The heirs of Sheldon Adelson may poison our democracy for decades to come, warns Sam Pizzigati.

Sheldon and Miriam Adelson at the Woodrow Wilson Awards in 2008. (Union20, CC BY-SA 3.0, Wikimedia Commons)

By Sam Pizzigati

Inequality.org

We haven’t seen the last of billionaire Sheldon Adelson. Or, to put the matter a bit more exactly, we haven’t seen the last of Sheldon Adelson’s fortune.

We haven’t seen the last of billionaire Sheldon Adelson. Or, to put the matter a bit more exactly, we haven’t seen the last of Sheldon Adelson’s fortune.

The great roulette wheel in the sky has most certainly stopped turning for casino king Adelson. He expired earlier last week at age 87. But Adelson’s $33-billion fortune will live on — and distort our nation’s political life for years to come.

How many years? We can’t, of course, see the future. But we can see how the past impacts our present. Consider, for instance, the current impactful political presence of Timothy Mellon.

The 78-year-old Mellon ranks today as one of America’s biggest political donors. In the 2020 federal election cycle, he donated just over $70 million to right-wing political groupings. Overall, only two political donors in the country, reports the Center for Responsive Politics, gave more to outside spending groups than Mellon. The No. 1 giver: Sheldon Adelson.

Timothy Mellon bears the surname of one of America’s all-time wealthiest. His grandfather, banker and industrialist Andrew Mellon, ranked as one of the nation’s three richest men back in the 1920s. The elder Mellon, notes historian Arthur Mann, cut quite a figure. He “dressed expensively, dined expensively, drank expensively.”

And contributed extensively, Mann could have added, to the massive GOP campaign war chest that helped smooth Republican Warren Harding’s 1920 ride into the White House.

Mellon the mogul had ample incentive to work for Harding’s election. Over the 20th century’s first two decades, American progressives had scored resounding victories on the tax front. America had entered the new century with a comfortably plutocratic tax code. The nation’s wealthy faced no taxes whatsoever on their incomes in 1900. By 1913, a federal tax on high incomes had become law. By the end of World War I, the wealthy faced a 77 percent tax on income over $1 million.

The Mellon National Bank Building in Pittsburgh. (Doug Kerr, CC BY-SA 2.0, Wikimedia Commons)

The 1918 tax act that established this stunning 77 percent rate still remained on the books when Warren Harding took office in March 1921. Under the act’s provisions, the top federal tax rate had by then only dipped slightly, to 73 percent. Businesses also faced an excess profits tax, and the heirs of the wealthy faced an estate tax that subjected bequests over $10 million to a 25 percent levy.

Mellon went to work to change all that, and he had — after Harding appointed him secretary of the treasury — all the political levers he needed to make that change happen. Over the course of the 1920s, Mellon’s efforts would shield the nation’s richest from any serious inconvenience at tax time.

“The social necessity for breaking up large fortunes in this country,” Mellon pronounced at one point, “does not exist.”

Most of the country disagreed. Collier’s, a top mass-circulation magazine, pointed out that Britain’s super rich, in the early 19th century, had banished the Highland Scots from their moors and mountains to make way for private hunting preserves. America’s two wealthiest families, Collier’s observed, held enough wealth to buy up all the farmland in New England and create their own preserve!

National Network of ‘Tax Clubs’

Calvin Coolidge in 1919. (Notman Studio, Boston, Wikimedia Commons)

But Mellon and his conservative allies adeptly neutralized this distaste for grand private fortune. They built a national network of “tax clubs” that barraged Congress with petitions that labeled high tax rates on the nation’s highest incomes a “national emergency.” Local small-town bankers flocked to these tax clubs. The bankers personally didn’t make enough to benefit from the cuts in tax rates on the super rich that Mellon was proposing. But they worried that rich bank depositors facing high tax rates would yank out their deposits and put their money in tax-exempt government bonds instead.

Mellon’s most shameless tax giveaway to the rich would sweep through Congress in 1926, by a whopping 390-25 margin. The fiery New York GOP progressive, Fiorello LaGuardia, found himself in that lonely twenty-five. With the Mellon plan in effect, LaGuardia argued in vain, the income tax would no longer have the capacity “to prevent the accumulation of enormous fortunes, and the control of industry and commerce that goes with such large fortunes.”

The final legislation that Congress deposited on President Calvin Coolidge’s desk gave Mellon most everything he wanted: a cut in the top income tax rate down to 25 percent, the repeal of the gift tax and a halving of the estate tax rate. For Mellon personally, the savings would be munificent. Estimates would put his net worth, just over $80 million in 1923, as high as $600 million — over $9 billion in today’s dollars — six years later.

