Special Report: America presents itself to the world as “the land of the free” but for the vast majority it is a place of enslaving indebtedness, a reality for much of “the 99%” that has deep historical roots hidden or “lost” from our history, as Jada Thacker explains.

By Jada Thacker

Since its center-stage debut during the Occupy Wall Street movement, “the 99%” a term emblematic of extreme economic inequality confronting the vast majority has become common place. The term was coined by sociology professor David Graeber, an Occupy leader and author of the encyclopedic Debt: The First 5,000 Years, published just as the Occupy movement captured headlines.

What Graeber’s monumental work did not emphasize specifically, and what most Americans still do not appreciate, is how debt was wielded as the weapon of choice to subjugate the 99% in the centuries before the Occupy protesters popularized the term. Like so many aspects of our Lost History, the legacy of debt has been airbrushed from our history texts, but not from our lives.

The original 99% in America did not occupy Wall Street in protest. They occupied the entire Western Hemisphere as original inhabitants of North and South America. After 20,000 years of Occupy Hemisphere, an Italian entrepreneur appeared, having pitched an investment opportunity to his financial backers in Spain.

Soon after Columbus launched his business enterprise on the pristine beaches of the New World, each native discovered there above the age of puberty was required to remit a “hawk’s bell’s worth” of gold dust to the Spaniards every two weeks. The hands of all those failing to do so were cut off and strung about their necks so that they bled to death, thus motivating the compliance of others.

Bartolome de las Casas, a contemporary slave-owning priest-turned-reformer, reported three million natives were exterminated by Spanish entrepreneurship in only 15 years. His population figures were guesstimates, but modern researchers confirm that 80 to 90% of the Taino people in the Hispaniola-Cuba region died within 30 years of Spanish contact, the majority from disease.

In the century following Hernan Cortés’s extreme “hostile takeover” of the admittedly brutal Aztec regime (1519-21) the native population of the entire region also declined by 90%. The same story generally followed the Spanish march across Central and South America.

Spanish conquistadors rationalized that their colonial business model, however brutal, was morally necessary: without religious conversion to the Church, pagan natives would have been condemned to an everlasting Christian hell. Ostensibly to save pagan souls, Spaniards destroyed pagan persons with the draconian encomienda system, in essence a debt-based protection racket.

The encomienda dated from the Roman occupation of Iberia (Spain), but had more recently metastasized from the practice of Christians exacting tribute from Muslims during the so-called Spanish Reconquista, which ended the year Columbus sailed. Under this medieval debt obligation, the native 99% were deemed to owe their labor and resources (not their land, which was expropriated by the Crown) to Spaniards in exchange for “protection” and religious education.

The system’s legitimacy in the New World depended upon the useful fiction that the native labor force was not composed of sentient human beings. Thus, it was not lawful to impose encomienda upon persons of mixed-race (mestizo) presumably because they had enough European blood to be considered human.

In practice, this debt-labor system devolved into slavery and butchery of the most brutal sort imaginable, as witnessed by de las Casas. Though the encomienda was eventually abolished, it was replaced only by the hacienda system.

Haciendas were Spanish plantations on which natives worked as landless peasants, who owed a share of their produce to the landowner for the privilege of living lives similar only to those of Southern plantation slaves in the U.S. a century or two hence.

Spanish mines were the scene of even worse atrocities. In The Open Veins of Latin America, Eduardo Galeano details the horrors: native mothers in the notorious Bolivian Potosi silver mine murdered their own children to save them from lives spent as slave troglodytes.

Although some Potosi miners were nominally “free” laborers, they worked under a debt-peonage system that forbade them to leave the mine while still indebted to employers who loaned them the tools of their trade. Not even death extinguished their debt: upon the death of the indebted miner, his family was required to repay the debt with their own perpetually-indebted labor.

The tragedy of the Spaniards’ devastation of untold millions of native lives was compounded by seven million African slaves who died during the process of their enslavement. Another 11 million died as New World slaves thereafter.

The Spanish exploitation of land and labor continued for over three centuries until the Bolivarian revolutions of the Nineteenth Century. But even afterward, the looting continued for another century to benefit domestic oligarchs and foreign businesses interests, including those of U.S. entrepreneurs.

Possibly the only other manmade disasters as irredeemable as the Spanish Conquest in terms of loss of life, destruction and theft of property, and impoverishment of culture were the Mongol invasions of the Thirteenth and Fourteenth centuries. The Mongols and the Spaniards each inflicted a human catastrophe fully comparable to that of a modern, region-wide thermonuclear war.

The North American Business Model

Unlike Spaniards, Anglo-American colonists brought their own working-class labor from Europe. While ethnic Spaniards remained at the apex of the Latin American economic pyramid, that pyramid in North America would be built largely from European ethnic stock. Conquered natives were to be wholly excluded from the structure.

While contemporary North Americans look back at the Spanish Conquest with self-righteous horror, most do not know the majority of the first English settlers were not even free persons, much less democrats. They were in fact expiration-dated slaves, known as indentured servants.

They commonly served 7 to 14 years of bondage to their masters before becoming free to pursue independent livelihoods. This was a cold comfort, indeed, for the 50% of them who died in bondage within five years of arriving in Virginia this according to American Slavery, American Freedom: The Ordeal of Colonial Virginia by the dean of American colonial history, Edmund S. Morgan.

Also disremembered is that the Jamestown colony was founded by a corporation, not by the Crown. The colony was owned by shareholders in the Virginia Company of London and was intended to be a profit-making venture for absentee investors. It never made a profit.

After 15 years of steady losses, Virginia’s corporate investors bailed out, abandoning the colonists to a cruel fate in a pestilential swamp amidst increasingly hostile natives. Jamestown’s masters and servants alike survived only because they were rescued by the Crown, which was less motivated by Christian mercy than by the tax it was collecting on each pound of the tobacco the colonists exported to England.

Thus a failed corporate start-up survived only as a successful government-sponsored oligarchy, which was economically dependent upon the export of addictive substances produced by indentured and slave labor. This was the debt-genesis of American-Anglo colonization, not smarmy fairy tales featuring Squanto or Pocahontas, or actor Ronald Reagan’s fantasized (and plagiarized) “shining city upon a hill.”

While the Spaniard’s ultimate goal was to command native labor from the economic apex, the Anglo-American empire would replace native labor with its own disadvantaged 99%. The ultimate goal of Anglo colonization was not intended so much to put the natives under the lash as to have rid of them altogether.

