here are lessons to be learned from the Obama era foreclosures of 2008-2009

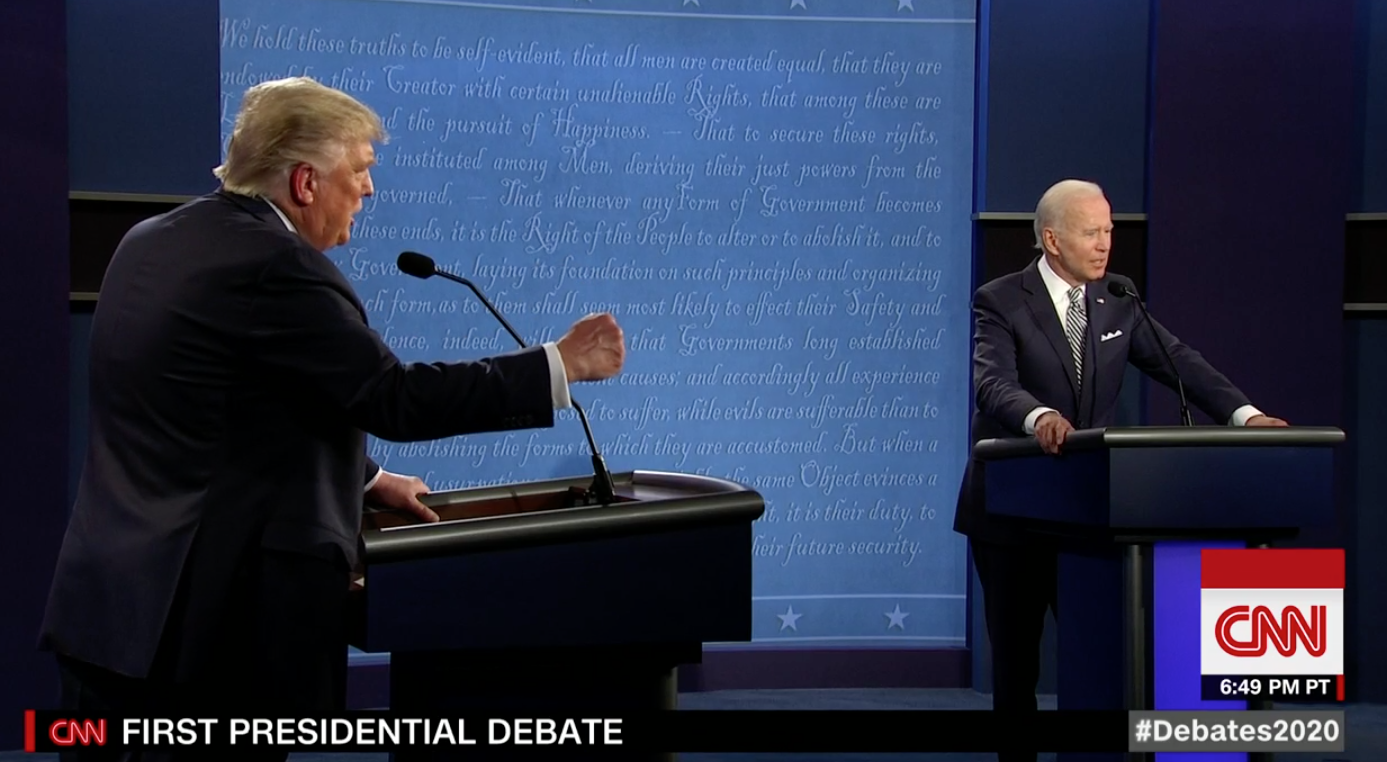

U.S. presidential debate, Oct. 22, 2012.

Whoever wins today’s election is virtually certain to be confronted by a severe foreclosure and eviction crisis as state and local governments face acute budget shortfalls. These crises interact with each other and in ways that intensify the economic damage they inflict. The harm is also psychological and political. There are lessons to be learned from the last great foreclosure, 2008-2009.

Whoever wins today’s election is virtually certain to be confronted by a severe foreclosure and eviction crisis as state and local governments face acute budget shortfalls. These crises interact with each other and in ways that intensify the economic damage they inflict. The harm is also psychological and political. There are lessons to be learned from the last great foreclosure, 2008-2009.

