Rust Belt voters turned to Donald Trump in hopes he could reindustrialize the U.S., but the President-elect’s plans could encounter major financial and geopolitical obstacles, says ex-British diplomat Alastair Crooke.

By Alastair Crooke

We are plainly at a pivotal moment. President-Elect Trump wants to make dramatic changes in his nation’s course. His battle cry of wanting to make “America Great Again” evokes – and almost certainly is intended to evoke – the epic American economic expansions of the Nineteenth and Twentieth centuries.

Trump wants to reverse the off-shoring of American jobs; he wants to revive America’s manufacturing base; he wants to recast the terms of international trade; he wants growth; and he wants jobs in the U.S. – and he wants to turn America’s foreign policy around 180 degrees.

The run-down PIX Theatre sign reads “Vote Trump” on Main Street in Sleepy Eye, Minnesota. July 15, 2016. (Photo by Tony Webster Flickr)

It is an agenda that is, as it were, quite laudable. Many Americans want just this, and the transition in which we are presently in – dictated by the global elusiveness and search for growth (whatever is meant now by this term “growth”), clearly requires a different economic approach from that followed in recent decades.

As Raúl Ilargi Meijer has perceptively posited, greater self-reliance “is the future of the world, ‘post-growth’, and post-globalization. Every country, and every society, needs to focus on self-reliance, not as some idealistic luxury choice, but as a necessity. And that is not as bad or terrible as people would have you believe, and it’s not the end of the world … It is not an idealistic transition towards self-sufficiency, it’s simply and inevitably what’s left, once unfettered growth hits the skids. …

“Our entire world views and ‘philosophies’ are based on ever more and ever bigger and then some, and our entire economies are built upon it. That has already made us ignore the decline of our real markets for many years now. We focus on data about stock markets and the like, and ignore the demise of our respective heartlands, and flyover countries …

“Donald Trump looks very much like the ideal fit for this transition … What matters [here] is that he promises to bring back jobs to America, and that’s what the country needs … Not so they can then export their products, but to consume them at home, and sell them in the domestic market …There’s nothing wrong or negative with an American buying products made in America instead of in China.

“There’s nothing economically – let alone morally – wrong with people producing what they and their families and close neighbours themselves want, and need, without hauling it halfway around the world for a meagre profit. At least not for the man in the street. It’s not a threat to our ‘open societies’, as many claim. That openness does not depend on having things shipped to your stores over 1000s of miles, that you could have made yourselves, at a potentially huge benefit to your local economy. An ‘open society’ is a state of mind, be it collective or personal. It’s not something that’s for sale.”

A Great Wish

That’s Trump’s ostensible great wish, (it seems). It is not an unworthy one, but things have changed: America is no longer what it was in the Nineteenth or Twentieth centuries, neither in terms of untapped natural resources, nor societally. And nor is the rest of the world the same either.

Mr. Trump rather unfortunately may find that his chief task will not be the management of this Great Re-orientation, but more prosaically, fending off the headwinds which he will face as he hauls on the tiller of the economy.

In short, there is a real prospect that his ambitious economic “remake” may well be prematurely punctured by financial crisis.

These headwinds will not be of his making, and for the main part, they lie beyond human agency per se. They are structural, and they are multiple. They represent the accumulation of an earlier monetary doctrine which will fetter the President-elect into a small corner from which any chosen exit will carry adverse implications.

Ditto for anyone else trying to steer any ship of state in this contemporary global economy. Paradoxically – in an era moving toward greater self-sufficiency – what success Trump may have, however, will likely depend not on self-reliance so much as he would like.

For his foreign policy about turn, he will depend on finding common interest with Russian President Vladimir Putin (that should not be too hard) – and for the economic “about turn” – on Trump’s ability not to confront China, but to come to some modus vivendi with President Xi (less easy).

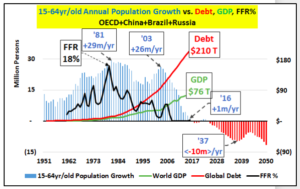

“Things are not what they were.” Complexity “theory” tells us that trying to repeat what worked earlier – in very different conditions – will likely not work if repeated later. In the Clinton era, for example, 85 percent of the U.S. population growth derived from the working-age population. The headwind that Trump will face is that, over the next eight years, 80 percent of the population growth will comprise 65+ year olds. And 65+ year olds are not a good engine of economic growth. This is not an uniquely American problem; it is a global trend too.

