Once Beijing announces a digital currency backed by gold, it will be like the U.S. dollar being struck by lightning, writes Pepe Escobar.

The Bank for International Settlements building in Basel, Switzerland. (Wladyslaw Sojka, CC BY-SA 3.0, Wikimedia Commons)

By Pepe Escobar

Strategic Culture

A radical paradigm shift is in progress. The U.S. economy may shrink as much as 40 percent in the first semester of 2020. China, already the world’s largest economy by PPP for a few years now, may soon become the world’s largest economy even in exchange rate terms.

A radical paradigm shift is in progress. The U.S. economy may shrink as much as 40 percent in the first semester of 2020. China, already the world’s largest economy by PPP for a few years now, may soon become the world’s largest economy even in exchange rate terms.

The post-Planet Lockdown world — still a hazy mirage — may well need a post-Planet Lockdown currency. And that’s where a serious candidate steps into the fray: the fiat digital yuan.

Last month, the People’s Bank of China (PBOC) confirmed that a group of top banks started trials in electronic payment in four different Chinese regions using the new digital yuan. Yet there’s no timetable yet for the official launch of what is called the Digital Currency Electronic Payment (DCEP).

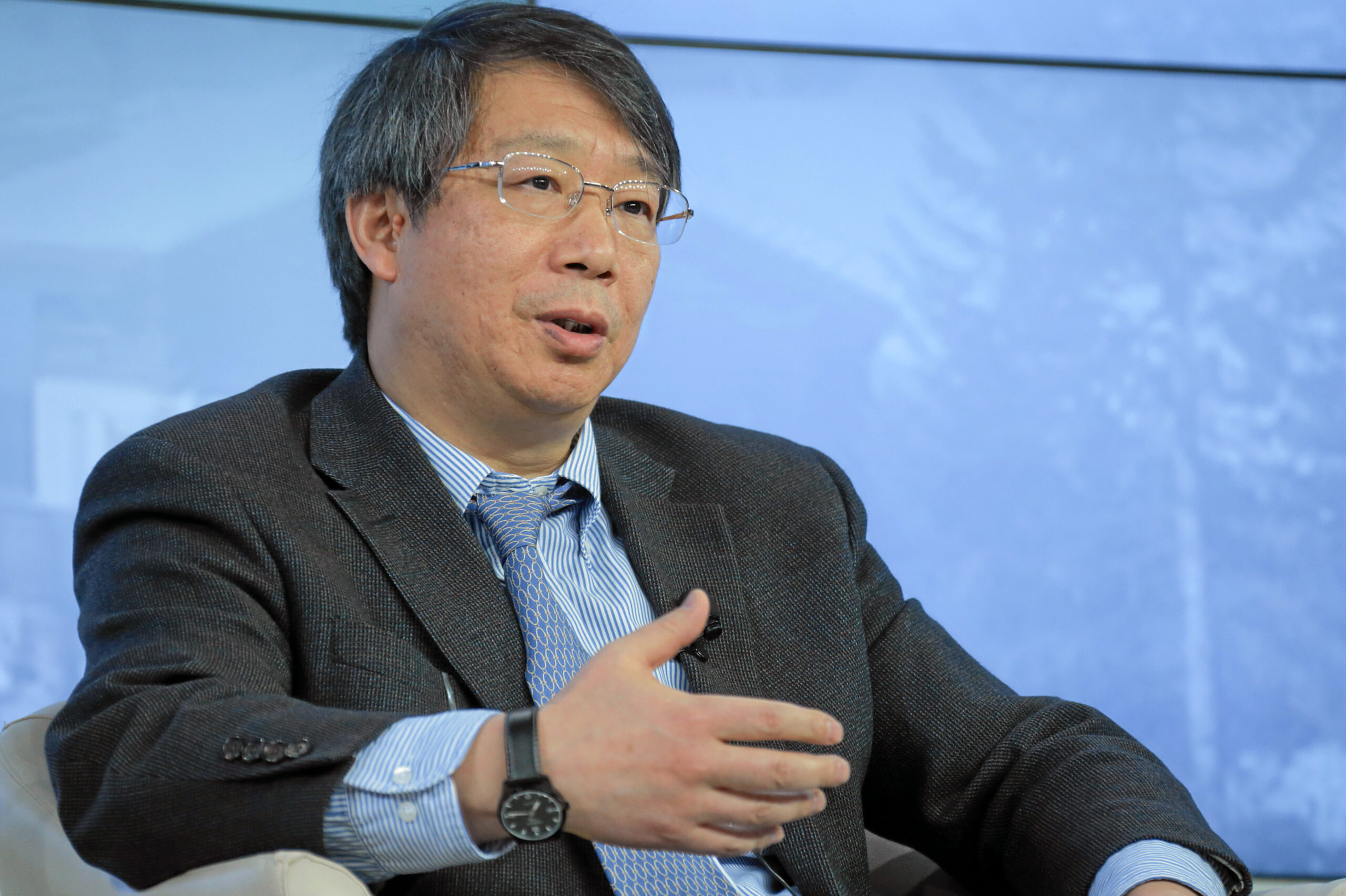

The man with the plan is PBOC governor Yi Gang. He has confirmed that apart from the trials in Suzhou, Xiong’an, Chengdu and Shenzhen, the People’s Bank is also testing hypothetical scenarios for the 2022 Winter Olympics.

While DCEP, according to Yi, “has made very good progress,” he insists the Chinese central bank will be “cautious in terms of risk control, especially to study anti money-laundering and ‘know your customer’ requirements to incorporate in the design and system of DCEP.”

PBOC’s Yi Gang in 2013 while attending the World Economic Forum in Davos, Switzerland. (World Economic Forum, CC BY-SA 2.0, Wikimedia Commons)

DCEP should be interpreted as the road map for China leading to an eventual, even more groundbreaking replacement of the U.S. dollar as the world’s reserve currency. China is already ahead in the digital currency sweepstakes: the sooner DCEP is launched the better to convince the world, especially the Global South, to tag along.

