Outside the United States, in countries ranging from Argentina and Malaysia to Finland and Fiji, airlines essentially operate as a public utility, not an opportunity for big CEO paydays, writes Sam Pizzigati.

Washington headquarters of the U.S. Department of Transportation, which regulates the country’s civilian aviation. (kmf164, Flickr, CC BY-SA 2.0)

By Sam Pizzigati

Inequality.org

![]() For America’s rich and powerful, the new year is beginning in a most inauspicious fashion. Millions of Americans are once again fuming at the greed and grasping of those with the deepest pockets.

For America’s rich and powerful, the new year is beginning in a most inauspicious fashion. Millions of Americans are once again fuming at the greed and grasping of those with the deepest pockets.

That fuming — from would-be passengers of Southwest Airlines and their families — filled airports during this past holiday week. For good reason. At the height of the travel-heavy holidays, Southwest was canceling 60 percent of the airline’s daily flights. Over 15,000 Southwest planes never lifted off.

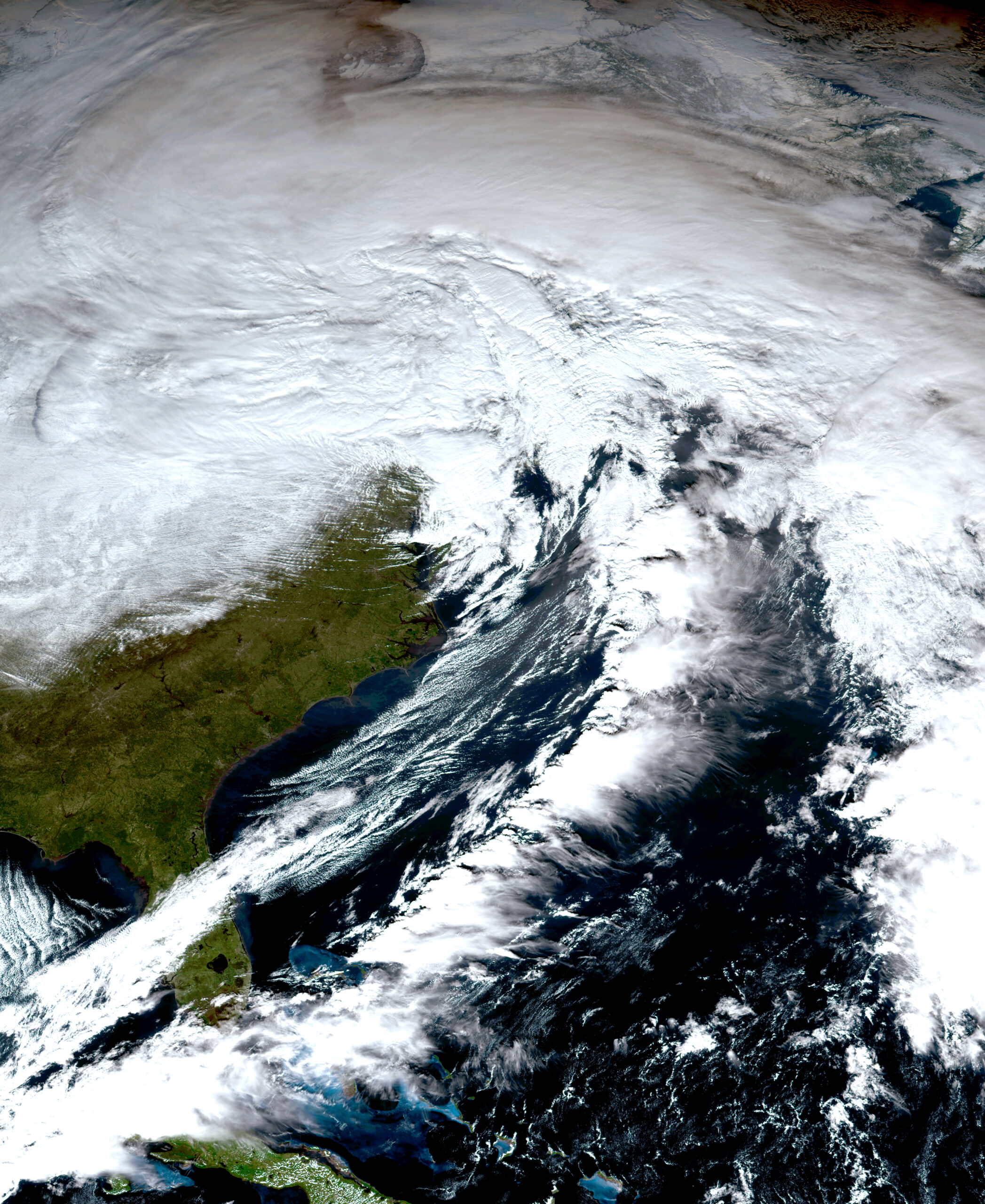

Late December’s heavy dose of stormy weather certainly did set the stage for Southwest’s holiday meltdown. But Southwest can’t put the blame for the airline’s massive melt on the cold, wind, and snow. Other airlines delivered, amid the same winter weather, far better service.

So what did Southwest in? The airline’s top executives, analysts point out, have spent years underinvesting in needed new technology. One telling example: This past November, a generation into the electronic age, Southwest officials acknowledged that the airline was still delivering weather and baggage reports to pilots and gate managers on paper.

“It almost became a running joke around the company,” said Lyn Montgomery, Southwest’s flight attendant union president, “that we aren’t able to make certain changes because it would involve technology.”

Southwest planes backed up at the gate in Santa Barbara, California, on Dec. 27, 2022. (Glenn Beltz, Flickr, CC BY 2.0, Wikimedia Commons)

During the holiday storm crisis, some Southwest employees phoning in for instructions from the airline found themselves on hold for over five hours, reports The Dallas Morning News. Some even went to sleep with their phones — still on hold — next to their bedsides. They awoke the next morning, to find their phones still holding.