Trade deficits and slavery would answer their purpose quite nicely. By the 1670s New England Puritans were already rigging the wampum market at their trading posts in order to pressure the Wampanoag into ceding land thus in part precipitating the Narragansett War, King Philip’s War, the ensuing genocide of some natives, and the mass enslavement of others to be sold abroad.

As chronicled by Alan Gallay in The Indian Slave Trade: The Rise of the English Empire in the American South, 1670-1717, Carolina colonists concurrently sold Indian slaves to the God-fearing Puritans and trading others for African slaves at a 2:1 exchange rate while wielding trading-post debt against local Indians, precipitating the Yamasee War which proved to be a major disaster for natives and whites alike.

For half a century, the Carolina colonists’ export of tens of thousands of Indian slaves exceeded imports of black slaves. This was the origin of Southern plantation agriculture.

The institution of North American Indian slavery was necessarily based upon debt. English law forbade colonists from enslaving free persons, but it conceded that prisoners of war could be considered slaves. Because captives owed their lives to their captors, the latter could dispose of the debt as they saw fit, to include transferring the debt to a third party for goods and services.

The captive-to-slave pipeline was sanctioned by none other than John Locke, the renowned philosopher who directly inspired Jefferson’s composition of the Declaration of Independence, and who is often championed today by libertarians and no wonder! as an oracle of private property rights.

All along the westward frontier, American colonists continued to foreclose on natives’ land with debt machinations perhaps less overtly brutal, but far more devious than the Spanish encomienda: to remove the self-reliant 99% from their land, it was necessary first to remove their self-reliance.

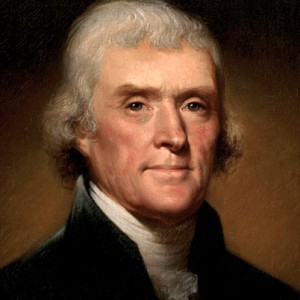

Here is how President Thomas Jefferson explained the process to future president William Henry Harrison in 1803: “To promote this disposition to exchange lands [] we shall push our trading uses, and be glad to see the good and influential individuals among them run in debt, because we observe that when these debts get beyond what the individuals can pay, they become willing to lop them off by a cession of lands.

“As to their fear, we presume that our strength and their weakness is now so visible that they must see we have only to shut our hand to crush them, and that all our liberalities to them proceed from motives of pure humanity only. Should any tribe be foolhardy enough to take up the hatchet at any time, the seizing the whole country of that tribe, and driving them across the Mississippi, as the only condition of peace, would be an example to others, and a furtherance of our final consolidation.”

Debt more so than firepower, firewater, or even disease provided the economic weapon by which Anglo-Americans designed to privatize the Indians’ means of self-reliance. “How the West Was Won” in the “Land of the Free” was a saga of debt moving inexorably westward in what Jefferson called “our final consolidation.” He might well have said “final solution,” but he did not.

As debt expanded westward, desperate Anglo settlers believed the frontier land was “free for the taking” for those with the stamina to seize it. This belief ultimately proved illusory, as land “squatters” and homesteaders were evicted or forced into paid tenancy through debt or the legal maneuvering of wealthy land speculators.

George Washington secured the eviction of pioneer families from western Pennsylvania land he claimed to own in absentia, although those he forced from the land possessed a deed that pre-dated his own, as related in Joel Achenbach’s The Grand Idea: George Washington’s Potomac & the Race to the West.

On the other hand, Daniel Boone, famed for leading pioneers westward through the Cumberland Gap, died landless, all his land claims having been picked off by legal sharpshooters. Also landless, Davy Crockett died at the Alamo in an attempt to secure Texas acreage he never survived to claim.

The final illusion of free soil vaporized when in 1890 the United States census declared the American Frontier closed. Much of what was left had at any rate been monopolized by railroad, ranching, mining, and forestry corporations after the Dawes Act had privatized most of the natives’ “protected” reservation lands in 1887. For most white and black Americans, meanwhile, free tenancy homesteads had never materialized in the first place.

Debt vs. Self Reliance

Jefferson’s “final consolidation” was accomplished by a system he admitted offered debt with one hand but held a sword in the other. The estimated 3,000,000 families who lost their homes during the Great Recession that began in 2007 understand this principle intimately.

The debt system is in fact more powerful in the Twenty-first Century than ever before because the 99% are far less self-reliant now than ever before. To understand why this is so, we must first think seriously about the term “self-reliance.”

Although we may casually refer to someone as being self-reliant, such people do not actually exist. Human beings simply are not equipped to survive, much less prosper, strictly as self-reliant individuals. As infants and children we cannot survive without familial care, and as adults we cannot prosper without the cooperation and support of peers.

There has never been, and never will be, such a thing as a “self-made man.”

On the other hand, the 99% was self-reliant the day before Columbus arrived. They possessed the means of production of the energy and food resources needed for their group’s long-term survival and biological propagation, all without significant contact with others. Had the culture of Columbus been equally self-reliant, he would never have needed to set sail.

Judged by modern standards, American native groups were intensely cooperative, extremely egalitarian, and inherently (if informally) democratic. Government as a coercive force did not exist in these groups as we know it today, though leadership and traditional mores were vital to group survival.

Similarly, the concepts of money and monetary debt were unknown, as was the concept of an economic “class” that reserved economic privileges or property to itself at the expense of all. Interpersonal behavior within native groups, by eyewitness accounts, was respectful and peaceful.

Behavior between native groups usually was not peaceful. Persistent low-level warfare was the norm. It could be brutal indeed, but rarely if ever rose to the scale of civilized “total war.”

Indeed, since a “warrior class” did not exist and could not be conscripted, native combatants were necessarily volunteers who otherwise were needed at home to help provide for their families. Consequently, the severity and duration of native warfare were limited as it is for all human groups everywhere to what society at large can economically afford.

Among the original 99%, all men mostly performed the same sort of occupational tasks. All women did the same. Both sexes had a common goal: food production and the reproduction and rearing of children. While all human groups must achieve these basic goals, civilized peoples do so within a complex hierarchical labor system, wherein some occupational tasks are considered more worthy than others and are compensated accordingly.

Civilized division of labor inevitably has metamorphosed into a hierarchy of economic classes, ultimately resulting in the private ownership of the means of production by the “haves” and the lack of private ownership by the “have-nots.” This was unknown in uncivilized native society.

