Even when real estate tech firms go belly up, Omar Ocampo says thousands of properties are snapped up by Wall Street, granting corporate investors greater undue market power.

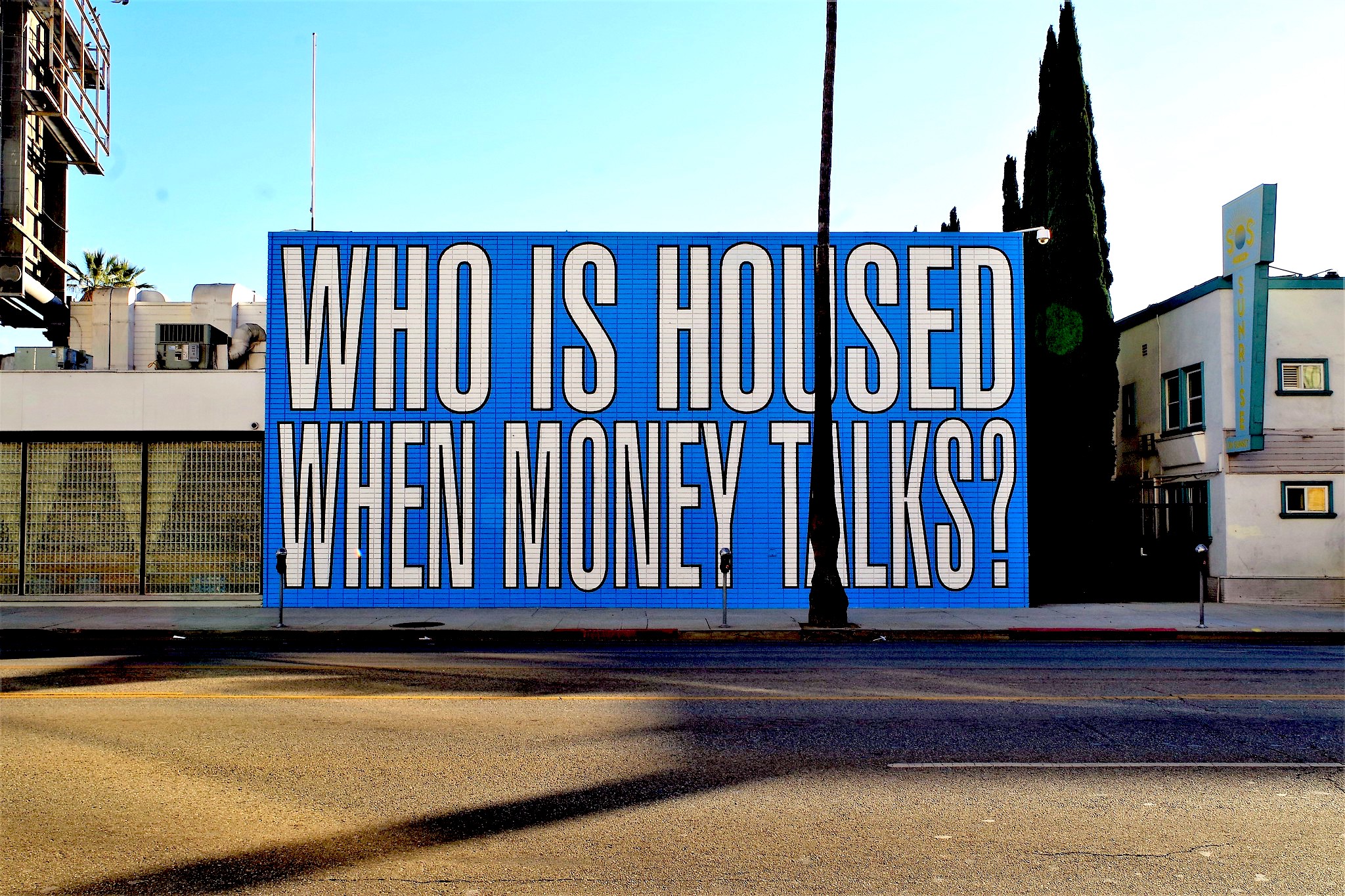

Housing Crisis Mural by Barbara Kruger, Sunset Boulevard, Los Angeles. (joey zanotti, Flickr, CC BY 2.0)

By Omar Ocampo

Inequality.org

With billions of dollars of cash on hand, and millions of working-class families unable to find affordable housing, corporations are increasing their share of the housing stock and expanding their portfolios.

With billions of dollars of cash on hand, and millions of working-class families unable to find affordable housing, corporations are increasing their share of the housing stock and expanding their portfolios.

A 2021 report co-authored by the Institute for Policy Studies, “Bargaining for the Common Good, and Americans for Financial Reform Education Fund” demonstrated how corporate and institutional investors were well positioned to take advantage of a red-hot real estate market.