The People’s Bank of China is developing the system with four top state-owned banks as well as payment behemoths Tencent and Ant Financial.

A mobile app developed by the Agricultural Bank of China (ABC) is already circulating on WeChat. This is in effect an interface linked to DCEP. Moreover, 19 restaurants and retail establishments including Starbucks, McDonald’s and Subway are part of the pilot testing.

China is advancing fast on the whole digital spectrum. A Blockchain Service Network (BSN) was launched not only for domestic but also for global trade purposes. A large committee is supervising BSN, including executives from the PBOC, Baidu and Tencent, according to the Ministry of Industry and Information Technology (MIIT).

Backed by Gold

So what does this all mean?

Well-connected banking sources in Hong Kong have told me Beijing is not interested in the yuan replacing the U.S. dollar – for all the interest across the Global South in bypassing it, especially now that the petrodollar is in a coma.

The official Beijing position is that the U.S. dollar should be replaced by an IMF-approved Special Drawing Rights (SDR) basket of currencies (dollar, euro, yuan, yen). That would eliminate the heavy burden of the yuan as the sole reserve currency.

But that may be just a diversionist tactic in an environment of all-out information war. A basket of currencies under the IMF still implies U.S. control – not exactly what China wants.

The meat of the matter is that a digital, sovereign yuan may be backed by gold. That’s not confirmed – yet. Gold could serve as a direct back up; to back bonds; or just lie there as collateral. What’s certain is that once Beijing announces a digital currency backed by gold, it will be like the U.S. dollar being struck by lightning.

(Agnico-Eagle Mines Limited, CC0, Wikimedia Commons)

Under this new framework, nations won’t need to export more to China than they import so they have enough yuan to trade. And Beijing won’t have to keep printing yuan electronically – and artificially, as in the case of the U.S. dollar – to meet trade demands.