Native land, for example, was not actually “owned” in the contemporary sense at all. Natives were acutely aware that they, themselves, were products of the land; for them, claiming ownership of the land would have made as much sense as children claiming ownership of parents.

Sioux chieftain Sitting Bull, who led his people to victory at the Battle of Little Big Horn in 1876.

This is not to say that natives were not territorial, for they were highly territorial. But their territoriality was not based upon legalistic titles of private property. Access to communally-held food resources not ownership of real estate was their sine qua non for sustainable survival.

What natives shared in common they defended in common. Having no economic hierarchy, no one in their society could control the food supply of others, simply because no individual could claim exclusive ownership of the collective means of food production. Abundant resources were therefore abundant for all; if scarce, they were scarce for all.

True enough, when the Europeans arrived, they found native societies everywhere in conflict with their neighbors, but nowhere did they find endemic poverty, famine, disease or social degeneracy. Indeed, it was the self-reliant natives who helped feed the first generation of starvation-prone English colonists both at Jamestown and at Plymouth.

Once private ownership clamped down upon the landscape, virtually nobody would control their own food supply without some form of indebtedness to another. But since the resource stock of self-reliant food production the land itself would remain in place, private monopolist-owners required an economic mechanism to keep what remained within their grasp forever out of reach of others.

The Hand That Gives

As self-reliant native societies were decimated by debt, disease, and sword, ownership of the previously un-owned land was usurped by the conquerors. But it was not to be usurped equally by all of them.

Economic-class domination was problematical in British North America, because the economic pyramid that supplanted the communal native system was composed largely by people in the same Anglo ethnic group. It is one thing to justify violent economic domination of those with a “foreign” language, culture, religious sensibility and physical appearance; it is quite another to justify overlord-ship of those virtually indistinguishable from oneself.

Nevertheless, class domination was a stark fact of life in Colonial America where the economic division between masters and servants was sharp and where all land titles originally flowed down from the Crown to a short list of royal favorites, sycophants and lackeys. After the Revolution, however, maintaining economic class domination proved especially tricky, eventually requiring the drafting of an “all-American” document for that specific purpose.

Yet the solution to the problem to elite domination of a supposed “republic” had been imported, disease-like, from the Old World. In the centuries preceding Columbus’s arrival, two critical economic developments had transpired in Europe: the rise of an economy based upon metallic currency and the de facto repeal of the Biblical prohibition on loaning currency at interest.

The upshot of these quiet revolutions was the replacement of the sovereign currency owned by kings and emperors by that of private currency owned by the new economic elite known as bankers. In Antiquity, currency was owed by subjects to the monarch as tax. This was the reason for Joseph and Mary’s celebrated journey to Bethlehem.

But by the time of Columbus (and continuing to the present day) currency was to be owed to private persons by the monarch, who borrowed from them at interest to finance wars to protect and defend monarchical control over the means of food production.

To be sure, government still levied taxes as in the days of Jesus, but the tax revenue was not exchanged directly to conduct war, but to repay principal and interest to bankers only too obliging to finance wars for personal gain.

Indeed, war and bank-indebted sovereigns are inseparable. The very first European bank to loan at interest was established during The Crusades by the Knights Templar; Spanish king Charles I squandered the vast majority of his conquistadors’ New World gold on paying crushing interest charges incurred during his long war in the Netherlands; King William’s War against France was made possible by the establishment in 1694 of the Bank of England, the world’s first central bank.

Wherever modern war exists, governments are indebted to bankers. This is what prompted a cash-strapped Napoleon to observe: “When a government is dependent upon bankers for money, they and not the leaders of the government control the situation, since the hand that gives is above the hand that takes. Money has no motherland; financiers are without patriotism and without decency; their sole object is gain.”

It is hardly coincidental that the first bank in North America was chartered to supply arms for the American Revolution, and the first central bank of the United States was chartered specifically to fund Revolutionary War debt. Although no banks had existed in British North America during the 174 years preceding the Declaration of Independence, America’s first commercial bank sprang forth in 1781, literally before the smoke had cleared from the American Revolution nearly a decade ahead of Constitutional government.

This fact alone suggests where real economic power had been vested, long before the words “We the People” ever went to press.

Unlike the days of Antiquity, wealth taken by force was not to be held by those who wielded the sword, but by those who financed the supply of swords. The means of North American food production, first expropriated under the banner of European imperial power, would be owned thereafter in Republican America as in monarchical Europe alike by new conquistadors called creditors.

Scarcity, Debt, and “Necessitous Men”

Monopoly of the food supply of the 99% was accomplished by replacing self-reliance with debt bondage. The second step was to reserve private land ownership to particular individuals within the dominant class. This would be accomplished by imposing upon the land a wholly arbitrary number called a “price.”

The prime function of a monetary price was to render land unaffordable for all except a few creditor-entrepreneurs. Under the precious-metal-based system then in place, currency had been endemically scarce in North America, making this an easy task.

If American land so recently filched from its native inhabitants, then re-filched from its imperial British overlords were to be had by freedom-loving American common folk, it would be had on credit, and on the creditor’s terms. The fate of the Ohio land of the Old Northwest Territory provides a case in point.

In 1749, King George II granted Ohio land to a private corporation, the Ohio Land Company, whose shareholders included George Washington’s paternal uncles. Tellingly, the grant was bestowed 15 years before Britain actually established sovereignty over that land by winning the French and Indian War.

That war which became the first World War in all of human history was ignited, not incidentally, by George Washington himself when he ordered the murder of Indians and a French nobleman upon Ohio land Washington likely considered private property, possibly his own.

It would yet require the American Revolution, three more Indian Wars all under Washington’s presidential authority plus a good deal of diplomatic treachery, finally to “open” the land for Anglo settlement.

But its first owners were not to be hardy frontiersmen and their growing families. In the meantime, select government committees, again not incidentally, had priced the land out of reach of those most in need, so ownership fell into the hands of well-heeled real estate speculators, to include of course Washington, himself.

With the Ohio land grab as background, let us consider the principle of scarcity as it relates to trade. All trade is predicated upon exchanging something one possesses for something one would prefer to possess instead. If there were no such thing as scarcity that is, if all persons already possessed sufficient quantities of the stuff they need nobody would have the inclination to trade anything at all.

