Sam Pizzigati explains why a luxury penthouse in New York stood vacant during the 1940s.

A penthouse view of Manhattan, 2014. (Glenn Beltz, CC BY 2.0)

By Sam Pizzigati

Inequality.org

![]() Once upon a time, the United States seriously taxed the nation’s rich. You remember that time? Probably not. To have a personal memory of that tax-the-rich era, you now have to be well into your seventies.

Once upon a time, the United States seriously taxed the nation’s rich. You remember that time? Probably not. To have a personal memory of that tax-the-rich era, you now have to be well into your seventies.

Back at the tail-end of that era, in the early 1960s, America’s richest faced a 91 percent tax rate on income in the top tax bracket. That top rate had been hovering around 90 percent for the previous two decades. In the 1950s, a Republican president, Dwight D. Eisenhower, made no move to knock it down.

The rich felt those taxes. The high life struggled. Consider what happened to one fabled emblem of that era’s excess, the nation’s first-ever penthouse.

Marjorie Merriweather Post, an heiress who had become America’s richest woman, had that penthouse built atop a new Fifth Avenue luxury tower in 1925. The top federal tax rate then in effect as builders were putting the finishing touches on Post’s spectacular three-floor, 54-room residence was just 25 percent.

Marjorie Merriweather Post Hutton Davies, American socialite and owner of General Foods, Inc. (C. M. Stieglitz, World Telegram, Public domain, Wikimedia Commons)

The Post clan held on to that penthouse for the next 15 years and then decided to “move on.” The American people, by that time, had decided to move on as well — from bargain-basement tax rates on high incomes.

In 1940, the federal tax rate on income over $200,000 started at 66 percent. By 1944, the top tax rate on all income over $200,000 — about $3.4 million in today’s dollars — had jumped to 94 percent.

Post’s fabulous penthouse would find no new takers in this new high-tax era. The penthouse went vacant all through the 1940s. In the 1950s, with the nation’s top tax rate still above 90 percent, the luxury tower’s owners threw in the towel and broke up the former Post palace into six separate units.

America’s rich, most observers figured, were adjusting to living lives significantly less rich.

But the political winds were changing. In 1963, President John Kennedy, himself the product of one of America’s grandest fortunes, asked Congress to drop the nation’s top tax rate down to 65 percent. Congress would mostly oblige, and that top tax rate would sink to 70 percent in 1965.

In the 1980s, Ronald Reagan and his friends on Capitol Hill would shove that rate down even further, first to 50 and then to 28 percent.

This top tax rate then inched up to 31 percent in 1991 and has been bouncing around in the 30s ever since. The current top-bracket rate: 37 percent.

Report by James Steele

What has this nosedive in tax rates on the rich meant for average Americans? Nothing good, concludes veteran tax analyst James Steele in a just-published report from the Center for Public Integrity and Bloomberg Tax.

Over recent decades, says Steele, “Congress after Congress has cut taxes on the richest people and corporations — billions of dollars that would otherwise have gone to the federal till for spending that could help the rest of the public get ahead.”

Donate Today to CN’s

2022 Winter Fund Drive

Steele’s new study acknowledges upfront that a variety of factors have contributed to the deeply unequal United States we have today, everything from deregulation and a weakened labor movement to the shrinking of our national safety net.

“But taxes,” he emphasizes, “have been a principal engine of worsening economic inequality simply because the wealthy, thanks to their success in Congress, now have more money — to buy stocks, invest in real estate, build mega-yachts, blast off into space, and make campaign contributions to politicians so the cycle isn’t interrupted.”

Internal Revenue Service building in Washington, D.C., 2008. (Shashi Bellamkonda, CC BY 2.0, Wikimedia Commons)

Steele’s report adds all sorts of eye-opening detail to a don’t-tax-the-rich story tax analysts have been tracking for years now. Consider his take on the tax treatment of dividend income, a concern few average-income Americans have on their radar screens.

Dividend income, in the decades before the start of the 21st century, faced the same tax rates as wages and salaries. In 2003, the Bush White House and Congress gifted the nation’s rich a new arrangement and chopped the tax rate on most dividends down to 15 percent.

In 2019, Steele points out, this neat little gift saved taxpayers who were making making $1 million or more some $16.2 billion, “the equivalent of the federal income taxes paid by everyone earning $50,000 or less in California, Idaho, Iowa, Kansas, Minnesota, Nebraska, New Hampshire, Oklahoma, Pennsylvania, South Dakota, West Virginia and Wisconsin — combined.”

The corporations rich people run have fared equally nicely under America’s now decades-old don’t-tax-the-rich regime. Major U.S. companies, Steele’s analysis notes, took particularly good advantage of the tax breaks lawmakers bestowed upon them in the 2004 “American Jobs Creation Act.”

The tax breaks resulting from this legislation benefited only 4 percent of America’s businesses — mostly giants like Hewlett-Packard, Pfizer and Merck — and did “little more than enrich corporate shareholders and executives.”