Why didn’t Southwest invest in new technology?

“Modifications and refinements to systems,” last year’s Southwest annual report explained, “have been and are expected to continue to be expensive to implement and can divert management’s attention from other matters.”

What sort of “matters” struck Southwest executives as more important than keeping their planes on time? Keeping shareholders happy — and themselves richer in the process. Everything else could wait.

Ex-Southwest CEO Gary Kelly at a banquet in 2016. (SouthwestArchive, CC BY-SA 4.0, Wikimedia Commons)

Top management has readily admitted as much. In one pre-Covid “earnings call” with stock analysts, The Washington Post noted last week, then-CEO Gary Kelly explained that the airline had been delaying the tech upgrades his operations team had been seeking.

“We have starved them a little bit over the last decade,” he explained, “because again, our focus was more on the commercial side.”

Money that should have been going into upgrading Southwest’s operations has gone instead into dividends and stock buybacks. Since 2015, The Los Angeles Times analyst Michael Hiltzik reported last week, the airline “has paid out about $1.6 billion in dividends and repurchased more than $8 billion in shares.”

Those moves have worked out exceedingly well for top Southwest executives like CEO Kelly, the airline’s chief exec until early last year. In 2020, Kelly pulled down a “record $9.2 million” at the same time the Covid outbreak had the airline $3.1 billion in the red and a quarter of the Southwest workforce taking voluntary leave. CEO Kelly then took home another $5.8 million in 2021 before retiring early in 2022.

“Southwest’s well-compensated executives could have prioritized its workers and customers by preparing for the worst, but greed trumped all as they put a small group of wealthy investors first,” charged Kyle Herrig, the president of the corporate watchdog Accountable.us. “Consumers shouldn’t be the ones stuck holding the bag for Southwest’s greedy management decisions, but here we are.”

Southwest took in a $7-billion federal bailout during the Covid crisis, then showed its appreciation to America’s taxpayers by becoming, early last month, the first Covid-subsidized airline to announce plans to resume paying out dividends to shareholders, to the tune of $428 million in 2023.

