Sam Pizzigati welcomes a national “Tax the Ultra-Rich Now” campaign that aims to to challenge profound inequality in the U.S.

Healthcare, Not Wealthcare! rally in Philadelphia, June 22, 2017. (Joe Piete, Flickr, CC BY-NC-SA 2.0)

By Sam Pizzigati

Inequality.org

If Dustin Hoffman should ever do a remake of The Graduate, the classic 1967 film that launched his famed cinematic career, what might be the 2020s update for that film’s most iconic exchange?

If Dustin Hoffman should ever do a remake of The Graduate, the classic 1967 film that launched his famed cinematic career, what might be the 2020s update for that film’s most iconic exchange?

A good many of us still fondly remember that poolside party scene. A 21-year-old “Benjamin” gets pulled aside for a career pep talk from an overbearing “Mr. McGuire” who says he has just one word of wisdom for Dustin Hoffman’s newly graduated young man: “Plastics!”

One real-life young man back then, James Dyson, would end up following Mr. McGuire’s advice — and go on to fashion plastic vacuum cleaners into the first global billion-dollar fortune that rests on polymers.

But no Mr. McGuire here in the 2020s would ever be pitching boring old plastics as a sure-fire path to grand fortune. What red-hot field of business endeavor would a modern-day McGuire be hawking? A report from Bain & Company, a global consultancy with offices in 65 cities worldwide, has a suggestion: wealth management.

And why do analysts at Bain see wealth management — the business of helping people of means grow their assets — as such a promising career path? A simple financial fact: A colossal chunk of the world’s wealth now sits in the pockets of affluents who have no clue what to do with all their good fortune. The “investable assets” of these wealthy worldwide, Bain is predicting, figure to double by 2030.

“The rich are getting richer, that’s for sure,” as Bain partner Markus Habbel, one of the authors of the financial firm’s new report, told the Financial Times earlier this week.

“If you have a wealth management capability,” agrees Goldman Sachs chief operating officer John Waldron, “you have a much more valuable business.”

The new Bain study doesn’t dive deep into any detail about our continuing maldistribution of global income and wealth. But other analysts most definitely have been subjecting that maldistribution to some increasingly sophisticated analysis. Over the past quarter-century, these researchers — many inspired by the work of the French economist Thomas Piketty — have been developing new statistical approaches to determining just who has what and how much of it.

Thomas Piketty in São Paulo, Brazil, 2017. (Fronteiras do Pensamento, CC BY-SA 2.0, Wikimedia Commons)

Researchers like Emmanuel Saez and Gabriel Zucman, both at the University of California-Berkeley, have taken us well beyond the tax return data that’s traditionally driven our core inequality stats. In their just-published latest work, Saez and Zucman have joined with their UC colleague Thomas Blanchet to tackle the challenge of calculating inequality in what they call “real time.”

Improving the Stats

U.S. government stats, the three authors point out, “do not make it possible to know who benefits from economic growth in a timely manner.” Indeed, until recent years, most numbers on income and wealth distribution came from snapshots taken well before the data went public.

The most recent distributional stats currently available from the Federal Reserve’s exhaustive triennial Survey of Consumer Finances, for instance, cover 2019.

In that same year, Federal Reserve analysts did inaugurate a data series with a much briefer lag time. These new distributional snapshots have been appearing quarterly ever since and the latest, released last month, covers this year’s first three months. In 2022’s quarter one, the Fed’s “Distributional Financial Accounts” show, America’s top 1 percent held 31.8 percent of the nation’s wealth. The nation’s bottom half held 2.8 percent.

The University of California’s inequality stats team has now trimmed the data lag time even further, to help us “track the distributional impacts of government policies” on a month-to-month basis and provide critically important information to have in the middle of an economic crisis.

The Berkeley team notes that none of the timely government economic stats we’ve had up to now — on total national personal income, unemployment, and more — have come “disaggregated by income level.” Without that disaggregation, we can’t know what social groups are benefiting from current government policies and what groups aren’t. And if we don’t have that information, then government programs successfully helping people who really need help can fall politically by the wayside.