“The peak growth” (according to Econimica blog), “in the annual combined working age population (15-64 year/olds) among all the 35 wealthy OECD nations, China, Brazil, and Russia has collapsed since its 1981 peak. The annual growth in the working age population among these nations has fallen from +29 million a year to just +1 million in 2016 … but from here on, the working age population will be declining every year … These nations make up almost three quarters of all global demand for oil and exports in general. But their combined working age populations will shrink every year, from here on (surely for decades and perhaps far longer). Global demand for nearly everything is set to suffer.”

(FFR stands for Federal Funds Rate: i.e. the US key interest rate) Source: http://econimica.blogspot.it/2016/11/trump-lies-no-different-than-obama-or.html

And then there is China: It too is passing through a difficult “transition” from the old economy to an “innovative” one. It too, has an aging population and a debt problem (with a debt-to-gross domestic ratio reaching 247 percent). Trump argues that China deliberately holds down the value of its currency to gain unfair trade advantage, and he further suggests that he intends to confront the Chinese government on this key issue.

Again, Trump does have a point (many nations are managing their exchange rates precisely in order to try to “steal” a little bit extra growth from the diminished global pot). But as noted at Zerohedge, citing the analysis of One River Asset Management executive Eric Peters:

“What’s good for the US in this case [the rising dollar and interest rates in anticipation of ‘Trumponomics’], is not good for emerging markets (EMs). Emerging markets benefit from a weaker dollar, and you’re not going to get that. Emerging markets benefit from global capital flows moving in their direction and that’s not happening either. Back in February, emerging markets were in sharp decline, driven by (1) a strong dollar, (2) rising US interest rates, and (3) slowing Chinese growth. Then China spurred a massive credit stimulus, the Fed became wildly dovish, and the dollar declined sharply.

“Interest rates collapsed throughout the year. As the growing pool of dollar, euro and yen liquidity searched for a decent return, it headed to emerging markets. Trump has reignited the dollar rally, and his fiscal stimulus will force interest rates higher. This reversed everything. [the dollars are heading home]

“And to be sure, the Beijing boys don’t want to see material weakness ahead of next autumn’s Party Congress. But we’re currently near peak impulse from China’s Q1 stimulus.”

In short, Peters is saying that, with the appreciating dollar and rising interest rate environment, growth from emerging markets as a whole will falter, since emerging markets have effectively leveraged their economies to Chinese growth. It used to be the case that they were closely tied to U.S. growth, but it is now China which dominates the EMs’ trade flows [i.e. without China growth, the EMs languish]. The question is, can America reboot its growth whilst China and the EMs languish? It is another structural shift, whereas heretofore, it was vice versa: without U.S. growth, the EMs and China languished. Now it is the converse.

Hollowed-Out Economies

There are other structural changes of course which will make it harder for the industrially hollowed-out economies of the West to recuperate jobs off-shored earlier. Firstly, there has been a systemic shift of innovation and technology eastwards (often to a more skilled and better-educated workforce). This represents not only an economic event, but a redistribution of power too. In any case, technology in this new era is being more job destructive than creative.

In one sense, Trump’s economic plan to “get America working again” through massive debt-financed, infrastructure projects, harks back to the Reagan era, which was also a period in which the dollar was strong. But yet again, “things today are not what they were then.” Inflation then was at 13 percent, Interest rates were around 20 percent, and crucially, the U.S. debt to GDP ratio was a mere 35 percent (compared to today’s estimate of 71.8 percent or 104.5 percent with external debt included).

Then, as Jack Rickards has suggested, the strong dollar was deflationary (deliberately so), and interest rates had nowhere to go, but down. It was the beginning of the three decades’ bond boom, which finally seems to have come to an end, coincident with Trump’s election. Today, inflation has nowhere to go but up – as have interest rates – and the bond market, nowhere to go, but (perilously) down.

Growth and Jobs?