Andrew Mellon, left, and his successor as U.S. treasury secretary, Ogden L. Mills. (National Photo Company, Wikimedia Commons)

The repeal of the federal gift tax, meanwhile, would enable Mellon to end-run what remained of the estate tax — and start shifting his fortune to his heirs, grandson Timothy Mellon eventually among them.

This 21st-century Mellon would go on to do his grandpa proud. Timothy Mellon began feeling his plutocratic oats in the Reagan years. President Reagan, Mellon would later write in a self-published autobiography, “understood that people did best for themselves when shackled with the least amount of governmental constraints.” Americans, Mellon believes, have become too dependent on the government for help and schools too beholden to teacher unions.

“Black Studies, Women’s Studies, LGBT Studies, they have all cluttered Higher Education with a mishmash of meaningless tripe designed to brainwash gullible young adults into going along with the Dependency Syndrome,” he has angrily fumed.

Timothy Mellon made his initial big-time foray into political cash just over a decade ago, as the top donor defending an Arizona law that essentially required police to racially profile locals who looked like they might be in the country illegally. He first became a player nationally in 2018, with a $10 million outlay to a super PAC supporting House Republicans.

Mellon’s most recent dip into the political waters: a $5 million donation earlier this month to the two Republicans in the Georgia Senate run-offs. That contribution alone will put Mellon in the upper reaches of this year’s political donor class top 1 percent. But Andrew Mellon’s grandson still remains nowhere near Sheldon Adelson’s giving level.

Adelson’s 2020 Election Spending

In the 2020 election cycle, Adelson and his wife Miriam poured over $215 million into right-wing political spending groups, making him the nation’s top political donor. The pair first won that No. 1 ranking in the 2012 election cycle, the initial set of elections after the Supreme Court’s 2010 Citizens United ruling. That decision essentially killed off meaningful limits on campaign spending.

No billionaire took more advantage of the resulting anything-goes atmosphere than Adelson. His household would rank eighth in political contributions for the 2014 cycle and second in 2016, before regaining the number-one slot in both 2018 and 2020.

Adelson’s influence within Republican Party ranks would, amid all this cash, become legendary. By early 2014, GOP presidential hopefuls were shuttling to Las Vegas, notes The New York Times, “for what critics called an audition before the Republican Party’s most coveted and fearsome moneyman.”

In the 2020 election, reports Politico, Adelson’s campaign contributions “accounted for more than one-quarter of all Republican outside spending on President Donald Trump’s behalf.”