Support CN’s Winter Fund Drive!

“The reinstatement of our quarterly dividend,” Bob Jordan, Southwest’s new CEO, proudly noted during this dividend announcement, “reflects our balance sheet strength and continued focus on generating consistently healthy earnings, margins, and long-term capital returns.”

Missing from that focus: the well-being of Southwest workers. Just a few weeks after announcing the upcoming new dividends, the “bomb cyclone” hit wide swatches of the United States the day before Christmas. Southwest ground workers soon found themselves working 16-to-18 hour days, with some, said their union president Randy Barns, ending up frostbitten.

North American winter storm on Dec. 23, 2022. (NOAA satellite image, Public domain, Wikimedia Commons)

Some lawmakers in Congress are now calling for a serious overhaul of how the United States goes about its airborne business. America’s airlines have essentially been calling the shots, notes a Washington Post analysis, ever since the Airline Deregulation Act of 1978 iced state regulators out of the picture and “left airline companies accountable only” to the federal Department of Transportation, an agency that’s never prioritized consumer protection.

New "In the Breakroom with TWU Local 555" podcast with President Randy Barnes. "It's not about the weather" #Southwestmeltdown https://t.co/rzdnDYjWSm

— TWU Local 555 (@TWUlocal555) December 30, 2022

“Southwest simply has failed to prepare for the worst and that’s a fundamental breach of trust,” said Connecticut U.S. Senator Richard Blumenthal, who wants to see Congress enact a passenger bill of rights. “They said to passengers, in effect, if things go south, you are the ones who will bear the burden.”

Outside the United States, in nations ranging from Argentina and Malaysia to Finland and Fiji, airlines essentially operate as a public utility, not an opportunity for big CEO paydays. Scores of nations, points out journalist Joe Mayall, currently “either own airlines outright” or hold majority-shareholder status.

The United States could join that camp, Mayall notes, if Congress chose to charter a state-owned enterprise to start up a new national airline. Or Congress could go the nationalization route by buying up enough stock “in publicly traded airlines to acquire a controlling share.”

Could the United States afford to take that sort of nationalizing step? The four most dominant U.S. airlines — Delta, American, United and Southwest — last summer held a combined market value of $77.5 billion, Mayall points out, just $5 billion less than the $72.6 billion in U.S. tax dollars that funded the federal government’s airline bailouts after 9/11 and during Covid.

Sam Pizzigati co-edits Inequality.org. His latest books include The Case for a Maximum Wage and The Rich Don’t Always Win: The Forgotten Triumph over Plutocracy that Created the American Middle Class, 1900-1970. Follow him at @Too_Much_Online.

This article is from Inequality.org.

The views expressed are solely those of the authors and may or may not reflect those of Consortium News.

Support CN’s

Winter Fund Drive!![]()

Donate securely by credit card or check by clicking the red button:

The airline industry is already very highly regulated, and every airline must follow strict rules, regulations and protocols in order to operate. The fact the US airline industry is one of the safest, if not the safest in the world, is a testament to this fact.

I don’t think nationalizing the airlines will solve the problems, experienced by the Southwest this holiday season. The failure of Southwest to invest in its IT should incentivize it to fix the problems, or its customers will switch to other airlines or modes of transportation. The result is, in a competitive environment, each airline has to either improve itself when it makes mistakes or risk going out of business because the other airlines operate better.

What incentives are there for unelected government employees to make improvements to a system rather than maintaining the status quo, if there is no competition forcing them to make improvements or risk going out of business?

Yes Southwest will be incentivized to do better. In the meantime, the problem arose from the outsized greed of its executives who plunder the company and then leave. The company made up of the workers will suffer. That is our way of doing business – benefit the parasites and make the productive men and women pay the price. Nationalizing may have its drawbacks but it is far better than for- profit ownership.

Whatever it takes to eradicate KILLER KAPITALISM…

Put that last sentence first; it speaks for itself!