What, then, about debt? No self-regarding person would voluntarily borrow currency at interest if they already possessed enough currency to exchange for the stuff they need to live. If this is so, then for creditors to profit by lending at interest, a single condition is always necessary: persons should not be allowed a sufficient quantity of currency to complete the desired exchange. When currency is scarcer than the goods for which it is to be exchanged, prospective buyers have only two legal options: do without, or borrow.

If the consequences of doing without (starvation or homelessness, for example) are sufficiently unacceptable, and if a creditor is available, then a debtor is certain to emerge. This emphatically does not imply that the debtor is always a willing party to a debt obligation.

Indeed, the entire logic of indebtedness implies the opposite. No rational entities businesses, governments, or individual persons put themselves into interest-bearing debt if they need not do so. Put simply: debtors are the needy who can no longer afford self-reliance.

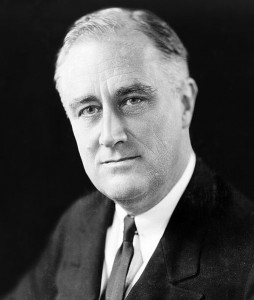

Franklin Delano Roosevelt expressed this reality eloquently in 1944 when he declared to the nation, “Necessitous men are not free men.” He was mostly preaching to the choir. The American 99% had known this truth since indentured-servant pioneers had waded ashore at Jamestown in 1607 only to find upon their emancipation that all the valuable land had already been monopolized by the planter elite.

Having failed to learn the history debt played in the exploitation of the New World, modern Americans fail to perceive they have inherited the same debt-system foisted upon the natives by colonizing Europeans and later by American elites upon their own people. Consequently, we think of debt only as a contract made voluntarily between two consenting adults.

But in America today every newborn child is a predestined debtor, no matter what he or she will consent to in the future. Once the free land tenure of communal native societies was destroyed, it was never to return, not even for the progeny of the destroyers.

Debt-bondage today takes a more subtle form. If Americans are no longer debt-peons, forced to slave away on the landlord’s estate or starve, it is only because the landlords no longer care where we slave away. Landlords extract their monthly payments regardless. Today about 25% or more of the earnings of workers flows as rent to landlords or as debt payments to mortgagees.

Indeed, fully half of the debts held by commercial banks alone are tied to real estate. Nor do Americans conceive the staggering price tag affixed to land: for example, economist Michael Hudson reports the dollar valuation of real estate in New York City alone is higher than that of the industrial plant of the entire nation.

As 2016 arrived, American households owed about $13.8 trillion in home mortgage debt, which effectively is a rent payment to the mortgagee who holds the title to the property. All persons without a mortgage must pay rent to a landlord. All persons without mortgages or landlords must still pay property taxes until death, at which time any unpaid taxes in an echo of the Potosi miners’ debt-peonage system must be paid by their indebted heirs.

Thus, the entire landmass of the Western Hemisphere, which for over 20,000 years had been the source of self-reliance for all its human inhabitants, remains hostage to the same debt system that seized it and which now extracts ransom from the 99% who would claim the least corner of it as home.

Debt vs. Dollars

In Early America, the scarcity of precious-metal coinage (specie) was a perennial problem. So scarce was gold that the first coinage act passed by Congress in 1792 defined the U.S. dollar as “each to be the value of a Spanish milled dollar as the same is now current, and to contain four hundred and sixteen grains of standard silver.”

Thus the United States dollar was literally established on a “silver standard,” and it was Spanish silver at that! The now oft fetishized American “gold standard” for currency would not officially materialize until the Twentieth Century with the passage of the Gold Standard Act in 1900. It did not last long.

After only 33 years, the Gold Standard was abandoned by the Emergency Banking Act of 1933, which was passed to remedy what else? the scarcity of currency during the Great Depression. (All the world’s major currencies dropped the gold standard during this crisis.)

Subsequently, the gold standard never was reemployed domestically in the U.S. And even the dollar’s international convertibility to gold finally was declared extinct, courtesy of President Richard Nixon, in 1971.

It was appropriate for gold to tread the path of the dinosaur, for it had come to resemble one. Though it is evident that currency must be scarce to some degree in order to maintain its exchange-value purchasing power, all precious-metal-backed currencies suffer from their dinosaur-like tendency of becoming increasingly scarce.

As the volume of trade increases in a growing economy, any medium of exchange based upon a finite quantity of metal cannot keep pace. The result is a constant increase in the purchasing power of the metal-backed currency, which becomes ever-more scarce in proportion to the number of persons needing to possess it.

This, in turn, leads to “necessitous men” becoming debtors to those in possession of the metal sometimes to governments, sometimes to businessmen, but always to bankers.

Historically, American currency has usually consisted of a mish-mash of specie, paper money, and debt, often accompanied by copious reserves of flimflammery. Thus, purchasing power has always been based partially upon some form of debt obligation, not just gold or silver coin.

During the Colonial Era, “bills of exchange” essentially IOUs of transferrable debt served as currency for the wealthy and the merchant class. Later, “bills of credit,” un-backed fiat currency issued by the Continental Congress as paper money, financed the Revolution, along with some $60 million of private domestic lending.

Finally, under the National Banking Act of 1862, paper currency issued by national banks was backed by the amount of federal debt IOUs owned by the bank. This officially made the most popular medium of exchange broadly based upon national (war) debt. In addition, the government spent into existence Greenback fiat money, which was backed by nothing at all.

When in 1913 the Federal Reserve Bank (the Fed) began issuing Federal Reserve Notes, they were at first redeemable either in gold or “lawful money,” but their redemption was soon cancelled by the Emergency Banking Act noted above. Since then, all “backed” currency has been withdrawn from circulation, leaving Federal Reserve Notes (dollar bills), exchangeable only for debt owned by the privately-owned Fed as the sole legal tender of the United States.

Although the gold standard is long gone, “necessitous men” remain. This is not happenstance.

A classic photo of a poor mother and children in Elm Grove, California, during the Great Depression. (Photo credit: Library of Congress)

This is the result of applying the mentality of gold-standard scarcity to the modern creation of financial debt, which is but the latest scheme by which the means of production of food that is, the vast landscape of North America is owned by the few and rented out to the rest at interest.

“Gold Bug” libertarians decry the absence of a federal statute defining the value of a U.S. dollar but they miss the point. No doubt the “value” of a dollar matters a great deal to those who hoard them by the billions; but dollar “value” is less a concern for the 99%, who are allowed to earn so few dollars they are forced to borrow them at interest from the hoarders.