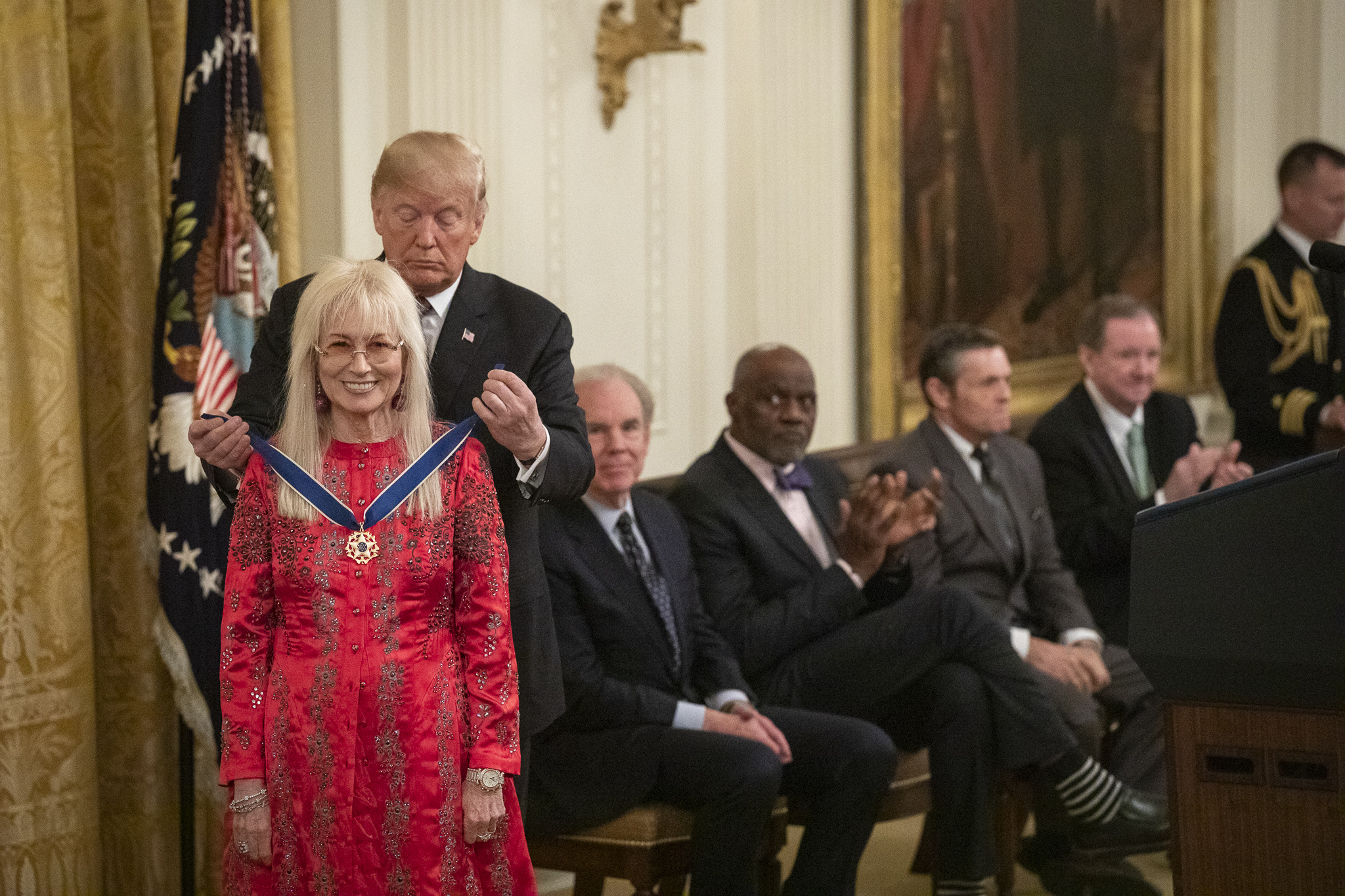

President Donald Trump presenting Medal of Freedom to Miriam Adelson, Nov. 16, 2018. (White House, Amy Rossetti)

Over the last five years, his dollars supplied over a third of the funding for the prime super PAC serving Republican candidates for the House of Representatives and a quarter of the funding for Senate Republicans.

His total outlay for right-wing electioneering: over half a billion dollars since 2010.

But Adelson did more to shape American politics than write checks to candidates and political committees. In 2015, the casino magnate secretly bought up Nevada’s most influential communications outlet, the Las Vegas Review-Journal. The paper would later become the first major daily paper in the country to endorse Trump for president.

Sheldon Adelson, in the end, amassed a personal fortune many times larger than the stash that Andrew Mellon extracted from the economy of his time. Adelson’s heirs will likely now wield an influence considerably more potent than Mellon’s heirs, and that would be going some. Timothy Mellon hardly stands alone. His cousin, Richard Mellon Scaife, bankrolled the rise of the Heritage Foundation, the ideological mothership of modern right-wing orthodoxy.

So Adelson — through his immense fortune — could remain a powerful force in American life for generations to come. Or not. The rest of us do have an option. We can restore limits on what men — and women — of means can “invest” in the political process. We can, even more crucially, put in place taxes stiff and lasting enough to shear grand private fortunes down to something approximating democratic size.

Adelson, in other words, need not be immortal.

Sam Pizzigati co-edits Inequality.org. More on the life and times of Andrew Mellon appears in his 2012 book, The Rich Don’t Always Win: The Forgotten Triumph over Plutocracy that Created the American Middle Class, 1900-1970. Follow him at @Too_Much_Online.

This article is from Inequality.org.

The views expressed are solely those of the authors and may or may not reflect those of Consortium News.

The new versions of wealth monsters are aligned with the ascending neo-liberals, surveillance state fascism and cultural authorities pretending to be “ democratic”.

Staring into the fading past and mocking those dinosaurs is suitable for the comfortably retained intellectuals, but does nothing for the working class.

Mr. Pizzigati’s highly thought-provoking article bolsters the positive side’s perceptual validity in response to one of the top handful set of historically ever-present, philosophically unavoidable, most important debate questions ever wrestled with by humanity: “Is it true the love on money is the root of all evil?”

Peace.

Edit: “Is it true the love OF money is the root of all evil?”