U.S. households were in tenuous shape for years leading up to the onset of Covid—19. Consequently we should not be surprised by the implications for the housing market. The Wall Street Journal reports:

“about a quarter of American renter households with children are now carrying debt from not paying rent, U.S. Census Bureau surveys show… Mounting rental debt could also impede the path to a U.S. economic recovery, when 30 million to 40 million people from New York City to San Francisco face potential eviction once moratoriums expire.”

If foreclosures and evictions are standing in the way of recovery, it is also safe to say that the draconian cuts in budgets of state and local governments translate into wage reductions and/or unemployment for public sector workers and thus more pressures on the housing market.

If homeowners and government workers are not able to create sufficient demand to restore economic growth the federal government must step in. State governments are constitutionally prohibited from borrowing for daily expenses

Subprime Mortgage Bailout

Resolution of the subprime mortgage crisis required a federal bailout of the banks holding these toxic instruments. But did saving the banking system require saving the bankers whose malfeasance caused the crisis? Borrowers lost their homes and savings even as bankers reaped multi million dollar bonuses. Borrowers alone were punished despite the fact that for every improvident borrower there is a reckless or manipulative lender.

The bailout legislation in effect recognized this truth and allotted a portion of the bailout relief for homeowners. Nonetheless, the Obama Administration chose not to implement that part of the legislation even though assistance to ordinary borrowers would have been at least as effective in saving the banking system. This despite the fact that this controversial legislation was passed only by commitment to foreclosure relief as a part of the TARP program

Long-Lasting Implications

The implications of this neglect were significant and long-lasting. Michael Olenick argues:

“This frustration, the betrayal from the right and the left, led to enormous anger. People wanted to burn something down and, at just the right time, Trump came down the escalator promising to do exactly that.”

Secretary of the Treasury Steven Mnuchin addresses discusses aspects of the Covid-19 stimulus package, March 25, 2020. (White House, Tia Dufour)

Despite the massive mortgage debt overhang and the impending foreclosure crisis there is very little talk about how debt might be restructured or how to house the many who will be left homeless. What talk there is once again seems to blame the debtors. Yves Smith, founder of the blog Naked Capitalism, reprints an especially nasty example of this genre from the Letters column of the Wall Street Journal:

Howard S

- “Single mothers are suddenly discovering why its good to have a responsible husband who works and supports his family before you start making babies. Bad decisions have bad consequences.”

Like the authors of the first bailout, Howard S has also forgotten that for every irresponsible borrower there is a reckless lender. In any case however much some may rant and rave, these debts are far too massive ever to be paid down in full.. They will be restructured either by major depressions, war, bankruptcy courts,– or democratic political movements.

As regards the last alternative, in Debunking Economics Australian economist Steve Keen presents a provocative intervention into debates about debt forgiveness. He acknowledges that debt forgiveness can hurt creditors, a class that might include workers’ pension funds as well as affluent investors.

He advocates instead a simple one- time grant of say $50,000, which can be spent only after it has been used to pay down any personal debt. This proposal has several merits. Because it is universal, it would help the thrifty homeowners sufficiently who have paid off most of their mortgage while also aiding those under water from home or student loans. With another debt foreclosure crisis coming it is imperative that such ideas receive a fair hearing.

John Buell has a PhD in political science, taught for 10 years at College of the Atlantic, and was an associate editor of The Progressive for 10 years. He lives in Southwest Harbor, Maine, and writes on labor and environmental issues. His most recent book, published by Palgrave in August 2011, is “Politics, Religion, and Culture in an Anxious Age.” He may be reached at [email protected]

This article is from Informed Comment

The views expressed are solely those of the author and may or may not reflect those of Consortium News.

Please Contribute to Consortium News

Donate securely with

Click on ‘Return to PayPal’ here.

Or securely by credit card or check by clicking the red button:

Buffalo Ken,

> there are many places in the US where the price of property is depressed and you can find somewhere to live “on the cheap”.

That may be true; but how are those people supposed to earn a living there, since the job market is also “depressed” there?

The only thing the democrats are left of is that one degree left of center position they now occupy after drifting right several degrees after WWII. Great call Lois. We had to stop those dirty commies you know.

If Trump wins tonight I expect many folks will be astonished by the number of people in the U.S. who are starving in 2025 and maybe even if Biden wins this will be true.

