Bruce Baigrie highlights AMLO’s battle against privatization and suggests it offers a model for South Africa, in particular, to follow.

(Matthew Rutledge via Flickr CC BY 2.0)

By Bruce Baigrie

Africa is a Country

In the 2018 Mexican general election, Andrés Manuel López Obrador (known as “AMLO”) swept to victory. His presidential victory coincided with the historic collapse of the Partido Revolucionario Institucional (PRI). Barring losses in 2000 and 2006, the PRI had ruled Mexico uninterrupted since 1929 (under three different titles).

In the 2018 Mexican general election, Andrés Manuel López Obrador (known as “AMLO”) swept to victory. His presidential victory coincided with the historic collapse of the Partido Revolucionario Institucional (PRI). Barring losses in 2000 and 2006, the PRI had ruled Mexico uninterrupted since 1929 (under three different titles).

In 2012, PRI’s Enrique Peña Nieto won the presidency with 39.17 percent. But by 2018, the PRI received just 16.4 percent of the vote compared with the 54.71 percent (the largest margin since 1982) received by AMLO’s Movimiento Regeneración Nacional (MORENA).

The issue of corruption was front and center in this election and AMLO explicitly framed it as a systemic byproduct of neoliberalism.

While markets were initially rattled, capital was not in an outright panic; AMLO had broadly promised that “his government will not spend beyond its means.” In 2018, The Economist cited “uncertainty,” but three years later AMLO’s face was plastered on their print edition as “Mexico’s false messiah.”

The Economist alluded to various ruinous policies, but it is AMLO’s actions in the energy sector that justified the typical association of a leftist leader with proto-fascist figures such as Viktor Orban, Narendra Modi and Jair Bolsonaro.

AMLO’s energy reforms are geared toward reasserting energy sovereignty over an (increasingly foreign) private sector that owns most of Mexico’s renewable energy. The subsequent contestation has sparked national referendums, attempted constitutional amendments, and cases in the country’s supreme court. The market-led transition creates such contestations wherever it leads. It generally wins. Thus, the battle for Mexico’s energy sector offers an essential example for the left — and for South Africa’s especially.

The Revolution in Development

Mexico offers a rich history of class struggle, from its independence to its 10-year revolution that ended in 1920. The postrevolutionary years saw a series of inter-elite violent contestations.

Mexico offers a rich history of class struggle, from its independence to its 10-year revolution that ended in 1920. The postrevolutionary years saw a series of inter-elite violent contestations.

In Origins of the Mass Party, Edwin Ackerman explains that the constitution of the PRI (then the Partido Nacional Revolucionario) was to “‘institutionalize the revolution’ by offering a vehicle for the circulation of the elite and [to] discipline ‘the revolutionary family.’”