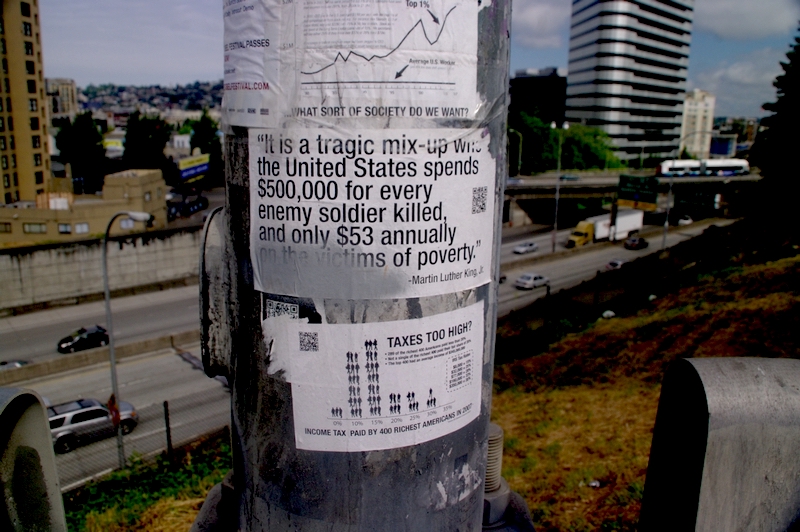

Income inequality poster, Seattle, 2011. (mSeattle, Flickr, CC BY 2.0)

The Berkeley analysts illustrate that dynamic by applying their new “real-time inequality” statistical methodology to our Covid pandemic years. At the end of 2021, their approach shows, America’s working-class households found themselves with 20 percent more disposable income than before the pandemic, thanks to the federal government’s expanded child tax credit and expanded earned income tax credit for adults with children.

But disposable income for the nation’s working families promptly then fell in early 2022 after Congress let those aid programs expire. By June 2022, the Berkeley economists sum up, the wealth share of America’s top 0.1 percent had returned “to its pre-Covid level.”

So, what do we do with all the new distributional data we now have available? Do we gaze at the new numbers and marvel at how incredibly rich our rich continue to be? Or do we battle to create a much more equal society where helping the wealthy manage their money no longer rates as our nation’s hottest career option?

New Institute

A host of long-time egalitarian activists are choosing the latter. They’ve just come together to establish an Excessive Wealth Disorder Institute, and this new institute, as its first order of business, is now teaming up with social justice advocacy groups and coalitions in a “Tax the Ultra-Rich Now” campaign to “TURN” America around.

A host of long-time egalitarian activists are choosing the latter. They’ve just come together to establish an Excessive Wealth Disorder Institute, and this new institute, as its first order of business, is now teaming up with social justice advocacy groups and coalitions in a “Tax the Ultra-Rich Now” campaign to “TURN” America around.

TURN campaign activists will be initially “collaborating with grassroots organizations across five key states – Georgia, North Carolina, Nevada, Pennsylvania and Wisconsin – with a focus on organizations centered in communities of color.”

Other campaigns will no doubt follow, on a wide variety of fronts. Those campaigns will have no shortage of tax-the-rich proposals to draw from. Among the latest, from Bob Lord and Dylan Dusseault of Patriotic Millionaires, a call for the passage of an “Oppose Limitless Inequality Growth and Restore Civil Harmony Act.” This “OLIGARCH” legislation would key new taxes on the wealth of America’s super rich to the nation’s median — most typical — household wealth.

Under the OLIGARCH Act, households holding between 1,000 and 10,000 times America’s median household wealth would pay an annual 2 percent tax on their fortunes. Those rates would escalate on households sitting on even greater stores of wealth. In the top tax bracket, for households worth over one million times our most typical household wealth, the annual tax would run at 8 percent.

Back in 1980, Lord and Dusseault note, fewer than 0.005 percent of America’s adults held over 1,000 times the nation’s median household wealth. By 2020, the ranks of that wealth cohort had quintupled. In 1983, not a single American held a fortune that equaled 100,000 times the nation’s median household wealth. In 2021, slightly over 50 Americans exceeded that threshold, and two Americans actually held over a million times the wealth of America’s most typical households.

That can all change.