As it applies to the 99%, our wages are the source of the currency we all must possess in order to live. But none of us actually controls how much currency we earn (or quite often how much of it we must spend); as a result, we do not control how much we may be forced to borrow.

Finally, we certainly do not control the conditions that will be imposed upon us if we must borrow (or whether we will be allowed to borrow at all). Put bluntly, the economic lives of wage earners are not in their own hands, but rest in the “hand that gives.”

We have only to be thankful we live in a “free country,” whatever in the world that is supposed to mean.

How the West Was Owed: Redux

In the years following the Revolution, some 90% of the American population subsisted as farmers. American women in the coming century would, on average, give birth to eight children who lived into adulthood. Accordingly, not only did population double every 30 years, the demand for additional farms more than trebled every generation.

Moreover, uninformed agricultural practices rapidly destroyed topsoil, sending “dirt poor” farmers streaming westward in search of land more fertile than their wives. As the frontier chased the setting sun, speculators and corporate agents raced ahead like locusts, devouring the landscape on the cheap, renting or re-selling at the price dictated by the demographics of desperation.

When American school kids are taught about Conestoga wagon “prairie schooners” creaking along the Oregon Trail or the Oklahoma “Sooners” land grab or the California Gold Rush, they are encouraged to view these events as technicolor visions of a unique American Opportunity unavailable to lesser mortals.

In truth, the 99% headed west simply because there was no place left for them to go. These economic refugees no doubt saw opportunity before them, but a great many of them must have perceived it the same way the many Third Class passengers on the Titanic viewed the opportunity offered by a lifeboat with an empty seat.

In 1893, historian Frederick Jackson Turner enunciated his famous “Frontier Thesis.” He claimed that the American Frontier experience had produced a unique form of democratic culture, increasingly more hostile to social and economic hierarchy as it spread from the Atlantic to the Pacific. The Frontier Thesis is a powerful idea, especially in its view of the frontier as an evolutionary process, which it was.

But Turner’s thesis perhaps unintentionally reinforced both the preexisting theocratic Puritanical creed of American Exceptionalism and the ordained racism of Manifest Destiny both of which were based upon a belief in the sanctity of Anglo-American economic domination of the New World.

For 40 years, Turner continued to proselytize his prototype of Hollywood Americanism as the rapidly industrializing United States rose to world-power status, and he became a celebrity doing so. Had Turner spent an hour or two of that time pondering the deeper implications of his own home mortgage, he might have discovered a more profound reality.

While the American frontier had indeed fundamentally and irrevocably revolutionized the economic relationship between human beings and their control of the North American landscape, the revolution was not achieved by abandoning European principles of social and economic hierarchy, but by transplanting them to the Western Hemisphere.

To view the conquest of North America as the triumphant flowering of democratic liberty and affluence over bestial savagery and abject poverty is so factually vacant, so morally and economically perverse, as to be considered hallucinatory.

Native people literally had no words to describe the cataclysm that had destroyed them. It was left to follow-on generations of “necessitous men” to learn the vocabulary of servitude needed to describe their economic lives.

Here is only a part of the terminology “necessitous men” needed to learn: poverty level, payday loans, food stamps, interest rate, surcharges, eviction, unemployment rates, lock-outs, foreclosure, bankruptcy, credit scores, down payment, damage deposits, credit limit, collection agency, mortgages, user fees, closing costs, title loans, bail outs, insolvency, title insurance, origination fee, installment plans, tax levy, deed restrictions, market crashes, illiquidity, non-sufficient funds, minimum payment due, late fees, lay-offs, property lien, pawn tickets, collateral, tax withholding, service fees, forfeiture, inflation, deflation, stagflation

Is this the vocabulary of free people?

As of January, 2016, Americans (government, business and individuals) owed an estimated $65,000,000,000,000 ($65 trillion) in total debt, with the average citizen’s share about $200,000. Of course, these are aggregate figures: many individuals and businesses owe more, many owe less, but everybody owes.

Now consider: the annual median income (mid-point, not the average) of American citizens is $29,000; that median family savings is below $9,000; and that the median price of a new home is over $294,000. Personal debt (not including national and business debt) per citizen is $54,000, or about twice the median income.

It does not require Napoleonic genius to grasp the fact that the “hand that gives” can load more debt onto the 99% than they can ever possibly repay. This is not a mistake or a “conspiracy”; it is simply a business plan. For every citizen’s $200,000 share of debt, some other entity or citizen expects to collect $200,000 plus interest. Will such a business plan succeed? Ask a Taino or a Wampanoag if you can find one handy.

There is an historical anecdote of a question posed long ago by a Cherokee. “White Brother,” he said, “when you first came to this land, there were no debts. There were no taxes. And our women did all the work. Do you expect me to believe you can make this situation better?”

The 99% should know the answer. And women still do most of the work.

Jada Thacker, Ed.D is a Vietnam veteran and author of Dissecting American History. He teaches U.S. History at a private institution in Texas. Contact: [email protected]

Nice article. At the end you imply that the Wampanoag, like the Taino, were wiped out. You might be surprised to know that the Wampanoag are alive and well in Mashpee, Massachusetts:

http://www.mashpeewampanoagtribe.com/

An eloquent but deranged mixture of truth and lies.

Thank-you for such a detailed and informative post. It is not surprising there is so much debt considering that is how the money supply is created. I believe that the world of money and debt is ripe for disruption and look forward to the challenge of making something better. Maybe even making some history. http://equid.instapage.com/

Fantastic peice of historic work. It is amazing how relevant this is and why it is not taught in schools. Thank you for this fantastic information

I can take only small bites at a time of heavy reading like this, so I’ve saved the long essay.

From what little I’ve read so far, it’s my impression that Mr. Thacker is one hell of a good history teacher.

The mathematics of compounding interest on a money system based upon usury is acting to exponentially enrich the very top and impoverish those who own the debts.