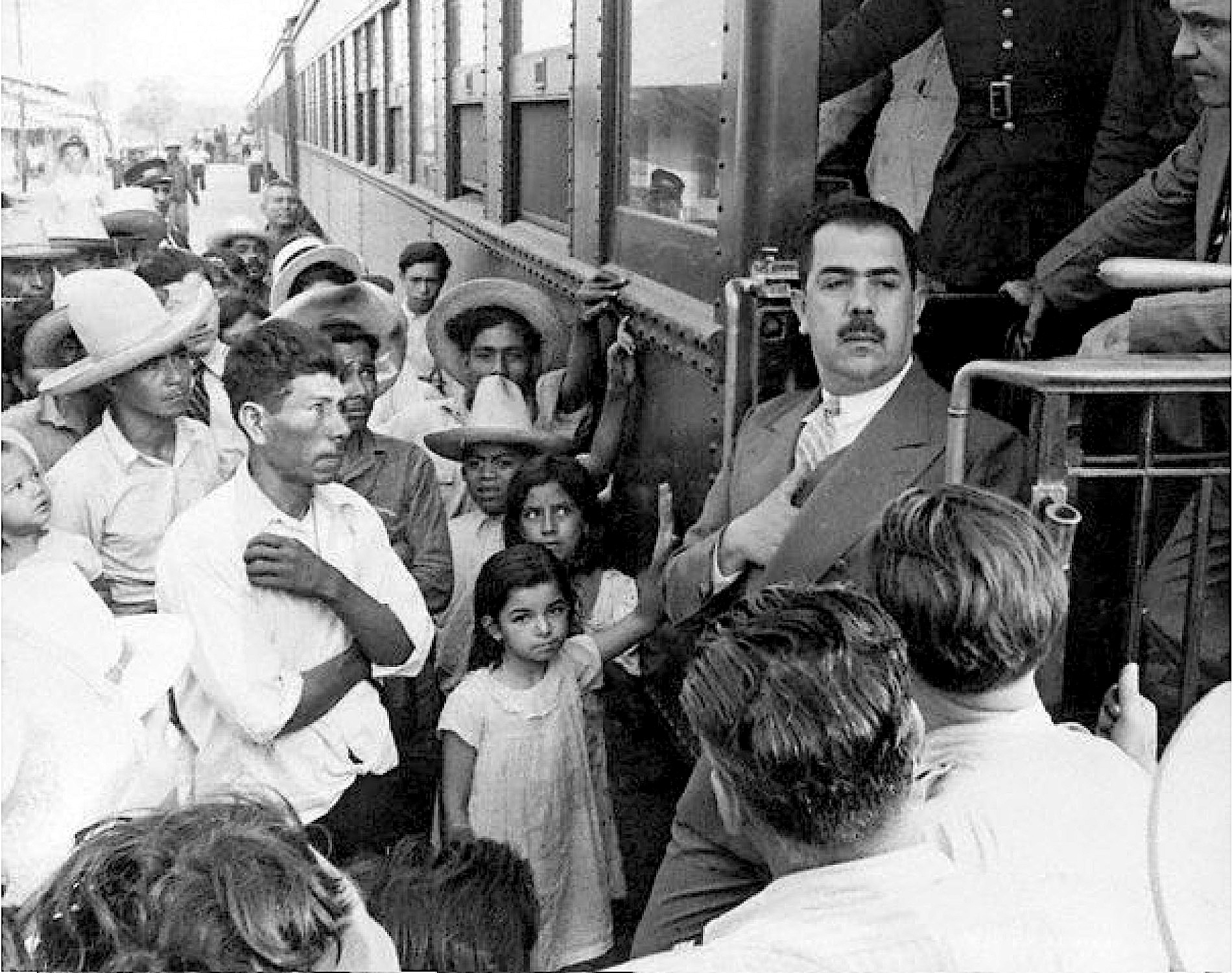

Irrespective of the needs of the elites, under President Lázaro Cárdenas (1934-1940), the PRI — then the Partido de la Revolución Mexicana —followed the postwar Keynesian pathway of state-led development.

The nationalization of Mexico’s oil in 1938 was, and remains, a source of great national pride after the unfettered foreign pillaging of its resources during the 31 years of the Porfirio Díaz regime (1877-1911). Then, Mexico was beginning what Christy Thornton calls its “revolution in development,” which sought “to devise new rules and institutions for managing the global economic systems.”

The World Bank was irked by this state ownership and refused to loan capital in the 1950s to the state-owned oil company, Petróleos Mexicanos (PEMEX), although it did offer capital to partially state-owned power utility the Comisión Federal de Electricidad (CFE). The “revolution in development” even saw Mexico use foreign investment to nationalize the electricity sector and the CFE.

Eventually, the neoliberal turn set in, and Mexico’s foreign debt would supply ammunition to its spate of liberalizations under the PRI. Thornton reflects that the “revolution in development” had inadvertently been “used to dismantle the country’s state-led developmental project.”

Mexican President Lázaro Cárdenas del Río in 1937. (Doralicia Carmona Dávila, CC BY 2.5, Wikimedia Commons)

But the energy sector remained largely off the table, and capital would have to bide its time until the PRI returned to power in 2012 under Nieto. This return saw it continue on a path of liberalization, now explicitly targeting the energy sector through the Energy Transition Law of 2013. PEMEX was cleared to do business with private companies on exploration, which came with various modalities of privatizing reserves that were discovered. But it was the spate of reforms privatizing the power sector that drove the mass confrontation today.

To Liberalization & Back

The opening salvo in the war for Mexico’s power sector came in 1992 under former president Carlos Salinas de Gortari, when gas companies were afforded power-purchase agreements (PPAs), locking the government into purchasing their power at agreed-upon prices for decades.

Two decades later, former CFE officials are in court over awarding contracts to a U.S. gas company “which had no previous experience in the energy industry.” Despite their lawyer’s connection to the Salinas family, these contracts were under Nieto, whom Sean Sweeney of Trade Unions for Energy Democracy calls the “poster child for ‘the standard model’ … power sector privatization.”

Nieto’s reforma energética (energy reform), as is standard, empowered the market over the public sector. Private companies were allowed to produce and sell power for the first time, while PEMEX and CFE were demoted from state-owned enterprises to “productive state enterprises” with corporate structures. The CFE was to be “unbundled” and mandated to ensure “value creation” by “ensuring the country’s energy security.”