The digital yuan will be effectively backed up by the massive amount of Made in China goods and services – and not by a transoceanic Empire of 800 Bases. And the value of the digital yuan will be decided by the market – as it happens with bitcoin.

This whole process has been years in the making, part of serious discussions started already in the late 2000s inside BRICS summit meetings, especially by Russia and China – the core strategic partnership inside the BRICS.

Considering multiple strategies to progressively bypass the U.S. dollar, starting with bilateral trade in their own currencies, Russia and China, for instance, set up a Russia-Chian RMB Cooperation Fund three years ago.

Beijing’s strategy is carefully calibrated, like playing Go long-term. Apart from methodically stockpiling gold in massive quantities (just like Russia) for seven years now, Beijing has been campaigning for a wider use of SDR while making sure to not position the yuan as a strategic competitor.

But now the post-Planet Lockdown environment is shaping up as ideal for Beijing to make a move. Even before the onset of the Covid-19 crisis the predominant feeling among the leadership was that China is under a full spectrum attack by the United States government. Hybrid War already reaching fever pitch implies bilateral relations will only get worse, not better.

So when we have China as the world’s largest economy by both PPP and exchange rate; still the strongest growing major economy, barring the first semester of 2020; productive, innovative, efficient and on track to reach a higher technological level with the Made in China 2025 program; and capable of winning the “people’s war” against Covid-19 in record time, all the necessary elements seem to be in place.

But then, there’s soft power. Beijing needs to have the Global South on its side. The United States government knows it very well; no wonder the current hysteria is all about demonizing China as “guilty” on all – unproved – counts of fostering and lying about Covid-19.

An ‘Impeding Arrival’

People’s Bank of China headquarters in Beijing. (Max12Max, CC BY-SA 4.0, Wikimedia Commons)

A key advantage of a sovereign digital yuan is that Beijing does not need to float a paper yuan – which by the way is being sidelined all across China itself, as virtually everyone is switching to electronic payment.

The digital yuan, using blockchain technology, will automatically float – thus bypassing the U.S.-controlled global financialized casino.

The amount of sovereign digital currency is fixed. That in itself eliminates a plague: quantitative easing (QE), as in helicopter money. And that leaves the sovereign digital currency as the preferred medium for trade, with currency transfers unimpeded by geography and, the icing on the cake, without banks charging outrageous fees as intermediaries.

Of course there will be pushback. As in non-stop demonization of neo-Orwellian China for straying away from the whole purpose of bitcoin and cryptocurrencies — which is to have freedom from a centralized structure via decentralized ownership. There will be howls of horror at the PBOC potentially capable of seizing anyone’s digital funds or turning off a wallet if the owner displeases the CCP.

China is on it, but the U.S., U.K., Russia and India are also on their way to launch their own crypto-currencies. For obvious reasons, the Bank of International Settlements, the central bank of central banks, is very much aware that the future is now. Their research with over 50 central banks is unmistakable: We are facing an “impeding arrival.” But who will take the Biggest Prize?

Pepe Escobar, a veteran Brazilian journalist, is the correspondent-at-large for Hong Kong-based Asia Times. His latest book is “2030.” Follow him on Facebook.

This article is from Strategic Culture.

The views expressed are solely those of the author and may or may not reflect those of Consortium News.

>>Please Donate to CNs’ 25th Anniversary Spring Fund Drive<<

The world abandoned a gold standard almost 50 years ago because it was a bad idea. A gold-backed currency will not supplant the dollar. Moreover, it will constrain China’s ability to manage its economy autonomously.

Not True. The world did not abandon the Gold Standard agreed at Bretton Woods in 1944 to back Gold at the rate of US$35 an oz. It was Tricky Dicky Nixon who abandoned the Gold Standard when he closed the Gold window on 15 August 1971 (temporarily, he lied) because the United States cheated and printed more dollars that it had Gold to back them up, to fund the immoral/illegal Vietnam War.