A book “Truth in Money” first published in 1982 proposes a math formula, that graphed out, predicts M3 and it becomes obvious why they discontinued M3. It’s the simple graph of compounding interest since the FED was established in 1913. Use 6% as the 100 year average interest rate. So the graph has 100 years on the horizontal axis and $$$ on the vertical. That’s ($1 borrowed in 1913 X 1.06) X 1.06) for 100 years, capitalizing in the interest. This simple graph is nearly exactly M3…until M3 was removed. At the end, the usury on the $1 is $330, next it’s nearly $600 and the next $1300. Thereafter it grows exponentially. M3 would be scaring the mommy’s and daddy’s with it’s NECESSARY exponential growth. It shows the flaw of the fractional reserve system…being a pyramid scheme of debt that we have no hope of ever repaying. Just reduce the interest to make the graph temporarily flatten, but when it’s raised…the usury explodes higher. That being the problem of raising interest in any sizable amount.

Now the solution. It’s not to nationalize the FED but to change the US money system away from a monopoly and into a system beneficial to the public, the 99%. Don’t make the same mistakes that Germany did when they threw out the Wiemar Republic bankers and nationalized their assets. Make the FED Note and US Treasury Dollar equal by law, for all debts public and private…thus a co-currency. Cap the FED to a small multiple of growth and all new money is US Treasury Dollars. Keep the FED operating, just not to fund government, the social safety net, a limited military and some public infrastructure. Take the monopoly on money away from the FED and put at least some in the US Treasury. Learn from WW2…don’t repeat it.

The FED is radically unconstitutional. The United States Constitution explicitly states that the Treasury Department of the Federal Government has the exclusive right to issue currency. Look at your cash, if you have any, it says Federal Reserve Note. If it does not say United States Treasury Note, it is garbage.

David: It is true the Constitution does not authorize the establishment of a central bank such as the Fed, nor even the original Bank of the U.S. But the Constitution does not reserve any “right to issue currency” to the Treasury Department.

Article 1, Sec. 8 of the Constitution says “Congress shall have power to coin Money and regulate the value thereof.” And that is all it says about the issue of Federal currency.

Congress, for obvious practical reasons, cannot conduct administrative functions. There is no practical means, besides the Treasury Department, for Congress to coin money. Therefore, the Treasury Department is neccesarily the sole source of United States currency, and the only means for Congress to exercise its power to coin money. To deny it is the exclusive power of the Sovereign Government to issue currency is a peculiar doctrine.

I had some of this down and have had for some time, but this essay was wonderfully more comprehensive and trenchant.

Let me add that our books, our phones, our very notes and diaries are no longer ours and are subject to persistent rents or we loose them, thanks to such things as iTunes (control-freak Steve Jobs leading the way), “the cloud,” Google docs (also not in my possession). Indeed, digital, as it has developed, has led to the loss of personal physical ownership of what used to be ours, from music recordings which are now rented streams, to videos which are also only via stream, to books which in electronic format cannot be sold or inherited or stored and which can be edited or removed at any time from the publisher or other seller. Google docs and other text, some of it very personal (think diaries) somewhere in “the cloud” (mainframe servers not owned by the 99%) which can disappear at any moment or be surveiled by corporations even more than by governments.

Essentially we are seeing that we are becoming tenant farmers in our own lives.

Thank You, Mr Thacker. Such unifying clarity of context makes history so much easier to comprehend, and gives that much clearer vision of the present, and means to foresee the next threat approaching us.

I do not describe perpetrators of corporatist war on Earth and life to be civilized. There is nothing civilized about pirates.

Here is where I stopped reading;

” While all human groups must achieve these basic goals, civilized peoples do so within a complex hierarchical labor system, wherein some occupational tasks are considered more worthy than others and are compensated accordingly.”

There is nothing civilized about wage slavery and supression of the distributed intelligence of cosmic powered biology.

Garrett: Thank you for reminding me to mind my words — or at least define how I use them more carefully. When writing about history, I use the word “civilization” only to mean societies that are economically complex enough to have built cities, as the root of “civilization” derives from Latin “civitas” or city. I definitely do not mean to imply that “civilized peoples” are only those who value universal justice, equity or personal liberty. Indeed, as I indicated in the passage you quoted, civilizations always erect economic class barriers between humans.

The principal utility of written law is to justify the use of power to obliterate any sense of decency and fairness among human beings.

Most larger religions outlaw usury within it except xianity. Jews and other have been faulted at vile for lending at high rates to others, when that was one of their only tools for surviving– ffilling the need or demand, iKews were not allowed to own land, be in the military, and multiple restrictions imposed. So it is. Now why, is another matter. So you have to wonder why they were called on and encouraged to proceed by others? Because economic slavery fits the pattern of xian living badly to focus on the postdeath heaven. Muslim does not do usury and all the Big Bank B$CEOs are after the middle east break up to install their usury and capitalize on the oil revenues instead of the locals. More like Greece etal– usury is a death pox upn a civilization, which spreads. Xianity and the US must rid itself of this– you caintgetbloodoutaturnip! Do not blame others for your faults. Peace!

The problem is not with the debt. The problem is people and entities expropriating things that do not belong to them and then selling or renting them back to the people they expropriated them from.

Without debt, we’d all be like indians living in teepees. Forcing us all to go back to that type of living is fine if you want it, but forcing people who do not want it to do it is just as tyrannical is the other side expropriating land.

Iow, lending out savings you have worked for is fine and good and can create the betterment of society.Lending out stolen goods is tyranny. And if you have big gov’t, they will always, always, always expropriate what does not belong to them. Infinitely more than a “corporation” will.

“when you first came to this land, there were no debts. There were no taxes. And our women did all the work. Do you expect me to believe you can make this situation better?â€

There were no indoor toilets, hospitals of better treatments and numerous gadgets (indoor running water, better food preservation etc., etc.) eliminating much of the debt we constantly have to pay off nature to survive.

No one will put themselves in debt if there is no need? I can’t believe any could believe that!

Thank you for this great article.

In the “vocabulary of servitude” that you have specified you’ve missed one, relatively newcomer but appear to be here for while.

“The fee for not having health insurance in 2016”

https://www.healthcare.gov/fees/fee-for-not-being-covered/

Yes, you mentioned “fee” but this one is the special one. I guess not fees all of same kind and this one is lethal and apply throughout 99%. I am sure that the US is the only country on planet earth that have web site with such content?

Absolutely first rate info, analysis and writing. Thank you.

While this article will no-doubt appeal to the sensitivities of those who identify with the “99%,” if they really wish to *solve* the financial stranglehold which the 1% have achieved over us, we must realize that this “Thacker’s” work contains notable “sins of omission.” Notably– while I have no disagreement with the broad sweep of the article– how could *anyone* purport to write an “economic history” of America (because while he does not say it, that is what this Thacker wants you to think he has done), without even mentioning Alexander Hamilton, the man essentially *assassinated* by Wall Street’s “founding father,” Aaron Burr? Also left out is Abraham Lincoln’s (short-lived) “greenback” currency; and FDR’s Reconstruction Finance Corporation.