Yes, I get it, and it’s TERRIBLE. But I’m at a loss over what to do about it. Is there a strategy?

The notion of taking someones money away from them as punishment for horrid behavior is hardly new. The fact that the US DOJ continues to slap the wrists of corporate gougers who seldom are fined until they bleed is no deterrent or the behavior would stop. So it’s plea bargains and I do mean bargains.

As I have stated previously here at CN that is exactly what must be required. If these billionaire are going to insist on behaving badly the state needs to intervene by way of the taxing authority so cherished by Congress and others.

This approach might be the one method to solve two problems at once.

The bogus supreme court has said money is speech, as in free speech, thereby creating a bogus based conundrum to be navigated in the process.

The International Consortium of Investigative Journalists has and is developing methods that would be effective.

The many countries in rest of the world seems to get the concept and accept is with welcome arms and are prosecuting case. This should be big news but then we have the MSM.

Meantime here in the US congress twiddles it’s thumbs will pondering the catastrophic mess large portions of the US has become while trying maintain civility and peace.

I would suggest if congress is serious about making things right in this country they figure out a method of taxing the rich to allow them the honor of rebuilding an America all Americans can be proud of and they can rightfully claim they need nothing in return for they have done their PATRIOTIC DUTY. Something many could use some schooling on.

A great step would be telling the far right wing government of Israel the free lunch is over.

I wish U could wish everyone a happy new year, but we will have to wait and see.

Don’t take any wooden nickles friends.

Thank you CN

“The rest of us do have an option. We can restore limits on what men — and women — of means can “invest” in the political process.”

Surely Sam Pizzigati is not pretending the rest of us (ie the 90% or more) actually have an influence on what our “elected reps” and senators decide? All the studies show that they do not care at all about the majority of the population of the USA, but prepare the laws and pass the laws which the money lobbies decide on. We can see that from polls showing what most of us would like to have.

No wonder nearly half of US eligible voters usually do not bother to vote. Why bother when only the rich matter?

And the biggest joke is that the US espouses itself to be the ‘Leaders of the Free World’.

More Orwellian doublespeak from the Plutocratic / Oligarchic drones that form the GOP & Dems.

When all industry & commerce is owned by a few I’m not sure there is way out, unless, one of these Billionaires has a ‘Damascene’ style conversion of their principles.

Mr. Pizzigati needs some help. The US constitution barred the government from levying an income tax until the ratification of the 16th amendment in 1913.

Why??? are we letting them?

Nice, informative article. Thanks!

But the conclusion feels counterintuitive. If the wealthy are allowed to buy Congressional votes, just who is this “we” that is going to limit these absurd, legal bribes? It certainly will never, ever happen through electoral politics. That deck, as this article explains, has been stacked against us for over a hundred years.

People in the streets? Maybe, if we can see through the haze of identity politics and the smokescreen of American Exceptionalism in a country that dumbs down the polity through a grossly underfunded public education system, a compliant, propagandistic media culture, and a coming wave of electronic surveillance and censorship.

You omit the fact that Adelson was also Netanyahu’s chief financier, with all that implies. And he and his hemchmen played a critical role in the criminal spying on Assange.

The only measure of anything is money. Health, environment, food, air, water, infrastructure – they are measured by cost (i.e. profit) performance, not functional effectiveness.

Money is a bad value system, the only thing it is good for measuring is itself. Because of the death grip that money holds on power this won’t change without a complete collapse of capitalism brought on by insatiable wars of greed, environmental collapse, or violent revolution.

“Those who make peaceful revolution impossible will make violent revolution inevitable.” – JFK

Under the coming domestic terrorism laws JFK would be thrown in jail for making that statement, which would be blocked on all social media platforms and unreported by corporate media.

“Overall, only two political donors in the country, reports the Center for Responsive Politics, gave more to outside spending groups than Mellon. The No. 1 giver: Sheldon Adelson.”

I had to follow the link provided to learn the No.2 donor – Michael Bloomberg. Yes, the one and the same that hilariously jumped into the Democrat’s frantic STOP SANDERS AND PROGRESSIVE POPULISM campaign.

During the 2006 midterms campaign I followed a hunch and found real-time figures of where all the big dough was going at that time. The politically astute – mostly the ownership class, and not us proles – saw the writing on the wall: Republicans, because of the disastrous Iraq war were going to lose big, and so the lion’s share of all that “speech” was going to D candidates, because they were going to win.

That is how the mongrel breed of Blue Dogs was bred, and this is how you own a government. The best government money can buy.