In contrast to the Depression, the Great Recession exacerbated both income and wealth inequality, say Ken-Hou Lin and Megan Neely.

By Ken-Hou Lin,

University of Texas at Austin

and Megan Neely,

Stanford University

As the coronavirus continues to spread around the world, it is abundantly clear that the global economy is entering a recession – the first we’ve seen since 2008.

Some officials have compared the last period of economic decline – also know as the Great Recession – to the Depression, which began in 1929.

Yet it is clear that these two downturns differed not only in severity but also in the consequences they had for inequality in the United States.

Though the Depression was bigger and longer than the Great Recession, the decades following the Great Depression substantially reduced the wealth of the rich and improved the economic security of many workers. In contrast, the Great Recession exacerbated both income and wealth inequality.

Some scholars have attributed this phenomenon to a weakened labor movement, fewer worker protections and a radicalized political right wing.

In our view, this account misses the dominance of Wall Street and the financial sector and overlooks its fundamental role in generating economic disparities.

We are experts in income inequality, and our new book, “Divested: Inequality in the Age of Finance,” argues that inequality from the Recession has a lot to do with how the government designed its response.

(Xinhua News Agency/Getty Images)

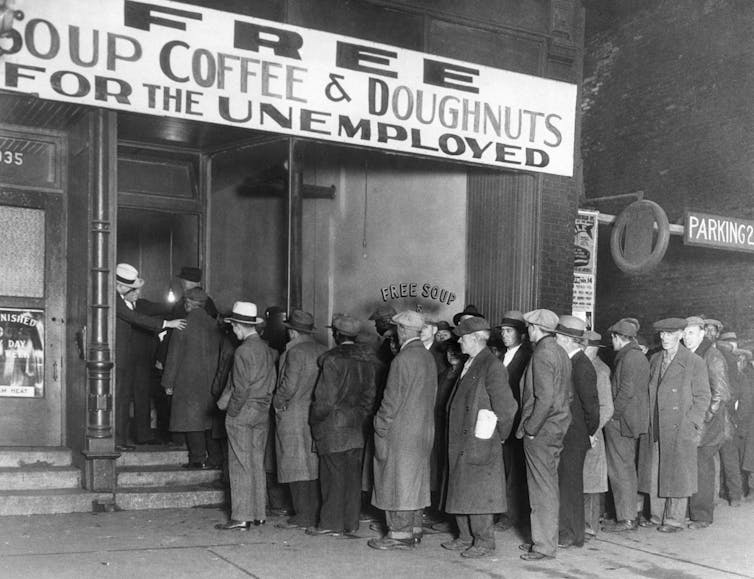

The Depression

Reforms during the Great Depression restructured the financial system by restricting banks from risky investment, Wall Street from gambling with household savings and lenders from charging high or unpredictable interests.

The New Deal, a series of government programs created after the Great Depression, took a bottom-up approach and brought governmental resources directly to unemployed workers.

On the other hand, the regulatory policies since the financial crisis that began in 2008 were largely designed to restore a financial order that, for decades, has been channeling resources from the rest of the economy to the top.

In other words, the recent recovery was largely focused on finance. Governmental stimuli, particularly a mass injection of credit, first went to banks and large corporations, in the hope that the credit eventually would trickle down to families in need.

The conventional wisdom was that banks knew how to put the credit into best use. And so, to stimulate economic growth, the Federal Reserve increased the supply of money to banks by purchasing treasury and mortgage-backed securities.

But the stimulus didn’t work the way the government intended. The banks prioritized their own interests over those of the public. Instead of lending the money out to homebuyers and small businesses at historically low interest rates, they deposited the funds and waited for interest rates to rise.

Similarly, corporations did not use the easy credit to increase wages or create jobs. Rather, they borrowed to buy their own stock and channeled earnings to top executives and shareholders.

As a result, the “banks and corporations first” principle created a highly unequal recovery.

Who Lost in 2009?

The financial crisis wiped out almost three-quarters of financial sector profits, but the sector had fully recovered by mid-2009, as we covered in our book.

Its profits continued to grow in the following years. By 2017, the sector made 80% more than before the financial crisis. Profit growth was much slower in the nonfinancial sector.

Companies outside of the financial sector were more profitable because they had fewer employees and lower wage costs. Payroll expenses dropped 4% during the recession and remained low during the recovery.

The stock market fully recovered from the crisis in 2013, a year when the unemployment rate was as high as 8% and the single-family mortgage delinquency still hovered above 10%.

Median household wealth, in the meantime, had yet to recoup from the nosedive during the Great Recession.

The racial wealth gap only widened, as well. While the median household wealth of all households dropped around 25 percent after the burst of real estate bubble, white households recovered at a much faster pace.

By 2016, black households had about 30 percent less wealth than before the crash, compared to 14 percent for white families.

As the government debates a stimulus package, officials can either decide to continue the “trickle-down” approach to first protect banks, corporations and their investors with monetary stimuli.

Or, they can learn from the New Deal and bring governmental support directly to the most fragile communities and families.

Ken-Hou Lin, associate professor of sociology, University of Texas at Austin and Megan Neely, postdoctoral researcher, Stanford University.

This article is republished from The Conversation under a Creative Commons license. Read the original article.