The national airline of the US is run by the Pentagon woth virtually unlimited budgets.

Jimmy Carter deregulated the airlines, not Ronny.

Ah . . Ha . . . ! Seems we have some fertile ground here for free thinkers. Gotta love it!

Susan, Jacob In, Balu, shmutzoid and Guest. Hear! Hear!

Airlines should be regulated much better than they are. Fuel use is astronomical, and too many time that fuel is jettisoned to lighten aircraft having issues. See any carbon tax on dumped fuel ? Plus and this is a big plus, simply google US government Aid to airlines. Some say no reorganization or nationalization of them. Fine don ‘t spend my tax money propping them up. The same “exceptional Americans who are against nationalizing them bitch about taxes constantly. Same with lame ass aircraft manufacturers. The U.S. government gives those who are military contractors sweet deals and supports them when they get themselves in trouble.

How about nationalizing electric utilities who are running the system into the ground rather than invest some of their outrageous profits into updating their infrastructure and using better technology. This would be especially effective in limiting the financial damage out dated nuclear power plants pose to the country AND the electric generation industry in general. As Jacob said “there is no reason not to. None.”

Thanks CN

Nationalization will not happen, Sam. If our “owners” cared for people, healthcare would have been nationalized already. The population has been sold a bill of goods about free market and capitalism. Unfortunately too many people have drunk this Koolaid and do not see the issue. Somehow, we are #1 and that’s that.

I think re-regulation is a better way. South West made a fortune by cost cutting, starting from paying less to employees, and capturing market share. And on pure profitability, features that are needed on the average 1 day per year (averaging over USA, so many more days in norther tier states), or even worse, not every year, increase costs without adequate return. Human misery during those days is bad only if it decreases the demand, but people check what are the best deals for their planned trip without delving into “reliability”.

It seems that cost cutting can go beyond rational, market forces should take care of that … but not necessarily. Instead, weak regulations create a pressure to decrease convenience and reliability to get the coveted top spot on “listing by price”. Thus we get less and less leg space, and we can expect packing passengers yet more tightly using technologies from fish canning industry.

This is the story of Texas electricity collapse during a bout of cold weather. The system capacity was too small in cold weather for a sundry of reasons, e.g. natural gas pipelines being not operational below freezing or with interrupted power (technologically, gas pipelines work in Canada and Russian Arctic, so it is a matter of features that a pipeline may have or not). Generating electricity, like airlines, have regulators, and we have regulatory capture.

I was in the travel business for 15 years and started that career before Reagan deregulated the industry. Prior to deregulation, all airlines charged the same fare to destinations – there was a book (Official Airline Guide) that we used to determine flight schedules and regardless of the airline, fares were the same across the board. After deregulation, came the competition between airlines and also along with competition came the airline industry basically collapsing. We used to have so many airline companies here such as Pan Am, Western, TWA, Continental, Eastern, Northwest and others that have since gone out of business. Airline travel used to be somewhat of a luxury but today it’s like riding a bus. I don’t know if National Regulation is the answer but something sure needs to change…

There is no reason not to nationalize them. None.

Oh no. NATIONALIZE something ? That is communism , socialism and all those other “ungodly” things that the greatest “christian” nation on earth should not be guilty of. And where does it stop ? And how will the best “democracy” that money can buy survive unless the people are screwed ?

Gee, the combined assets of the big four airlines amounts to LESS than what the US has already committed to the war against Russia, currently being staged in Ukraine.

This episode with Southwest exemplifies how business is run in a capitalist system. The imperative of ever- expanding profits result in cost-cutting measures that affect workers, safety and customer experience. Boeing cutting costs resulted in the failure of its Max 7??, killing almost 400 people in two plane crashes. (there’s a good doc about this on Netflix)

Of course the airlines should be nationalized. Areas of society that should NOT be mined for profit——-> communications systems….. health care……education…….for starts.

A high enough carbon tax would put the passenger airlines out of business