Sam Pizzigati co-edits Inequality.org. His latest books include The Case for a Maximum Wage and The Rich Don’t Always Win: The Forgotten Triumph over Plutocracy that Created the American Middle Class, 1900-1970. Follow him at @Too_Much_Online.

This article is from Inequality.org.

The views expressed are solely those of the authors and may or may not reflect those of Consortium News.

In reference to my attempted post here yesterday. Not being a gifted writer or well trained one I struggled.

The reason for my referring to the Beau of the Fifth column was to put some emphasis on one of many problems those afflicted with “Excessive Wealth Disorder” are causing in this country. Beau is very subtle at times and this is one of them. Beau knows this is a very, very sensitive especially for the US government. Believe me rightfully so!

His point is that some of the wealthiest of the “Accelerationist” seem to believe they will miraculously be immune to the disastrous repercussions of what they are encouraging for others to become supportive of. Their behavior is nothing new and typical of self absorbed wealthy elitist we have in this country. Don’t think so look at the forever Trumpers.

These individual are extremely dangerous and everyone needs to recognize them for what they are. More proof that the US needs to focus on US problems in these times of great peril for all world citizens.

The time has come for us to focus on preventive movements to dash this sort of madness being propagated by these fools.

Thanks CN

We need someone to offer graduates this single word of advice: “Guillotines.”

Mmmm. What to write?

Over at YouTube Beau of the fifth column posted yesterday, “Lets talk about accelerating and a better use of your time.”

I’m pretty sure Beau was addressing an individual who wrote to him expressing total disgust with the current system in D.C. , one that should be getting failing and incompletes for grades on it’s performance.

He does a brilliant job here that needs to be seen by all, especially the deaf, dumb and blind who are presently called our nation’s leadership! Congress and the entire remainder of those who inhabit the swamp, all of them. The same group who I have commented before seems hell bent of causing a civil war in this country by their inept failure to get anything of real benefit accomplished for the masses.

Let us remember that we do not as individuals have to be in 100% agreement with others, in this case, Justin King but if this country is expected to survive our current trials and tribulations we all need sure as hell to get our collective “Shit Together”, or however one might like to phrase it. Beau has made sense here and has the bonifdes to back up his comments.

Beau goes through the scenario some feel might best benefit the U.S. and there for the “have nots.”

Both a logical and logistical explanations the explain very well what is wrong with the “Accelerationists” who are calling for a total tear-down of our government and society. The usual results of such extreme actions, the ones being touted by the unknowing fools trying to wreck our country.

Read it or don’t but remember this every one here had a chance to understand that one might want to watch what they wish for very carefully.

Thanks CN

There are likely differences somewhere, but we appear to largely be somewhere on the continuum of the grandiose neoliberal excesses in Chile and Argentina during the latter decades of the 20th Century.

This is not as mysterious as it can be made to sound. I’d say “Take the $54 bn US awarded to Ukraine for arms,” but it appears that someone already has. And then there was a trillion dollars here and another trillion there, mostly floating in accounts out thither and yon, almost none of it tied to any particular production or increase in value.

There is not a lot of essence or matter changed in the universe by a change in currency. But it is likely to mean that people who are holding will at some point cash their liquid assets in for something of substance. So at some point these things will be called “theirs” instead of “yours,” and arms will be wielded by different people and pointed in different directions to support all that.

We are already pretty thoroughly off the petrodollar, something that seems unlikely to return. This might be a pretty hard crash.

According to MMT, savings or ‘wealth’ are just the untaxed remnants of the money the government creates to provision itself. If we look at tax policy ever since the Reagan years, this savings has been substantial, year after year, and once invested, it has increased even more to the present unsupportable inequality.

The answer is very simple increased taxes as proposed, but hard to do politically.

If not done, the results will result in economic collapse as the government interest payments balloon–especially as the sanctions from the war in the Ukraine serve to disrupt the global dollar-dominance system that has made all this wealth creation possible.

Bring back the 91% top marginal tax rate. If it was good enough for Dwight David Eisenhower, it’s good enough for me.

I agree, Jeff. But with certain people in Congress, that ain’t a gonna happen soon.

If one looks up the meaning of the word valuable in an American dictionary; basically, it gives one meaning, and it is a literal concrete term, such as property – that which may be purchased and thereby owned.