What all these (99%-defending) individuals had in common was their understanding of the government’s role in the generation and use of PUBLIC CREDIT. It is to this end (as both Martin O’Malley and Bernie Sanders continue to insist) that the passage of Elizabeth Warren’s 21st Century Glass Steagall Act is an absolutely essential first action. This will wipe away the (multi-trillion $) residue of “bad debt” by which Wall Street continues to hold us hostage. From there the government must create a *new vehicle* to issue *new credit* while at the same time DIRECTING IT– as FDR, Lincoln and Hamilton did before– into PRODUCTIVE EMPLOYMENT, most explicitly, infrastructure repair and upgrade.

It is this program which is at the heart of the new, global “BRICS” financial architecture, being carried out by the Chinese, and which their President, Xi Jinping has characterized as a “win, win” program for the world. Either we in the US join in this peace-directed development, or our the war-party will certainly consume us, Bernie Sanders not excepted.

Very well-said Mark. Without those three, (Hamilton, Lincoln, FDR), our Revolution would have been yet another short-lived peasant revolt, and the World would have stayed organized into a grouping of various European Neo-Feudal/Proto-Fascist Empires, and the further French and Russian revolutions wouldn’t have gained traction…more failed peasant revolts. PUBLIC CREDIT is indeed all-important. It tacitly implies the truth that the real source of ALL Wealth of any-and-ALL Nations, is an organized, well-trained, well-educated LABOR FORCE that is open to inspiring visions of what could be. It is NOT Gold or any other commodity, NOT a parasitic Oligarchy of Rulers and Bankers that makes this World something more than just the “Blank Canvas” that Mother Nature has given us to create wonderful and beautiful things upon.

Also, check out Tarpley.net’s Wednesday Jan 6th briefing on the newly-forming Anglo-Chinese Power Bloc. This is a “Force 10 Geo-Political Earthquake”, and severe threat to both USA and the Russian Federation. City-of-London is playing “Venice” again in seeking to use China to destroy Russia and America, in the interests of the Russian Oligarchs and Wall Streeters probably, against their respective 99%ers. They’re trying to pull the “C” out of BRICS”. Both will no doubt try to double-cross each other. If the attempt leaves China in a shambles, destroying BRI?S and USA in the process, C-of-L, W.S. and Oligarchs everywhere will be pleased.

Excellent article, courtesy of diaspora social network.

https://diasp.eu/posts/3877196

Here’s a nice, interactive “e-history” map showing the “invasion of America”: https://youtu.be/pJxrTzfG2bo.

There is a problem with this one-percent-99-percent story. The one-percent part is valid but its members are not opposed by the other 99 percent. Among this latter group there is a sizable portion aiding and abetting the one-percenters. If there were an organization chart for the American people as far as the economy is concerned almost all of the people from middle management level upwards (and law enforcement) would be aiders and abettors. There is another one-percent group (or may two or three percent; e.g., Occupy Wall Street) who actively oppose this constant upward transfer of wealth to Mammon’s high priests and acolytes. In between are the sleepwalkers and addicted consumers.

Bill: Yes, the 99% is a generalization, but proved effective as a rallying slogan . And you are absolutely right that today there are many other percentages that aid and abet the 1%. This is unfortunate and short-sighted.

In Auschwitz, for example, the Jewish “Sonderkommando” also helped exterminate fellow Jews; but when they finally revolted against the system, they suffered the same fate at the hands of the SS. If what I read is so, many of the NYC police officers that faced off against the Occupy Wallstreeters had recently had their pension funds raided by Wall Street bankers, as well. Even among the American natives of yesteryear there were some who betrayed their own people’s interests by collaborating with — or not actively resisting — the colonizing forces that ultimately destroyed them all.

Situational shortsightedness appears to be a genetic trait in humans. But then social solidarity is, too. I believe people will act in their best interests, but only when they understand what is in their best interests.

Right. All mid and upper level management are higher paid stewards for the ruling elite, making sure labor below them are fully exploited, and intimidated daily to meet the grunt goals for the corporation.

Equating property taxes with debt, as this author does, is erroneous. Property tax is the recognition the deedholder owns the improvements on the land but not the land itself, which belongs to all the people, held in trust, not owned, by government. Property tax is a payment to the commons to maintain the commons. Also erroneous, is the equation of mortgage debt with residential rent. A mortgagee enjoys the use of the house while paying in installments, gaining 100% equity with the final installment. Given the mortgagee could never assemble the purchase price, while paying rent, and with mortgage interest very low, a sweet deal. It is how a pseudo-middle class is bought: sit down, soft hands jobs plus home ownership. And what about those losers with no initiative, that have all the bad qualities? Simple, they do the most neccesary, dirty jobs, their work held to the highest standard, for the lowest pay. As a bonus, they pay 50% of their pay, every month, for a lifetime, to a snearing landlord. Tenant pays 100% of costs, landlord gets 100% of equity. Truth is always found in what is not talked about.

David: You are quite right. Tax, mortgages and debt today are different obligations, assessed by different entities for different purposes. I did not mean to suggest otherwise. But compared to the original communal natives, the vast majority of whom paid none of these, the effect is the same. Tax, mortgages, and rent are all forced obligations by an entity that had no hand in creating the land upon which it bases the obligation. A monopoly “racket” in other words.

Fallacy of false equation. Stone Age village system is Elders Council + Headman. If your house burns Headman organizes a crew of guys to rebuild it, this is called Community Labor, this is the key group relation that defines the village system. Property Tax, all Taxes, are the analogue of this system, building commonly owned improvements. Village social status, future Elders Council service, proportional to your participation in Community Labor.Rent is an obscene racket, tenant pays 4X value of apartment for Zero Equity. Mortgage is not a racket, if middle class had to pay cash for house, none would have houses. Mortgage interest is low, mortgagee gets 100% equity. “Forced obligation” is meaningless as an attempt to falsely link three very different institutions.

