university level; and the abolition of student debt. She also supports a basic income guarantee; the reinstatement of Glass-Steagall, separating depository banking from speculative investment banking; the breakup of megabanks into smaller banks; federal postal banks to service the unbanked and under-banked; and the formation of publicly-owned banks at the state and local level.”

https://www.globalresearch.ca/can-jill-stein-carry-bernies-baton-a-look-at-the-green-candidates-radical-funding-solution/5539377?utm_campaign=magnet&utm_source=article_page&utm_medium=related_articles

The Green Party platforms on foreign and domestic policy scare the bejesus out of the Oligarchy. That is why they are nearly completely excluded from the MSM. I hope 2020 is a breakthrough year for the Greens. They are really the only hope for any kind of decent future.

Stein and the Greens are right. We need a complete replacement with a fully integrated solution. No incremental, half way measures will do.

GDP is a horrible measure for what’s needed. Can’t for the life of me know why people want to immigrate here (unless our bombs made their lives impossible).

The Green Party platform is one that encompasses so many of the things that I believe in that it was easy voting for Stein in 2016, even here in Wisconsin. I just don’t accept the idea that voting for a ‘lesser evil’, who then proceeds to go and do numerous conservative things I disagree with (that’s YOU, Bill Clinton) is somehow going to lead to a more progressive nation, other than by the most freakish accident.

While Prins makes some great points on inequality and the Federal Reserve/ banking neoliberal system (a privately owned and totally unnecessary system that lends government money to the government at usurious compound interest rates), I have a few questions. After the collapse of the world wide economy in 2009 when the repeal of Glass Steagall came home to roost, all the $trillions to back bankster mismanagement, with a few crumbs for Main Street, the economy BECAME Wall Street. While it is true that maybe 40% of the money in the stock market is retirement accounts, pension funds, endowments and such, the vast amount of both money and manipulation (for “harvesting” that 40%) is in the hands of unregulated, unscrupulous psychopaths who can never ever even spend all their money. Corporate CEOs are using their tax breaks to buy back and inflate their stock prices so they will get huge “performance” bonuses, not for better products or services. But Wall Street is NOT the economy. Why focus on it (unless advocating regulation, as with the 0.02% tax on stock transactions which was abolished in the 1960s)? Most of the people I talk with would like to see the stock market crash, since they have no money in it and think that will bring down Trump; there’s no “trickle down” to them and they don’t see themselves worse off if Wall Street fails. When America deindustrialized under Reagan, making it easy to move capital abroad to chase the cheapest labor, we became a service economy, with mostly low paying fast food-like jobs. This was greatly exacerbated under Clinton who sowed the seeds of our demise by opening Communist China to our capital and our technology, even military technologies, while encircling Russia with NATO bases after stealing most of their money with oligarchs. Our foreign policy seems based on Israel rather than the US? Offshoring jobs of course lowers labor costs (but also passes control and innovation of essential products to people who may become our enemies.) Neoliberalism seems based on free capital movement, with no freedom of labor organization and standardization of wages, and the resulting nationalism (as labor is forced to compete) lowers the ability in higher priced labor markets to consume. America pays twice what other OECD countries pay for universal health care; our outcomes are worse, our drugs are more expensive, and that insurance-based for-profit private system eats 20% of our GDP (which could easily be halved by going with almost any other system). Our infrastructure is a joke (I have lived abroad in several “poor” countries with much better). Why is the focus always on shielding corrupt banks and Wall Street and turning the empty shell of America into a debt peonage system? An economy based on debt may look great on Wall Street ledgers, but what is that future?

Yes, indeed. The elite, aided and abetted by a corrupt American government and an idiot named Reagan who cut their tax rate drastically, are going to town. Sorta like Cuba under Batista. Castro, understanding that the greedy bastards would never change their spots, simply lined them up and shot them. There weren’t that many. And I wouldn’t want it to happen here.

They would be wise to remember the words of Kris Kristofferson and sung by Janice Joplin: Freedom’s just another word for nothin’ left to lose…..

You nailed it michael! I for one agree with your analysis of the economic developments in this country since the 1980’s.

Nicely done–thanks. Now what needs to happen, aside from the obvious, is tie this in with the increased inequality being generated by climate change. In many parts of the world (Honduras, to pick a not-so-random example) inequality is being further exacerbated by the physical impacts of climate change–more severe droughts, for example. The outlook here is not comforting.

“Though the media hasn’t been paying much attention”

The reason the media hasn’t been paying much attention is because the media is owned by the scammers who are ripping off the entire economy. The reason these scammers can rip off the entire economy is because they own the Federal Reserve Bank, the Bank of England, and the central banks of other major countries. As the money supply is increased (necessary for a growing economy) all the new money created belongs to them. They then loan it out, including massive amounts to their governments, and get it back with interest. A condensed historical background of this scam, including more details of its mechanics, and with links to sources including The Web of Debt and Secrets of the Federal Reserve, is here.

https://warprofiteerstory.blogspot.com/p/war-profiteers-and-israels-bank.html

The US Constitution gives the federal government the sole power to create new money. It should not be delegating that power, and giving all that money, to private bankers. The ownership of the Fed should be returned to the people by nationalizing the Fed. The vast amount of money that would be recovered from the bankers would easily fund infrastructure projects, and greatly reduce most citizens’ income taxes.

The bankers would likely lose much of their grip on Congress, and hence their vast profits from the needless waste of their manufactured wars.

Exactly…undoubtedly the root of our monetary problems, which too few people are aware of…because of the kind of currency we use (debt-based fiat issued by private banking conglomerate), we are trapped. If only enough of the country would wake up to this….

Thanks for the link.

And what a scam it is! The interest on the debt just for fiscal year 2018 was over 300 billion dollars.

There is no doubt that rampant inequality in every “advanced” society brings with it mass middle class discontent and family life in decline. Political leaders have no inclination to confront the injustices of the economic system based on debt like US student loans. Any US interest rate rise impossible at this stage as we can see with US stock market volatility. There is no willingness to address offshore tax havens that rob every country of tax revenue. US national debt at 22 trillion USD will have trouble paying the interest at some point? Even after years of austerity Britain borrowing heavily every month; monthly interest payable 5 billion Pounds. If China and Japan refuse to buy US debt and Saudi Arabia pull the plug then USD will be useless paper? A day of reckoning looms…not just for SEARS.