Mr. Harrison is correct about who took what on the chin. Many of those in that middle class are now the poor, going broke and are destitute. Currently swelling those numbers are the economic casualties created by the pandemic.

Let us also remember that Slick Willie developed lock jaw after Billy B Barr urged his not to pursue the BCCI case with all due vigor.

But I digress.

Anne R and B K you both are right depending where we talk about however we all miss the mark here if we do not acknowledge the hopelessly large growing number of homeless needy is ballooning to gigantic proportions.

What to do what to do. How bout slapping the slobbers out of the wealthy and making the pay up?

Or would that be far too many degrees of a drift by democrats back to the left?

Clearly if we continue the next fifty years as we have the last fifty, . . . . . . . . ., maybe the government needs to study true socialism instead of conflating it with highly nationalized communism. Then maybe that same government can distinguish between what is humane and what isn’t.

Thanks to everyone at CN and VIPS

Mr Buell, if rents weren’t so bloody high in the first place – let alone in the midst of the lockdown causing job losses across a wide spectrum of businesses, small and not so small – and didn’t, as in many cases, rise every year (especially when the renter is a property company), then perhaps those on, you know (or perhaps not), lower working class wages/gig payments might have been able to put a little money to one side for that all too common (for the low income levels in western societies) rainy day.

As for those who were duped into buying houses that they couldn’t afford (in the longer run) – ummm. I do not think that they were to blame for not understanding the (all too usual) convoluted gobbledy-gook that I am sure those very duplicitous mortgage loan forms were expressed in. They very definitely were nowhere near the equivalent to the bastards in the banks and mortgage companies. Not by a long chalk. And Obama was as low level, duplicitous as those he really bailed out. But he and Wall Street have all done very nicely ever since then, ta. Which only shows the truth about this whole, so-called, democratic system.

Frankly – whichever face of the Janus Party resides in the WH (both being the same bar the color of lipstick), those on the lower rungs of the socio-economic ladder will be in the same utter mess and deprivation. The Janus Party looks after its own and its plutocratic comrades – together they form the corporate-capitalist-imperialist ruling elite. We – the vox populi/hoi polloi – do not matter one iota. Unless they need a floor washing, a meal cooking, a child cared for….

So I have a bit of a solution to this eviction “crisis”. If you go outside the big city, there are many places in the US where the price of property is depressed and you can find somewhere to live “on the cheap”. Heck, you might be able to find somewhere to live for free, and I encourage all to explore this possibility that is right in front of our eyes in our own country.

It could be a win-win situation and I’m all for that.

Peace,

BK

I’ll add one other thought. If you get outside the big city, and you live somewhere as a tenant or upon the grace of another who sees something that you have to offer, then you might have a bit of soil in the area around your home and you could grow some crops there for the fun of it and for your own sanity. Think about the learning opportunities your children might have as they see you struggle to grow some food and/or other natural vegetative materials.

Anybody could do this and they still could have a regular job especially if their job can be performed remotely. So what I think is that it is time to get back to our roots and to get our hands dirty in the soil and to be a bit more self-sustaining. If you are genuine in your desire to contribute towards a better future for all of us, then this is a real opportunity to achieve that. Things are going to get better is what I think and I think they are going to get better for pretty much all of us. Imagine that!

Peace,

BK

It’s misleading to readers to refer to the Democrats as the left. The left would have fought all of this criminality if it had any power to do so.

Indeed, most of them are not even close:

hXXps://www.politicalcompass.org/uselection2020

I’ll bet that Howard S didn’t realize that Yves Smith of Naked Capitalism is female.

The Great Recession can be blamed on the US government. Both the Republicans and the moderate Republicans (aka Democrats) are guilty, guilty, guilty. Repealing Glass Steagall (Slick Willie) allowed the commercial banks to start a go-go casino running on taxpayer money. Alan Greenspan kept the economy afloat on an ocean of fake money (Shrub) created by an artificially low Fed Discount rate. Mr Buell doesn’t seem to understand that all that money was going to go someplace. They allowed the US’s manufacturing base to be destroyed by allowing companies to off-shore their manufacturing and not punishing them by hitting them with a tariff to import the goods to the US (although this was largely promulgated by a Republican free trade myth). And it was the American middle class, not the rich, that took it on the chin.