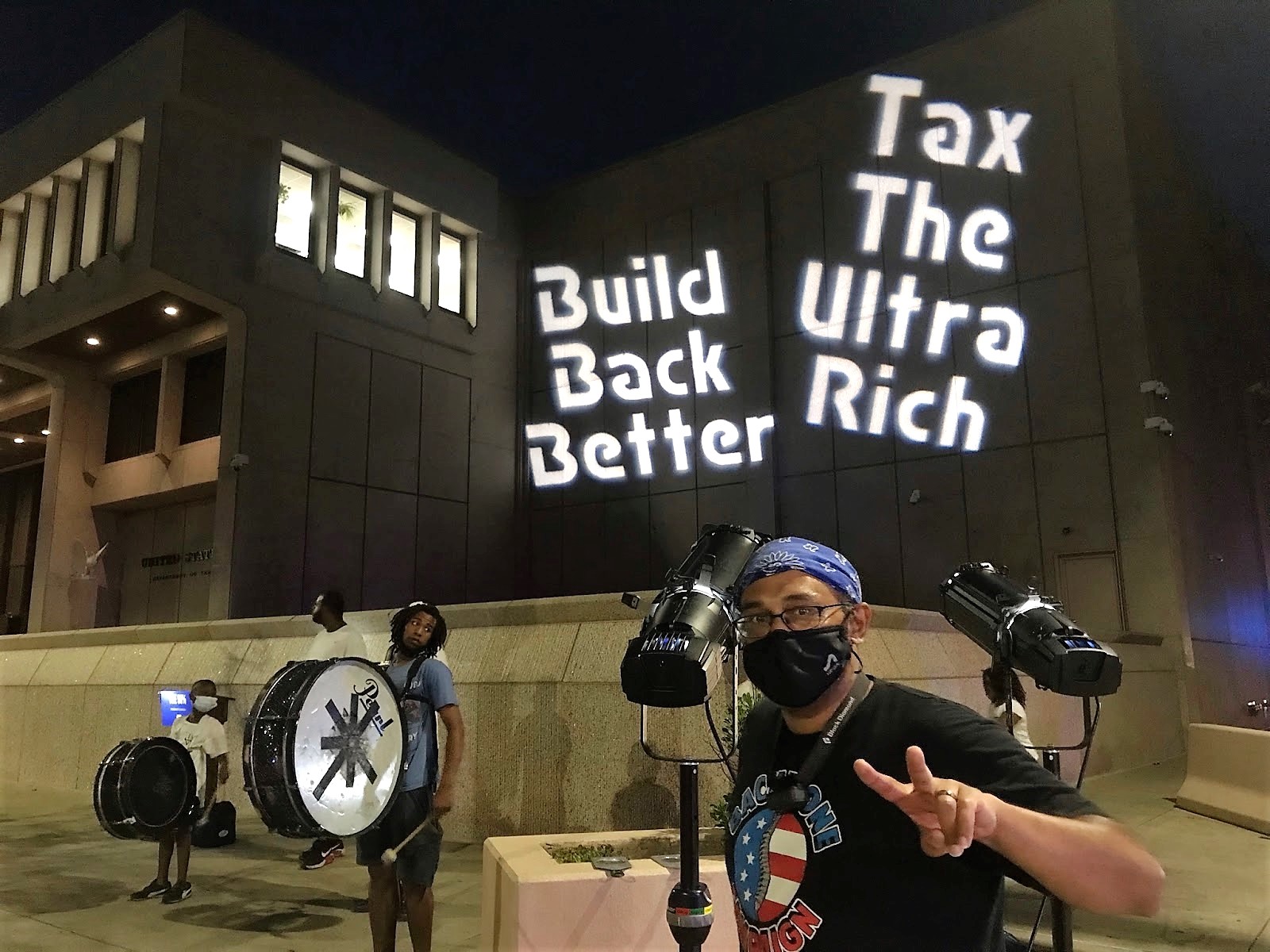

“Tax the Rich” projections and rally at U.S. Mint in Philadelphia, 2021. (Backbone Campaign, Flickr, CC BY 2.0)

These executives and shareholders so enjoyed how the 2004 American Jobs Creation Act played out that that they went out and convinced Congress to do it all over again with the Tax Cuts and Jobs Act of 2017. The convincing came easy. One reason: Corporations, observes Steele, annually spend “more than 85 percent of the total reported expenses associated with lobbying Congress.” Trade unions “account for less than 2 percent.”

How unequal a nation have dynamics like these created? A just-released report from the Congressional Budget Office helpfully paints a revealing picture. This new CBO study on the distribution of American income adds up all the changes “in household income, means-tested transfers, and federal taxes between 1979 and 2019.”

Between those two years, the CBO data show, household income “after transfers and taxes” — and after adjusting for inflation — grew on average by 97 percent among households in the nation’s most affluent 81st to 99th percentiles. In other words, America’s affluent but not super-rich households saw their after-tax incomes about double in the four decades after 1979.