President Charles de Gaulle saw through the scam and cashed in with the huge amounts of tourist dollars for Gold at the cheap rate of US$35 an oz. Soon other major countries with surplus dollars joined in and Tricky Dicky had not choice but to abandon the Gold Standard. By then the total Gold reserves in Ft Knox had dropped from about 20,000 tons to about 8,300 tons. But since the Gold at Ft Knox has not be audited since the 1960s, no one really knows if the Gold is still there.

According to Jim Sinclair, the famed Godfather of Gold, when interviewed at USAWATCHDOG, if the US National Debt (which is now a whopping US$25 Trillion) is divided by the amount of Gold held by the US Government to clear that debt , the price of Gold has to be between US$50,000 and US$87, 000 an oz.

To check his calculation why not divide the Global Debt of about US$261 trillion by about US$9 trillion of surface Gold globally? The Global Debt exceeds the Global Gold value by 29 times. But the current price of Gold is only US$1,731 an oz. Therefore, the price of Gold has to rise exponentially to US$50,000 an oz to equal the Global Debt, vindicating Jim Sinclair’s prescient prediction.

If the Digital Yuan is backed by Gold at say 350,000 to 1 oz of gold ( at 7 to 1 exchange rate to the dollar) it will be the next World Reserve Currency.

According to Egon von Greyerz, Founder of Matterhorn Asset Management (link GOLDSWITZERLAND), China has 20,000 tons of Gold. If China sells off the US$1.2 trillion US Treasury Bonds and buys Gold its price will rise exponentially to about US$50,000 an oz. China will gain another 20,000 tons of Gold, making it a total of 40,000 tons of Gold.

That will be enough to manage a Digital Yuan backed by Gold, since China is also the biggest producer of Gold at 480 tons too in 2019.

My comments may at first seem off topic but they are not. After reading this article, two wrtings began to surface in my mind. The first was Michael C. Rupperts evaluation of China’s dependence on US agriculture in his book, Confronting Collapse and the second an MIT Technology review, published over a year ago, written by Mike Orcutt.

Ruppert proposes that globalization cannot proceed without cheap energy. For instance in the case of crude oil, four hundred gallons of it are used each year to feed one American. Huge amounts of natural gas required for ammonia production fertilizer for farming but his fact finding publication, what has actually happened since 2008?

China has a stubborn, persistent food price inflation (never mind the oil glut). At the same time the CCP openly requested that the US double exports of Ag and meat to them. However over eighty percent of US Ag exports (mostly corn) are already committed to feed twenty countries, sold to first and second world markets. This trade is a dependable, steady distribution system of corn, soy and meats. Meanwhile and more recently, China’s acquiring an ever larger portions of our soy exports. The Ukraine and Canada make up the difference to satisfy China’s ever increasing demand for corn. This food distribution network between nations is quite competitive, from a profitability standpoint. The integration and transnational dependencies does more to keep the peace than a half dozen naval fleets could.

How can financial exchanges be improved within these huge market exchanges for Ag products, energy, various commodities? A strict international bartering exchange? Orcutt argues that block-chain technology is now subject to hacking, security holes, smart contract bugs, fraudulent transactions, histories of transactions under noticeable attack. The professional hacker can now rewrite these so called “very secure” transaction histories. Several Crypto exchanges such as Coinbase, Etherium Classic, Vertcoin and Gate.io were hacked by “small trades” or invaded by a “double-spend” strategy? (now good readers, I’m well over my head) so please search the referenced sources yourselves. I do understand this much, that crypto losses tally up to a cool, two billion dollars, stolen gleanings by cyber-criminals (since 2017) Be it a bank issued digital or crypto-currency system, hacking losses and safety concerns remain the same.

Will AI come to the rescue and join hands with blockchain technology? Perhaps the West finally understands the motivations within behind the Chinese government to finance the largest Artificial Intel Facility in the world and is pouring billions into it? Are US firms taking the time to make one good old fashioned, long term investment in AI R and D without the usual practice of turning a quick buck, to hell with tomorrow routine?