Mexican President Enrique Peña Nieto attending an aerospace fair in 2015. (Armando Olivo Martín del Campo, CC BY-SA 4.0, Wikimedia Commons)

Unbundling is a preliminary step towards liberalizing a power sector. Traditional power utilities’ generation, transmission and distribution divisions are “unbundled” into separate companies.

In the case of CFE, its generation was further separated into six entities to compete alongside private generators. These generators were granted PPAs for as long as 20 years with CFE’s transmission and distribution division. But they could also simply bypass the CFE by forming direct contracts with qualified private end users. In Mexico, these PPAs and other contracts were awarded via auction. The first round saw 18 proposals accepted from 11 companies (three from three Mexican companies), while the second round saw 36 proposals accepted from 23 companies spanning 11 countries.

These private generators could count on significant support from the state. Fixed transmission charges were scrapped and the extensive transmission infrastructure required to connect renewable energy projects was also covered by the public.

Companies were also afforded depreciation-based tax breaks. This was justified on the basis of climate commitments, since solar and wind projects dominated the auctions.

Mexico adopted the “privatize to decarbonize” mantra. It was therefore able to further justify these projects as they expropriated the lands of local communities and deepened their inequality. But such matters are apparently not worth considering. AMLO’s battle with private generators is simply reversing “positive trends in Mexico’s energy industry” in favor of its “dangerous addiction to fossil fuels.”

Portrayals of AMLO as anti-climate and pro-fossil fuels (in his support of PEMEX) have gone beyond the business press to garner condemnation from Bill Gates and Mexico’s North American trade partners. Seemingly, all his critics have chosen to ignore the dire state of the energy sector he inherited.

The Mexican government could do little when the Texas blackouts of last year came their way. Northern Mexico receives up to 80 percent of its power from private generators that answer to nothing but their bottom line. While the national electricity demand never exceeded 47 gigawatt-hours (GWh), Nieto’s auctions had granted enough projects to take the supply to 84 GWh. Another reality of renewable energy that is consistently ignored is the impact of its intermittency. The existing Mexican grid could not handle the surges and drops in supply that accompany changes in the weather and private generators refused to support the upgrades necessary to ameliorate them.

Mexican President Andrés Manuel López Obrador in the Zócalo, or main square, of Mexico City, December 2021. (Gobierno de México, CC BY-SA 4.0, Wikimedia Commons)

In a landmark memorandum to energy officials, AMLO described the CFE as

“almost in ruins: indebted, with its productive capacities reduced [and] subject to regulation that privileges individuals in the implementation of the energy reform. The deep-rooted vices of inefficiency, corruption and waste were preserved.”

He further laid out his own plan

“to implement the new policy to rescue Pemex and CFE it may be necessary to propose a new energy reform, we do not rule out that possibility; that is to say, the option to present an initiative for constitutional reform.”

In 2021, AMLO’s reformed Electric Industry Act (EIA) was signed into law, outraging international investors. Since its passage, AMLO’s energy ministry has canceled various transmission expansion contracts, demanding that private generators cover these substantial costs that are perennially excluded from total production costs in favor of just marginal costs. The piggybacking of large businesses’ “self-supply” on the grid, described as a mercado negro (black market), was also canceled. Given the dire state of the CFE under Nieto, AMLO’s reforms, pilloried by some as “(counter)reforms,” are better characterized by Sweeney’s description of a “wall of resistance.”

CFE Building in Mexico City, 2011. (Vic201401, CC BY 3.0, Wikimedia Commons)

Nieto’s reforms locked the CFE into a subservient position to private generators, whose power got priority. This leaves the CFE in the position of having to back up the intermittency of these generators at a loss.

Last year, the CFE reported that its dealings with private producers had cost some $20 billion through subsidies, exchange rate and inflation risks, irregular supply of power and rising rates.

Instead of leaving the CFE to continue to waste away, AMLO’s law guarantees its central position in supplying the nation’s power. And contrary to critiques of fossil addiction, it is the CFE’s emission-free hydroelectric plants that get first priority and whose underutilization had previously caused floods.

But the private sector has fought back and taken the government to court. After various losses in local courts, the EIA survived the country’s supreme court, despite a majority of justices voting against key sections such as the prioritization of CFE.

AMLO has also attempted to write the law into the Constitution through Congress. He held a referendum on his presidency in the buildup, and while he won with 93 percent of the vote, only 18 percent of eligible voters turned up. It all made little difference during the vote on constitutionalizing the reforms to the EIA, where ALMO’s bid fell well short of the two-thirds majority required in the lower house. Seemingly undeterred, AMLO simply nationalized Mexico’s lithium reserves (a critical mineral for clean energy) with a simple majority two days later.

Mexico is taking back its energy sovereignty, and it has tasked CFE with the job. In doing so, it is laying the groundwork for a potential public pathway towards decarbonization.