In the final quarter of 2022, investors purchased more than $31 billion worth of residential property in 40 of the largest metropolitan markets in the country – not a small sum.

Digital technologies helped facilitate this process. New business models like iBuying – which allow companies to instantly assess the value of and make offers on properties that are then resold – provide corporate landlords with privileged access to residential homes.

Real estate tech companies are transferring close to a quarter of their inventory directly to institutional investors off market. Even when these tech firms go belly up, thousands of homes are snapped up by Wall Street, granting the latter greater undue market power.

(RawPixel)

All of this translates to more expensive real estate for working families, as unlisted corporate purchases lower the housing supply available to thousands of households. As a result, 4-out-of-5 homes are now classified as unaffordable to median income earners, up from just half a decade ago.

“Housing affordability is at the lowest level in history,” declared Taylor Marr, deputy chief economist at Redfin, in a recent interview.

The ever-expanding presence of corporate landlords also increases precarity for renters. Large portfolios incentivize the development and use of software to automate property management and eviction filings to the detriment of tenants. The aggressive pursuit of evictions and unwillingness to negotiate alternative resolutions to ensure families remain housed highlights the need for more robust tenant protections.

Potential Revenue from a Tax on Investors

A tax on institutional investors could dissuade corporate purchases, giving working-class households an equitable opportunity to buy a house while also generating revenue for affordable housing.

To illustrate the potential revenue a 10 percent tax on investors could generate, the Institute for Policy Studies analyzed the sale records of Boston in the final quarter of 2022.

Any record where the buyer’s name included the words “LLC,” “Trust,” “Corporation,” “Partnership,” “Inc,” or “Homes” is categorized as an investor. The methodology excludes all transfers where the transaction was less than $1,000.

Investor purchases accounted for 24 percent of all residential real estate sales in Boston between October and December of 2022. The total value of their residential acquisitions was $820 million, with a median sale price of $1.1 million. A 10 percent tax on all investor purchases could yield $82 million in revenue.

Boston’s Back Bay neighborhood photographed from the Hancock Tower. (Rick Berk, CC BY 2.0, Wikimedia Commons)

Boston is just one city where investors are snatching up residential properties. If a 10 percent tax on investor purchases were in effect in Boston as well as the country’s nine other top housing markets, it could’ve generated a total of $1.4 billion just on 2022 fourth quarter sales alone.

The time for our elected representatives to address the affordability crisis and guarantee dignified housing for all is now.

The solution is straightforward: the federal government should ramp up the production of de-commodified public housing to put downward pressure on real estate prices. All newly constructed housing should serve the social needs of our communities instead of further enriching corporations and institutional landlords.

A federal tax on institutional buyers has the potential to generate significant revenue to help fund the construction of new public and social housing.

The lack of housing affordability is the direct result of commodification – the use of residential real estate as an asset for the purposes of financial speculation and capital accumulation.

The sooner we start treating housing as the public good that it is, the sooner we can create an economy that works for everyone.

Omar Ocampo is a researcher on the program on Inequality and the Common Good at the Institute for Policy Studies.

This article is from Inequality.org.

The views expressed are solely those of the author and may or may not reflect those of Consortium News.

.

Sure Rebecca, that is not a solution for all Capitalism and I don’t think there will be any solution until the world is destroyed by Greed. If there are any survivors after the Nuclear war, they may built a better society. Capitalism and secularism is the problem. We are seeing the effects now; there is no moral compass anymore. Our plan is plan to work with NGOs (not western) to provide clean water for people.

Maybe we should ask China,how to fix this problem,their population is much bigger than ours,yet they don`t have problems like lack of affordable housing,I wonder why ???

“If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless.” – Thomas Jefferson

Thanks Omar for the quick education… plus Realistic Solution… to the REIT Crisis… (& tnx CN 4 running).

Uhhhh… how Long can you Hold Your Breath?!!!

Not to worry. Our parasite class that owns most of everything will simply blame our dysfunctional exaggerated distribution of wealth all on China, and perhaps even conjure up the world war they seem so enamored with as a potential economic bonanza for themselves. After all, wars mean shortages, and shortages mean windfall profits! Shameless greed: Making America great!

The US has become a rentier economy since when Reagan said Americans would be a Service Economy (“would you like fries with that?”)

Ukraine is an excellent example of what all American puppet states will be. They have opened up to foreign buyers their farmlands, among the richest in the world and the source of their wealth (which dissipates quickly via corruption). They opened up general real estate sales to “the global community” shortly after the Soviet Union fell with the proviso that the buyer had to live in Ukraine (which I’m sure has work arounds). Kicking out the Russian language, culture and ethnic Russian Ukraainians is no more about “democracy” than is the “freedom” of the Rich to buy up of all American property and rent/ sell at extraordinary profits. This is just a knock-on from the $29 trillion bailout ( levyinstitute.org/publications/29000000000000-a-detailed-look-at-the-feds-bailout-of-the-financial-system ) and the massive foreclosures of millions of homes between 2008 and 2012, which are now realizing huge profits for Wall Street and secondary buyers. This is “American Democracy”! America has never stopped being Great! (But only for relatively few.)