The views expressed are solely those of the author and may or may not reflect those of Consortium News.

Please Donate to Consortium News.

Before commenting please read Robert Parry’s Comment Policy. Allegations unsupported by facts, gross or misleading factual errors and ad hominem attacks, and abusive or rude language toward other commenters or our writers will not be published. If your comment does not immediately appear, please be patient as it is manually reviewed. For security reasons, please refrain from inserting links in your comments, which should not be longer than 300 words.

The policy response after 2008 was to devalue the currency so that it took more dollars to buy a given asset.

This artificially propped up prices so that banks never had to confront their own insolvency.

Allowing for that devaluation, the events of 2008 met the definition of a depression.

The Fed has been propping up nominal prices, not feeding the creation of capital or value. Likewise corporate executives whose priority is/was stock buybacks. This is why it’s never been possible to turn off the money creation tap. If the authors call this restoring financial order, I’d have to disagree.

If you do it long enough, however, a new generation comes along to whom it’s the new normal. Thus there are now economists and financial professionals who observe the boundaries of discussion laid down by the Fed.

There is a much bigger issue that the authors miss – how a depression can coexist with apparently rising stock prices.

That would be eye-opening research.

“Order” has meant “attitudes and behaviors which promote progress” for a long time in this country. You cannot apply the traditional meanings of words to doublespeak and achieve anything but confusion.

Banks didn’t increase lending because they can’t lend reserves.

Banks create new money with every loan they make, but they can’t make loans if no one wants one, and no one did. The supply of money is endogenous. The fed funds rate is only a minor consideration and the amount of reserves on hand never is. It’s all about the creditworthiness of the borrower and value of collateral. They created the crisis by throwing underwriting standards out the window and actively searching for anyone naive enough to sign on the dotted line even if they had no job. Then the sold all the mortgages to pension funds and german banks, lying about the likelyhood to repay and betting that they wouldn’t. Then they took their winnings and bought Obama before he even won his election and guaranteed get out of jail free cards, and the right to keep foreclosing on as many poor people as they could.

Then they bought up all the property on the cheap and are now in the slum lord business.

The authors obviously place an emphasis on financial regulations as cause of the current financial inequalities in our society, but I would agree more with the idea (briefly mentioned then dismissed by the authors) that there are other more prominent causes and that the current financial inequity is the high-probability result of those factors. I see the primary factor as the return of right-wing/conservative/libertarian policies in this country that started in the mid-1970’s and has continued to this day, engulfing both major parties and too much of the electorate. I’d have been more interested to see this explanatory path explored — why DO too many people keep voting for these conservative politicians?

Simple, the capitalists in Washington did nothing to stimulate the demand side once the Great Recession took hold. The FDR administration’s response to the Great Depression included some ameliorative programs for the beleaguered masses.

Any by the way, FDR could have gone much farther — the general public was supportive — by nationalizing the banking industry, passing single-payer health ins, and making the WPA and CCC much more robust.

Any by the way, FDR could have gone much farther — the general public was supportive — by nationalizing the banking industry, passing single-payer health ins, and making the WPA and CCC much more robust.

Quite false, though it repeats a sadly now-dominant view. What is surprising is how far FDR was able to go; the general public and Congress, especially the Southern Democrats, after the worst had passed were NOT supportive enough.

Since around 1980 and ever more, as the people who had lived through those times and would have written derisive reviews have died off, there’s arisen a legion of bad books – especially from the “Left” painting a ridiculous picture of the times with a reluctant FDR (really a capitalist pawn/oligarch at heart) being led and pressured by the heroic socialists and unions. The facts were that the New Deal & FDR preceded and led the socialist / labor upsurge of the 30s. These movements were moribund when he was inaugurated; didn’t and couldn’t have led anything. Grandma’s and Grandpa’s nostalgic memories are far more accurate and consistent with primary sources than these revisionists, whose nonsense is now the dominant narrative, but is actually gatekeeping against older and more truly left and accurate history.

Post 1933 banking in the USA was not so much different from a fully nationalized system – it was closer to that than the post-Reagan/Clinton etc corrupt banana republic system we have adopted. That’s the only one that FDR could have done. The other things – the New Dealers tried to do them. They lost those fights; the fights and much else have been written out of bad history.

For instance, that and much more is in the National Resources Planning Board [Eveline] Burns Report, sometimes called the American Beveridge report. The congressional response was to complain about how a pair of British Communists were planning to interfere with the sex lives of American youth, and defunded the agency.

Throughout history kings, dictators, banks, big corps and political leaders have made sure that they and their cronies have the biggest share of the pie, by far.

When a leader emerges who actually wants to change this they are eliminated, sooner or later. Bernie comes to mind.

Only a well informed and united citizenry who will rise up and vote for intelligent, well informed leaders, who truly represent the interests of everyone, will this change.

In America, where the haves control the media and the minds of the many, these changes are next to impossible. Expect more of the same!!

Depression vs. Recession

Simple conclusion: the more socialism the worse the results.

2013, the unemployment rate was as high as 8%? That is just silly. 28% was still to low of a statement to make then and now. I know , it’s the old “excepting the people who have given up finding work” routine- excuse for claims like that one.