With all due respect to Mr. Escobar, the macroeconomic logic behind this article is missing, as is the knowledge necessary to explain how macroeconomics actually works. Quite bluntly, this article is way off the mark. I know Mr. Escobar has strong suits in terms of his knowledge, but respectfully, macroeconomics is not one of them. Please, Mr. Lauria, bring in some good economists to write articles of this sort. I can recommend quite a few. Otherwise, love your site and its reporting!

“Good economists” is an oxymoronic term. Economics is the art of trying and failing to predict the past.

Steve, then what are you waiting for? Your turn, do explain macroeconomics to us plebians and to Escobar.

The Federal Reserve wasn’t formed until 1913 when it was hashed out over on Jekyll Island. I always recall events such as this when placed in personal history of my own as my Father started his life that year. Going forward the currency and coinage changed in 1964 from silver to copper sandwich right after JFK was assassinated. I don’t think he would have approved. I know my Father didn’t. Then to top it off, President Nixon took us off the gold standard in 1971 the year that I graduated from high school which really put the screws in for me and many of us.

Simple math of China adopting the gold standard does not seem to work. Value of all the gold in the world at current spot is under 9 trillion. USA holds the vast majority, China currently a small fraction, far behind the U.S, or Germany or Italy or Russia…..

Where is China to obtain the physical gold reserves to back a digital golden yuan?

Sounds like a very thin theory. Does not China devalue its currency, some say in a manipulative fashion to benifit its own economy ? So why would it want to peg its currency to an international gold spot which would be subject to control by the USA and others given their vastly larger gold reserves? Would China prefer international obligations repaid to it in dollars devalued by a golden yuan?

Headline is catchy. Theory does not seem workable or desirable from China’s position.

You have to realize china owns americas gold through debt

Last I heard, getting your gold back from the US is like pulling hen’s teeth. There is as much evidence that hens have teeth as there is that the US still has anywhere near the amount claimed. The constant lying by the government about everything leaves me totally without confidence in anything.

First, its not a given that the “USA holds the vast majority” of Gold in the world because the contents of Ft Knox have not audited since the 1960s.

Second, its wrong to claim that “China currently (holds) a small fraction, far behind the U.S, or Germany or Italy or Russia…”. This is simply not true. Here’s why:

While its true that China’s central bank (PBOC), as at January 2020, holds 1,948.31 tons of Gold, which are “far behind the U.S, or Germany or Italy or Russia…”, this only represents 4 years of mining because as the largest producer of Gold in the world China produced 480 tons in 2019.

But China has been producing Gold for the last 40 years and the Gold mined were not for sale outside the country.

According to Egon von Greyerz, Founder of Matterhorn Asset Management (link GOLDSWITZERLAND), China has 20,000 tons of Gold. So where are the balance 18,051.69 tons of Gold held? My best guess is they are held by the four largest Chinese banks, (they also are four the largest banks in the world).

If China sells off the US$1.2 trillion US Treasury Bonds and buys Gold, China will add another 20,000 tons of Gold, making it a total of 40,000 tons of Gold, by far the largest Gold Reserves in the world.

Third, by having the largest Gold reserves China can back the Digital Yuan at say 350,000 yuan an oz of Gold. By extension, at a ratio of the current 7 to 1 exchange rate, the price of Gold in US dollars will be US$50,000 an oz.

Fourth, to verify the accuracy of this price, why not divide the Global Debt of about US$261 trillion by about US$9 trillion of surface Gold globally? The Global Debt exceeds the Global Gold value by 29 times. But the current price of Gold is only US$1,731 an oz. Therefore, the price of Gold has to rise exponentially to US$50,000 an oz to equal the Global Debt, vindicating Jim Sinclair’s prescient prediction.

Fifth, since Columbus set sail to Cathay (China) in 1492, the World Reserve Currencies were the Portuguese escudo, the Spanish peso, the Dutch gilder, the French franc, the British pound sterling and now the US dollar, which replaced the pound sterling in 1944 after the Agreement at Bretton Woods.

