U.S. efforts to secure strategic mineral supply chains may squeeze China out of the Australian market with the Antipodean nation being used as a raw materials supplier like the days of the British empire, writes Tony Kevin.

The open Super Pit in Kalgoorlie, Western Australia. The new Australia – United States Climate, Critical Minerals and Clean Energy Transformation Compact seeks to make Australia a ‘domestic’ supplier of strategic critical minerals to the U.S.. (Creative Commons/2.0 Generic (CC BY-NC 2.0)

By Tony Kevin

in Canberra

Pearls & Irritations

U.S.-driven fast-track negotiations to develop secure, strategic, critical minerals supply chains from Australia risk jeopardising Australia’s mining industry links with China and locking down its own industrial development.

This comes within the context of the Global South enthusiastically engaging with multipolarity, through BRICS, the Shanghai Cooperation Organization (SCO), the Chinese Belt and Road Initiative, new reserve currency systems, as well as other economic and political initiatives. More and more, centuries of U.S./U.K. hegemonic control over global resources is being challenged, especially in Africa.

More countries are abandoning exploitative Western resource deals, preferring China as a trading partner. The U.S., haunted by fear that China might lock up access to critical minerals essential to U.S. military power, is searching for politically reliable supply chains at least risk of political disruption. Canada and Australia are top of the U.S. wish list. Australia is one of the world’s foremost producers of critical minerals, like copper, lithium, nickel, cobalt, and rare earths.

On May 20 in Tokyo, U.S. President Joe Biden and Australian Prime Minister Anthony Albanese announced a new “Australia – United States Climate, Critical Minerals and Clean Energy Transformation Compact.” In a Joint Statement, the two leaders proclaimed climate and clean energy as “the third pillar of the Alliance,” alongside U.S.-Australian defence and economic cooperation. It is not clear which particular ‘Alliance’ was being referred to here.

Under the sub-heading Building Our Defence Capability, the Joint Statement said:

“The President plans to ask the United States Congress to add Australia as a ‘domestic source’ [i.e., alongside Canada] within the meaning of Title III of the Defence Production Act. Doing so would streamline technological and industrial base collaboration, accelerate and strengthen AUKUS implementation, and build new opportunities for United States investment in the production and purchase of Australian critical minerals, critical technologies, and other strategic sectors.”

Compact Welcomed in Australian Media

Australian mainstream media welcomed the Compact, highlighting its electorally popular climate and clean energy aspects. The strategic critical minerals content went almost unnoticed in the general Australian business community euphoria about truckloads of anticipated U.S. investment.

But in Washington briefings and commentary, the Compact’s significance for U.S. critical minerals, supply chain concerns about China figured highly. The White House Briefing Room noted that both countries were determined to identify concrete actions toward the Compact’s objectives within 12 months.

“Underscoring the central role of critical minerals,” Australia and the U.S. are to establish a ministerial-level Australia-United States Taskforce on Critical Minerals to be led by principals from the U.S. National Security Council and Australia’s Department of Industry, Science and Resources, with engagement from key stakeholders across industry and relevant government agencies, the White House said.

The Taskforce is intended to work with industry leaders to “… promote responsible, sustainable, and stable supply of critical minerals. The leaders intend to … identify risks and market distortions that impact on critical minerals markets and consider mitigation options.”

Just six days later in Detroit, on May 26, Australia’s Minister for Trade Don Farrell met with U.S. Secretary of Commerce Gina Raimondo for the second annual Australia-U.S. Strategic Commercial Dialogue. Their Joint Statement welcomed it “as a key bilateral mechanism to advance shared geoeconomic and commercial interests across the nexus of economic, foreign, and national security policy.”

They agreed to convene Australian and U.S. companies from across the critical minerals supply chain, including miners, processors, manufacturers, and investors at an event later in 2023.

Policy Institute Article May Reflect U.S. Ambit

U.S. Secretary of State Antony Blinken, center, addresses a Senate budget committee meeting on “investing in U.S. security, competitiveness and the path ahead for the U.S.-China Relationship,” on May 16. Commerce Secretary Gina Raimondo, right, met with Australia’s Minister for Trade, Don Farrell for the second annual Australia-U.S. Strategic Commercial Dialogue on 26 May. (State Department/Chuck Kennedy/Public domain)

To get behind the veiled language and understand what the U.S. might be really pushing for here – to cut China out of the Australian critical minerals mining industry and lock up this vital strategic resource for exploitation by the U.S. strategic defence sector as and when it wishes – a commentary piece by two Washington researchers in the July 24 edition of the Australian Strategic Policy Institute’s (ASPI) digital magazine, The Strategist, offers an invaluable resource. This article sets out what look to be U.S. claims in the forthcoming fast-track discussions.

These are quite horrifying. It says the U.S. aim is “to reduce U.S. dependence on China, where various links in the critical mineral supply chain are heavily concentrated.”

To do this, the U.S. will invest heavily under the Compact in Australian critical minerals resources mining, but only under certain conditions. The U.S. should only fund Australian mines and not refineries. All refining beyond the minimum level of crude refining in order to economically ship minerals to U.S. should be done in the U.S.