One more example of what I call KILLER KAPITALISM. Like a cancer… eating its way through societies.

Capitalism is not the problem. Failure of governments to invoke their power to deny market power to exist in one or a few players is the problem. Monopolies are illegal [anti trust laws] but no one at Justice is exercising the police power needed to prevent corporations from monopolizing markets.

For many on the Left here in the UK, housing is one of their guilty dirty secrets. Despite their claiming to want an egalitarian society, they own property whose value they know will likely increase massively, and they plan to pass this unearned wealth to their children. This, obviously, is the very essence of capitalism. Like socialists who send their children to private schools, the widespread ownership of property on the Left will hardly bolster their political credibility. The UK needs a massive expansion of good quality council housing suitable for everyone not just the poor and perhaps the expropriation of property itself. Houses are for living in, not for making money.

Capitalism is a death cult. It needs to be replaced by socialism. That is all.

Pass laws that require buyers of residential properties to live in those properties for at least 3 months per year. That might take some of the wind out of the corporate sails.

And maybe bar all sale of housing to corporations.

It’s called Capitalism on steroids, or Capitalism out of control, or Capitalism so perverted that it has become unsustainable.

No. It’s called ‘capitalism’.

This is becoming ridiculous here. I agree with your points. My wife and I decided enough is enough and bought land in Italy and built a house (helps to know a friend in construction in Italy). 10mins from mediterranean by car and it cost a third of what it would cost here. In a few years we plan to move there God willing.

Like that is a solution to the problem of capitalist housing-as-a-financial-asset.

It is called Capitalism.

Until the next great recession, people with good incomes won’t care about the rest — the bottom 75% who they generally don’t think of as equal anyway. When that recession or, based on the business cycle, the overdue Depression hits, these folks don’t care other than saying “tough”. When the great and projected long downturn hits, they will weep as their investments in companies that buy up homes collapse. Of course it will then be too late. It has previously happened many times in the not to distant past before things recovered and they did it all over again. Unfortunately these downturns were quite short compared to the so-called Great Depression and people rarely remember them other than as conversational items which they laughingly say they not only survived but used to do it again and again to purchase homes and real estate investments which have made them big bucks. It’s called capitalism, whether in America, Europe and even modern China where prices have also skyrocketed in the past couple of decades. Capitalism, my friends (pun intended), CAPITALISM.

NYC rental prices coming to the entire country. Get your pitchforks.

Health care, housing, food, energy, water. These factors are necessary for humans to live. Instead of a rational govt. policy to prevent monopolies and market manipulation, we have a free-for-all frenzy of privatization and monopolization. Monopoly price-gouging is the norm. Anti trust laws? Ignored or de-regulated. The above-the-law banksters and investment fund parasites call the shots, they are “too big to fail.” The rule of law? How quaint.

Want a place to live? It’s gonna be super expensive. Can’t afford it? Too f-in bad, you will be denied housing, become house-less and then die on the streets, just like an increasing number of people. (but the Mass Media Cartel ignores it).

Every essential good and service in the USA is becoming a giant extortion racket, or has already become so.

Recent articles in the financial press (Financial Times, Bloomberg, WSJ) explain what should be obvious: our recent inflation is caused by monopoly price-gouging. (aka economic rent, or financial parasitism). Wages have increased, but nowhere near the rate of inflation. This way we work for less, while the 1% parasites consolidate more wealth and power.

Don’t like unaffordable housing, health care, etc.? You better get used to it, it’s only gonna get worse.

The view of the US looks even worse from overseas. There is little to disagree with the 12 points in this video if anyone even remotely thinks the US is the best country to live in

hxxps://youtu.be/bIwOclLlRts

Nice video; agree on all points. I also lived and worked abroad for four years, and every time I return home to the US (for family), it is depressing. Since the government took over the media (with the abolition of domestic propaganda laws) and the increasing censorship (Twitter Files are just the tip of the iceberg. The infrastructure is a joke compared to other third world countries. Where does all our money go?

I would encourage all Americans to live abroad for at least a year. We are supposedly a country of immigrants; venture out to your ancestors’ countries or just discover the world. It is mostly a better place than the US.

Can you give the title of that video please, as the link does not work for me. Thankyou.

Excellent points JJ. I’ve always loathed the greedy and those who only think about money. I’ve only ever wanted enough and want that for everyone. This nation is soul-less – coming apart at the seams.