Households in the top 1 percent have fared considerably better. Wealthy Americans in the 99th to 99.9th percentiles — the bottom 90 percent of the top 1 percent — have watched their after-tax incomes nearly triple, rising 193 percent.

Within the rest of our super rich, the top 0.1 percent, we see even more striking leaps. Households in the bottom 90 percent of this top 0.1 percent have had their inflation-adjusted, after-tax incomes shoot up a stunning 367 percent.

And what about those households at the tippy top of our nation’s income distribution? Between 1979 and 2019, average after-tax incomes in the top 0.01 percent of America’s households skyrocketed 507 percent. These top 0.01 percenters averaged $30 million in 2019 after-tax income.

Anybody looking for a 54-room penthouse?

Sam Pizzigati co-edits Inequality.org. His latest books include The Case for a Maximum Wage and The Rich Don’t Always Win: The Forgotten Triumph over Plutocracy that Created the American Middle Class, 1900-1970. Follow him at @Too_Much_Online.

This article is from Inequality.org.

The views expressed are solely those of the authors and may or may not reflect those of Consortium News.

Donate Today to CN’s

2022 Winter Fund Drive

The fundamental error in understanding is that individuals produce wealth; they do not. Societies produce wealth from the many varied actions of the people, from the use of historical knowledge and from the use of environmental resources. Not everyone contributes the same to wealth production, but — this is essential — everyone that is not destructive of wealth production contributes. The primary issue is the distribution of the wealth produced. The failure of this understanding to drive both policy and public understanding sets the conditions that destroy societies.

Too many loop holes and too many government officials making millions for this country to even consider taxing the wealthy so that they pay their fair share. If these A-holes would donate even 1% of their wealth every year, we would have no homelessness or starvation here in the good ole’ USA. God forbid the Jeff Bezos’ or Bill Gates’ of this country would consider “donating” anything – they are takers, not givers…

Both parties receive donations from the Rich and both cut taxes. Obama made some temporary Bush tax cuts permanent (surprisingly, those rewarding the higher paid federal officials):

“The Bush tax cuts had sunset provisions that made them expire at the end of 2010, since otherwise they would fall under the Byrd Rule. Whether to renew the lowered rates, and how, became the subject of extended political debate, which was resolved during the presidency of Barack Obama by a two-year extension that was part of a larger tax and economic package, the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010. In 2012, during the fiscal cliff, Obama made the tax cuts permanent for single people earning less than $400,000 per year and couples making less than $450,000 per year, and eliminated them for everyone else, under the American Taxpayer Relief Act of 2012.” (wikipedia)

Would be interesting to know, how many Trillions were shifted via governmental tax gifts from the bottom to the top in the past decades.

To get an idea of what else could have been done with the huge fortune.

Don’t elect RICH people to any governmental position – regardless of political party.

Trickle down economics was never a thing the idea that only one class of people know how to invest money is by definition a nonsense

All of that money is invariably dead money, the rich are hoarders, they only have two motivations, Greed and Fear

I would suggest now Enough is Enough

Time for them to give back and invest from the bottom up

To avoid loopholes, simply make the punishment match the crime, the nuclear deterrent, unlimited jail and fines for the first high profile crook, Donald J would be perfect

All of this in a nation pretending to be democratic, pretending that lives matter, that people are represented in the Congress when they are never taken into account in the laws that are passed, where lobbies and their money decide elections and the rest of the globe is expected to follow the same path.

“Dividend income, in the decades before the start of the 21st century, faced the same tax rates as wages and salaries.” Now of course, this income, only available to the wealthy, is given less instead of more requirement to contribute to the rest of us.

The story of the penthouse is grotesque, yet the people we now hear about every day because of their excessive wealth are never called “American oligarchs” with disdain and efforts to change the rules.

54 room penthouse ? Was that oligarch’s side-business pimping, or why else would she be needing that many rooms for ? To save her business hotel expenses perhaps ? If America had royalty perhaps they could be forgiven for building such palaces for those may one day serve as governmental offices of their prospective future democratic republic. But this was not the case in America, so why own a penthouse with that many rooms ?

We used the term “pigs” for police, however these days it comes to mind when I see gross excess, shamelessly (proudly) on display.

If we want to go back to ‘when America was great’, then obviously we need the same tax structure that made America great.

Reaganomics was a mistake. A big mistake.

Income tax is a form of slavery. We are forced to work a portion of each year for nothing. Article 15 says: “Nobody should be compelled to perform forced or compulsory labor.”

“A wise and frugal government, which shall restrain men from injuring one another, shall leave them otherwise free to regulate their own pursuits of industry and improvement, and shall not take from the mouth of labor the bread it has earned.”

Thomas Jefferson

“A heavy progressive or graduated income tax.” Communist Manifesto