The U.S. should only fund Australian mines that produce minerals that are lacking in the U.S. and Canada, because “U.S. critical-mineral supply chains are most secure when they are in or near the U.S. and under friendly control. U.S. taxpayer dollars should not be expended on distant mines when nearby mines are available.”

This provision could make the proposal for funding Australian mines more palatable to Congress.

Chinese Entities Locked Out of Ownership

The U.S. should allow companies to partner in a U.S.-funded mine only if they are not owned in any way by foreign entities of concern, including all Chinese entities. The U.S. should not fund Australian mines where Chinese entities can benefit financially or influence the project at the expense of U.S. taxpayers. The article further states:

“To protect U.S. national security, if an Australian company is seeking to participate in a U.S.-funded mine in Australia, it should have to first divest any shares held by entities of concern.

American companies should have a controlling interest in U.S.-funded mines, so that the U.S. government can enforce compliance with U.S. regulations, such as blocking Chinese companies’ involvement or investment in the mine.”

This controlling interest can also determine whether to mine or to lock the Australian resource up as a U.S. strategic military reserve for the future.

The piece continues:

“Partnering with experienced Australian partners will also enable less experienced U.S. companies to build valuable mining skills. The U.S. should require that mined materials from Australia be refined by American companies in the U.S. The U.S. should also require that the mined material have an end use in a strategic U.S. sector like aerospace or transportation, not consumer electronics like televisions and mobile phones.

The U.S. should also require all companies participating in the mine to stop operating in China and selling their products to Chinese entities. Nor should the U.S. allow companies to use earnings from a U.S.-funded mine to support their operations in China or sales to Chinese entities.”

These are huge claims, probably put up through ASPI to test the climate of opinion in Australia.

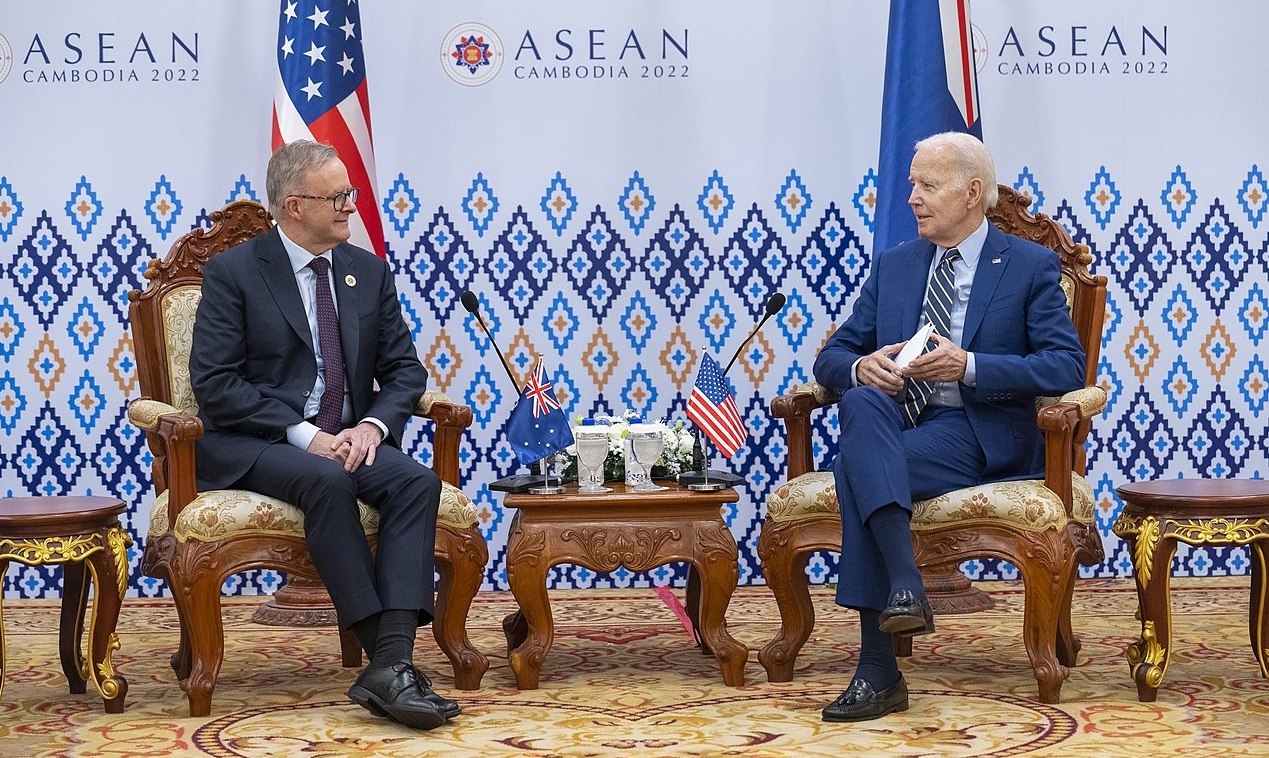

Australia’s Prime Minister Anthony Albanese meeting with U.S. President Joe Biden at East Asia Summit, November 2022. (Office of U.S. President)

The authors conclude that the Compact is “a satisfactory starting framework for strengthening critical-mineral supply chains between the U.S. and Australia. The stipulations attached to such an arrangement would help to ensure that U.S.–Australia supply chains are diversified, protected from Chinese influence, and forged by a workforce in both countries.”