The average tenure of each previous World Reserve Currency was about 71 years. The US dollar has been the World Reserve Currency for 76 years. Its time for a change and any currency backed by Gold will be the next World Reserve Currency. Digital Yuan anybody?

The idea that China would bury its QE tool is ludicrous. The only way to inflate an economy in recesssion is to add zeroes to bank accounts. It’s a delicate operation. Do it the wrong way and you get hyper inflation. But do the opposite and restrict the money supply by linking it to gold, you get economic implosion. Unless ofcourse its a big bluff, designed only to lure in people who don’t know any better.

The main reasons why the US dollar is the world’s reserve currency is because it has the highest level of confidence and liquidity, surpassing all other currencies in circulation.

In times of geopolitical turmoil, and during a lack of trust in other monetary systems, like the Euro, the US dollar becomes the currency of choice of foreigners and foreign institutions that convert and park their money in US dollars.

The foreign exchange, called ‘FX’ or ‘forex,’ is the marketplace where countries from around the world exchange currencies. It is the largest market in terms of trading volume, surpassing the credit markets and the trade of goods and services. About half of the approximately $5 trillion of transactions that are settled daily are denominated in US dollars.

It is estimated that approximately 70% of the physical paper dollars in circulation are held outside the United States, mostly in $100 notes.

What helped make the US dollar the reserve currency is exemplified by the fact that a Federal Reserve note issued in the 1860s is still a legal tender today, unlike the fate of many other currencies.

The US dollar is commonly known as money: A medium of exchange that guarantees the fulfillment of a transaction. Its value is generated by confidence in the government and its institutions to manage the economy in a trustworthy and competent manner. These institutions would not exist without the underlying reality that a currency is backed by the total productive capacity of its people.

Yes, the strength of the US dollar will inevitably cause dislocations to the world economy. When this happens, a reassessment about its role as a reserve currency will likely occur. If the USA does not get its act together politically, the financial center of the world will likely move to Asia. What the new reserve currency will be like is anybody’s guess.

@Michael Rizzotti

Confidence in the US Dollar (based only on “good faith”) has been and continues to rapidly diminish seems to me….especially lately. A bully is tolerated if you need what the bully has, but if an alternative currency comes into play, then good bye bully because who needs that.

By the way, I don’t think the Federal Reserve came into existence until 1913….so the note you mention must have been something else. If it was from the 1860’s I suspect it was either Civil War paper money (worthless now except for historical reasons) OR it was backed by gold (or silver), in which case it might still be worth something. If you were smart up till about 1965 in the US you would have saved your dimes and other coins because they truly did contain silver in those days.

I don’t know – it all gets so complicated, but the idea of China having their own digital “block-chain” currency possibly backed by a some sort of connection to a real commodity with real limits, has some true appeal to those of us who are sick of imaginary economics in the interest of only a few with their flawed ambitions.

there was no federal reserve to issue notes in the 1860s.

Let us look at this another way by introducing the C19 and its consequences into the equation.

If a government is paying 80% wages of several million people to stay at home can that be sustained? Any government issuing a fiat currency can always pay its bills. It never has to turn to the printing press and say, OK bud, how much do I owe ya? So long as too few goods aren’t chased by too much money, inflation isn’t a problem.

Ask yourself whether it makes any sense to say that the US needs another nation to “lend” America “dollars.” Simply put, that is self-referential nonsense. The US can always buy whatever there is to buy that’s denominated in US dollars. It has no need to borrow dollars from anyone else because it is the issuer of those dollars.

Now the real problem ….

The purpose of a capitalist system isn’t to make money, it is to produce goods and services. If millions of people are no longer producing goods and services, but are receiving the medium of exchange (money) to allow them to buy goods and services this will eventually reduce the standard of living for everyone since millions are now consumers but not producers.

There was no Federal Reserve in the 1860s.

Yes, you’re right. I meant a US dollar issued in 1860s is still legal tender today. Thank…

Always interesting, Pepe. If China can make the OFAC irrelevant, they will have done the world a great service.