I would still posit If I respectfully may, David, that the mortgage and tax system is a racket nonetheless for the benefit for the happy few and I’d better let Michael Hudson explain it in 4 minutes flat here: https://www.youtube.com/watch?v=sruhSoS7J6M

Apart from that, arguably, we shouldn’t equate taxes and mortgage payments as you eloquently explain in your village analogy farther down but, try not to pay your taxes for a couple of years and see what happens with your house/land “ownership”. Good luck with that.

I preemptively dealt with your objection in my comments, please reread, or consult Thomas Paine. I note you avoided the topic of Residential Landlordism.

Thanks for this great article!

As you point out the source of the increasingly crushing debt we have is the scarcity of money. If we don’t have enough, we have to borrow. The central problem is that even the money we do have is created as debt. If the money we have were created publically as money, instead of privately as debt, and simply spent into circulation by governments, neither the public nor governments would be trapped by debt as they are now. Today , all but the small fraction of our total money supply represented by coins and Federal Reserve notes (bills), estimated at less than 5% of the total, is created by banks as credit (debt) when they make loans.

The Federal Reserve Act passed in 1913 and enacted in 1914 was a piece of legislation designed by the banking magnates of the time to promote development by retaining the tyranny of debt. The system can be changed to one in which money is created as a public asset instead of as debt, which is a public liability. Legislation to do so was introduced into Congress in 2012 as the National Emergency Employment Defense Act, where it died in committee. Movements toward this step, which represent the only hope of stepping back from the collapse of the entire Ponzi scheme of our debt-based economy, are alive and growing in the U.S. and abroad. See the American Monetary Institute (www.monetary.org), Positive Money in Britain (www.positivemoney.org) and the Vollgeld Initiative in Switzerland (http://www.vollgeld-initiative.ch/english/).

Oh yeah John, you are so right.

A book “Truth in Money” first published in 1982 proposes a math formula, that graphed out, predicts M3 and it becomes obvious why they discontinued M3. It’s the simple graph of compounding interest since the FED was established in 1913. Use 6% as the 100 year average interest rate. So the graph has 100 years on the horizontal axis and $$$ on the vertical. That’s ($1 borrowed in 1913 X 1.06) X 1.06) for 100 years, capitalizing in the interest. This simple graph is nearly exactly M3…until M3 was removed. At the end, the usury on the $1 is $330, next it’s nearly $600 and the next $1300. Thereafter it grows exponentially. M3 would be scaring the mommy’s and daddy’s with it’s NECESSARY exponential growth. It shows the flaw of the fractional reserve system…being a pyramid scheme of debt that we have no hope of ever repaying. Just reduce the interest to make the graph temporarily flatten, but when it’s raised…the usury explodes higher.

Now the solution. It’s not to nationalize the FED but to change the US money system away from a monopoly and into a system beneficial to the public, the 99%. Don’t make the same mistakes that Germany did when they threw out the Wiemar Republic bankers and nationalized their assets. Make the FED Note and US Treasury Dollar equal by law, for all debts public and private…thus a co-currency. Cap the FED to a small multiple of growth and all new money is US Treasury Dollars. Keep the FED operating, just not to fund government, the social safety net, a limited military and some public infrastructure. Take the monopoly on money away from the FED and put at least some in the US Treasury. Learn from WW2…don’t repeat it.

Thank you, Consortium News, for publishing this excellent special report, and thank you, Mr. Thacker, for writing it.

The story of greenbacks is a bit misrepresented in the article. there is link to Linkoln assassination, after which greenbacks were covertly replaced with banknotes within few years

“It is from the Bible that man has learned cruelty, rapine, and murder; for the belief of a cruel God makes a cruel man.â€

Thomas Paine — “A letter: being an answer to a friend, on the publication of The age of reason.” Paris; May 12, 1797.

http://kenburchell.blogspot.com/2013/11/quote-check-belief-in-cruel-god-makes.html

http://www.deism.com/paine_essay_age_of_reason.htm

The whole time while reading this article I couldn’t help trying to imagine how our time now might appear to be historically explained say someday five hundred years from now. Will historians gasp or will they dream of how wonderful our times were. Without knowing what our successors will be left to deal with it is anyone’s guess to what they may conclude to of our existence of this particular period. I would understand if the future found us in our time to be utterly barbarian towards our treatment of each other. Will slavery have been replaced by ‘Trade Agreements’? Only time will tell.

Let us return to the origin of usury laws. For the worship of money now threatens to make sovereign law null and void, as proven by the Trans Pacific Partnership trade deal, which could become legislation as early as next month. If the TPP becomes law, corporations will be legally allowed to sue sovereign nations/states for “lost profits” This past Wednesday, TransCanada announced it would sue the US government for 15 billion dollars, for refusing to allow the completion of their tar sands pipeline. A pipeline that would go near our largest fresh water aquifer, with the dirty oil processed in Louisiana and then shipped to China for profit. The creation of a private, centralized bank or the “Federal” Reserve in 1913, established the debt-based system into overdrive, along with an accompanying tax on all citizen’s labor. We have even allowed the gov, to enslave our youth, as college students are in deep debt due to student loans. These loans are exempt from bankruptcy laws and if not paid, any inheritance to the debtor is subject to liens, even later in life, through pensions or social security. Wow, can’t get a job, but must repay your college loan.

…Deuteronomy19″You shall not charge interest to your countrymen: interest on money, food, or anything that may be loaned at interest. 20″You may charge interest to a foreigner, but to your countrymen you shall not charge interest, so that the LORD your God may bless you in all that you undertake in the land which you are about to enter to possess.

enter to possess? protect one’s own tribe at the expense of others? Now remember, this is

“God” talking. Yes but whose God? Federal Reserve was largely a creation of the Rothschilds, who had already taken over the finances of England.

21″When you make a vow to the LORD your God, you shall not delay to pay it, for it would be sin in you, and the LORD your God will surely require it of you.

How convenient for the chosen few and their lackey well-paid partners in crime.

Various groups throughout the ages have attempted to control others through nefarious self-gaining manipulative tactics, such as usury laws and a system based on debt. People really need to research the origins of the Federal Reserve system of fractional reserve banking.It is a system based exclusively on debt and can’t function without debt, and is the primary cause for never-ending inflation. Also, please research the true identity of Christopher Columbus. We can not understand the truth until we realize the standard history books were written by those who live to control others. And using “God” is a chief weapon to accomplish such efforts.

What a superb historical analysis. and how representative it is of what and how we are living today. Thank you Mr. Thacker, and thanks, Bob..

I believe that it is known as “Economic Slavery”.