In addition, a leading Washington law firm endorsed the Compact as a “huge step forward” in expanding U.S. proactive measures to secure supply of critical minerals and “hold out competitors.”

So, Australians will provide the critical minerals deposits and drive the trucks, while the U.S. will control and benefit from almost everything else in the supply chain, when and if the U.S. chooses to develop it. China will be kept out.

There are two big risks to Australia here: firstly, jeopardising whatever is left of its mining sector’s historic relationships of trust with its major mining market in China. Any Australian mining company currently selling to China could have its relationships and operations there crippled if it went into business with U.S. mining companies on this basis. It is pure mercantilism, to put it bluntly, aimed at cutting out Chinese competition in a fair marketplace.

Secondly, the proposals set out in the ASPI paper for U.S.-majority-owned mining companies to dictate and determine development of industry processing of critical minerals in Australia contradict Australian aspirations for economic sovereignty. They would put Australia firmly back in its place as a raw materials supplier to the Metropolis, and nothing more, as it was in the days of the British empire. This cries out for former prime minister Paul Keating’s acerbic pen.

I have no confidence in the ability of the present Australian Government, dazzled by the U.S. alliance, to manage these negotiations in the national interest – either commercially or strategically. I fear Australia will once again be exploited and entrapped by its great and powerful – and clever – friend.

Tony Kevin is a former Australian senior diplomat, having served as ambassador to Cambodia and Poland, as well as being posted to Australia’s embassy in Moscow. He is the author of six published books on public policy and international relations.

The views expressed are solely those of the author and may or may not reflect those of Consortium News.

Choose who’s colony you’ll be -OR- Friedrich List’s, “National System Of Political Economy” hxxps://ia800303.us.archive.org/34/items/nationalsystemof00list/nationalsystemof00list.pdf The forsaken US national system, The American System hxxps://americansystemnow.com/

You have to think at some point, the populations of US vassal states will rebel against their lame puppet governments. The rest of the world should be gearing up to give the US a taste of its own sanctions lesson. The abuses being proposed are beyond contemptible. It needs to stop.

Unfortunately they won’t as they’re more interested in the outcome of ‘Love Island’ than their own sovereignty.

To the US Mafia robber barons “sovereignty” has as much reality as “free market.”

Both US and Australia have driven off indigenous people from land rich in minerals; just look at the map where the aboriginal people are located today and the land abundant in natural resources that Australian government and US have seized. That’s the human crimes that are still happen under the nose of Amnesty and co… that is what UN and international justice should focus on… how can a culture be allowed to steal the land of indigenous people and be not held accountable???

Please tell me, what is this “Australian sovereignty” of which you write?

Thanks Tony. I have no confidence in the ability of the present Australian (Albanese) Government – full stop – and I voted for them. I think I lost confidence days after the election, when Albanese and Wong jetted urgently to kiss Biden’s Imperial Ring in Japan. My view now has moved to treachery approaching treason. I won’t vote for them again. Two-faced liars aren’t my idea of a government in Australia’s interests. They’re selling us down the river as I type these words. What a desperate disappointment.

Agreed Harry.

To say that one is disappointed does not begin to cover it. The sense of betrayal is keenly felt.

As one Oz commentator puts it (about Albanese):

“He seems fearful of standing up to what is rapidly becoming the worst Opposition in Australian political history. He is running scared of the malevolent Murdoch media.”

See: hxxps://johnmenadue.com/the-moral-emptiness-of-albaneses-politics/

Totally agree, Harry. The Albanese government is almost worse than the previous one in its eagerness to please its Washington masters. Actually, it is quite embarrassing and cringeworthy to see Albanese and Wong prostrate themselves before the senile satanic altar!

I knew ‘milquetoast’ Albanese was weak and ineffectual – a junior backbencher at best, only rising to become leader because he was the least offensive of the lot. But Wong, is far more of a disappointment. She has brains, and in the past has shown gumption, but seems to have been infected with the same political disease at the rest.

The same awaits us when Keir Starmer enters No 10 next year. Our ‘first past the post’ voting system is broken and so is the crooked ‘House of Lords’ where Boris appointed his hairdresser to the benches of government oversight.

Rotten to the core

US says “jump” & Oz says “how high”?

US says “bend over” & Oz says “how far”?

US wants to sell 8 nuke subs to Oz for $368 billion. That is enough to completely transform Oz infrastructure to 100% renewable energy, as well as construct high speed rail between the major cities, with change left over for medical and social programs.

Better do it, or the US will coup the Oz government, just as they did to Gough Whitlam in 1975*, who stupidly wanted to use Oz earnings for the benefit of ordinary Aussies. ALBANESE TAKE NOTE: your bloody university education was free thanks to Gough Whitlam.

*the CIA convinced MI6 to get the Queen and governor general to fire the democratically elected Whitlam, now accepted as proven fact by research and reporting from John Pilger and others.