Worth is used equivalently, which raises a corresponding question: Is concrete physical property identical to the inborn essences – the potentialities of the very underlying ground of natural life itself? Is the true worth in life – merely the ‘value added’ through constant pursuit of superfluous possessions rather than rising above the narcissism of self.

What international capitalism, and the apparently blind instinct of unceasing pursuit of greed fulfillment is bringing about, is the unconscionable dominance of the unconscious negative capacities in the heart and soul of humanity, and is turning gregarious man and her/his innate social tendencies into the least gregarious of all the animal species on the planet.

Capitalism is the antithesis of “giving the shirt off one’s back” to another. All those who must work for an employer must give the shirts off their backs to the employer. This is the devouring of life’s blood of persons, which is not too dissimilar, in this day and age, from cannibalism. War is to murder, as is the exploitation of human beings, to cannibalism.

“Freedom’s just another word for nothin’ left to lose” – Kris Kristofferson

According to Merriam-Webster the definition of ‘social animal’ is an animal that lives in groups.

According to Aristotle, human beings are “social animals” and therefore, naturally seek the companionship of others as part of their well-being.

Therefore, “Man is by nature a social animal; … Society is something that precedes the individual.”

What is the value of a society; what is its business, given that the business of corporations is not synonymous with the well-being of society, despite corporations having been determined to be persons by the SCOTUS?

The term highlights the contradiction in the definition of the word oxymoron; an insane society cannot both be sane and insane. Not a person in reality, cannot a person be, in reality, simply by dint of the fabrication of the mind of man! Only in the biases of the fantasies of a socioeconomic political ideology can this be accomplished!

A perpetual warmongering country, in the pursuit of hegemonic power abroad, cannot both be humanely pursuing the best interests of humanity at home, while acting towards the majority of its own citizens without an iota of the humanitarian conscience it proclaims to be expressing internationally. At most, this represents an example of the false dichotomy in disingenuous leadership!

The academic study of the statistics of economics, is akin to the academic study of the statistics of war. Do they bring inhumanity any closer, in the immediate term, to an effective preemptive for stopping the evil hand of irrational greed, death and destruction?

Inequality is also a result of excessive military spending.

In his book, Harry S.Truman and the War Scare of 1948: A Successful Campaign to Deceive the Nation, author Frank Kofsky quotes from a February 1949 edition of Business Week:

“Today the prospect of ever-rising military spending acts:

(1) as a sort of guarantee against any drastic deflation of the economy;

(2) as a ceiling. . . on ambitious social-welfare projects”.

The article goes on to warn that such a project “redistributes income.”

Cutting military spending is not, therefore, simply about promoting peace but also social justice.

“Under the OLIGARCH Act, households holding between 1,000 and 10,000 times America’s median household wealth would pay an annual 2 percent tax on their fortunes. Those rates would escalate on households sitting on even greater stores of wealth. In the top tax bracket, for households worth over one million times our most typical household wealth, the annual tax would run at 8 percent.”

Are you kidding me??? 2%? 8%? That’s like making a bank robber give back 2-8% of the money he stole. Wealth taxes should start at at least 50% and should be 100% for everything over a billion (I could be talked into a lower number there).

And that’s just for starters to take back what was stolen from us. What we really need is to prevent people from becoming billionaires in the first place. Key minimum wage to maximum compensation (no executive should earn more in a month than their lowest paid employee earns in a year). Eliminate the completely unneeded health insurance industry entirely and provide universal single-payer free at the point of service healthcare. Completely rework patent/trademark/copywrite laws so, for instance, big pharma doesn’t profit from preventing drugs from going generic and basic common phrases can’t be trademarked. Speaking of big pharma, price cap drugs. Restore the barrier between savings banks and investment firms. Regulate the real estate industry so we don’t have huge developers sitting on vacant housing while housing prices skyrocket.

Oh, hell, let’s just go all the way and nationalize everything.

“No executive should be paid more than his lowest paid employee in a year ” Wow this should be etched in gold and neon displayed on the UN plaza in New York to inspire myopic political leaders the word over !

Well sorry for the incomplete quote !

Complete quote:

“no executive should earn more in a month than their lowest paid employee earns in a year”