Despite its much-trumpeted low cost, renewable energy is still not profitable enough. The market-led transition is failing us. We need public investment divorced from the necessity of profitability. We need what Matt Huber and Fred Stafford call “big public power.”

AMLO is fighting for big public power, but it is not clear whether decarbonization is a pillar of his agenda. He did recently assert that “Mexico is going to show how it is one of the biggest producers of clean energy,” but did so in the face of a report by his own energy ministry that they are falling short of their targets as private renewables are curtailed.

This has been enough for green and climate organizations such as Greenpeace to sue the government over the EIA. It is a far too common occurrence that in its desperation for decarbonization, the climate movement lines up behind renewable capital against relatively fossilized public utilities.

Lessons for South Africa

Substation for Eskom power supply in Northern Cape Province,

South Africa, 2008. (Media Club, Flickr, CC BY-SA 2.0)

The similarity between the Mexican and South African situations is uncanny. Mexico can be viewed as perhaps a few years ahead of where South Africa is now.

South Africa is set to embark upon its own self-supply “Wild West” pathway which will no doubt bring about the same problems as it did in Mexico.

The combination of the land requirements of renewables, the track records of private generators and South Africa’s land question creates a ticking time bomb.

Eskom, South Africa’s national power utility, has been unbundled just as the CFE was, although the process is not entirely complete. The South African government’s renewable energy plans are almost entirely reliant on private capital through auctions producing long-term power-purchase agreements. The priority of the power supply from Eskom’s generation division will almost certainly be downgraded by its future “Independent Transmission System and Market Operator” in favor of clean private generators, but it will have to keep its plants running to fulfill its ultimate purpose to back up the grid.

That Eskom intends to dramatically increase its gas-power capacity seemingly confirms this. The case of the CFE under Nieto demonstrates that this arrangement will not be economically feasible without significant tariff hikes and continued bailouts.

But the plan has always been for Eskom to be sidelined. As with the CFE and PEMEX, Eskom has also been steadily corporatized, its procurement and provision of services outsourced. Cheap renewables and climate change have made the final blow of unbundling appealing beyond capital. But these play second fiddle to perceptions that Eskom is beyond saving. With South Africans constantly in the dark, such perceptions are hardly unwarranted. This is where the Mexican and South African situations diverge. There is no AMLO, no MORENA, in South Africa.

I have argued elsewhere that given the choice between capital and the vanguard of state capture, the former is preferred. But it should not be accepted. To reject this binary, the left needs to go beyond putting credible options on the table (many already have) to building a political entity capable of delivering it — and taking back the defense of Eskom from those who would continue to loot it.

MORENA has centered its politics and much of its policies on tackling corruption — this is an absolute necessity for any prospective South African formation. Of course, AMLO did not magically appear in 2018; he had received over 30 percent of the votes in the previous two elections. But making the South African public pathway credible does not necessarily require taking the reins of government. AMLO and MORENA have demonstrated an alternative and the South African left would do well to look to Mexico for some answers.

Bruce Baigrie is a PhD Candidate at Syracuse University and a climate justice researcher at the Alternative Information and Development Center in Cape Town.

This article is from Africa is a Country and is republished under a creative commons license.

The views expressed are solely those of the authors and may or may not reflect those of Consortium News.

The claimed contradiction between public owership and green energy is a false contradiction. The experience of Costa Rica now at 98% green energy and a publically owned electric sector since 1949 proves the opposite is true. See Instituto Costaricense de Electricidad (ICE)

Its not possible to scale up hydropower (by 320 times to the size of for example the US) or any other so-called “re-newable’ source since they all rely on fossils’ to build, just because in Costa Rica hydropower supplied 75% of nearly 13 TWh of electricity to it’s 5 million people in 2021 (compared to the US’ consumption of 4,157 TWh in 2021).

Same for nearly all other locations, save a few with abundant easy to harness natural resources and sensible governance like Costa Rica.

hxxps://ourworldindata.org/energy/country/costa-rica?country=~CRI#what-sources-does-the-country-get-its-energy-from

“The Economist alluded to various ruinous policies, but it is AMLO’s actions in the energy sector that justified the typical association of a leftist leader with proto-fascist figures such as Viktor Orban, Narendra Modi and Jair Bolsonaro.”

There’s no way to associate AMLO’s firm stance to bring back the energy sector to state control in Mexico with Jair Bolsonaro’s staunch ultra neoliberal agenda, seeking to hollow out, and to privatize for a pittance, every Brazilian state-owned enterprise he can lay his hands on. The Economist ought to be better informed, to say the least. And the author should also double check.