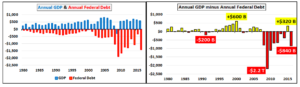

Can Trump then achieve growth and jobs through infrastructure expenditure? Well, “growth” is an ambiguous, shape-shifting term. The first chart shows both sides of the equation … the annual GDP growth and the annual federal debt incurred, spent, and (thus counted as part of the growth) to achieve the purported growth.

The second chart shows the annual GDP minus the annual growth in federal debt to achieve that “GDP growth.” In other words, unlike in the earlier Reagan times, more recently, the debt is producing no growth – but … well … just more debt, mostly.

In fact, what the second chart is reflecting is the dilution – through money “printing” – of purchasing power: away from one entity (the American consumer), through the intermediation of the financial sector, to other entities (mostly financial entities, and to corporations buying back their own shares). This is debt deflation: the American consumer ends having less and less purchasing power (in the sense of residual discretionary income).

The point here is that “growth” is becoming rarer everywhere. Russia and China, like everyone else, are in search for new sources for growth.

As Rickards has said, debt is the “devil” that can undo Trump’s whole schema: a “$1 trillion infrastructure refurbishment plan, along with his proposal to rebuild the military, will — at least in the short-term — significantly increase annual deficits. In fact, deficits are already soaring; the fiscal 2016 budget hole jumped to $587 billion, up from $438 in the prior year, for a huge 34% increase…in addition to this, Trump’s protectionist trade policies would implement either a 35% tariff on certain imports or would require these goods to be produced inside the United States, at much higher prices. For example, the increase in labor costs from goods made in China would be 190% when compared to the federally mandated minimum wage earner in the United States. Hence, inflation is on the way.”

In sum, self-sufficiency implies higher domestic costs and price rises for consumers.

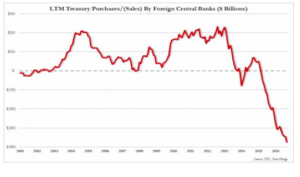

Source: http://www.zerohedge.com/news/2016-11-16/saudis-china-dump-treasuries-foreign-central-banks-liquidate-record-375-billion-us-p

Debt will rise. And there is seemingly already a buyers’ strike against U.S. government debt underway: well over a third of a $1 trillion worth of Treasuries were disposed of, and sold in the year to Aug. 31 by foreign Central Banks.

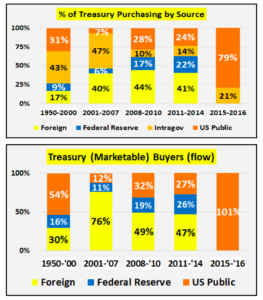

And who is buying it? (Below, the chart shows what this purchasing looks like, as a percentage of total debt issued by the Treasury). Well, foreign central banks have disappeared. (The Chinese have not bought a U.S. Treasury bond since 2011.)

(Above: who purchased the marketable debt as a percentage, by period)

Source: http://econimica.blogspot.it/2016/11/trump-lies-no-different-than-obama-or.html

It is the American public who are buying. Will they be willing to take on Trump’s $1 trillion infrastructure spree? Or, will it be “printed” in yet another dilution of the American consumer’s purchasing power? The question of whether the infrastructure splurge does give growth hangs very much in the balance to such answers. (Equity shares in construction firms will do okay, of course).

The bottom line: (Michael Pento, Pento Report): “If interest rates continue to rise it won’t just be bond prices that will collapse. It will be every asset that has been priced off that so called ‘risk free rate of return’ offered by sovereign debt. The painful lesson will then be learned that having a virtual zero interest rate policy for the past 90 months wasn’t at all risk free. All of the asset prices negative interest rates have so massively distorted including; corporate debt, municipal bonds, REITs, CLOs, equities, commodities, luxury cars, art, all fixed income assets and their proxies, and everything in between, will fall concurrently along with the global economy.

“For the record, a normalization of bond yields would be very healthy for the economy in the long-run, as it is necessary to reconcile the massive economic imbalances now in existence. However, President Trump will want no part of the depression that would run concurrently with collapsing real estate, equity and bond prices.”

A Pending Financial Crisis

Trump, to be fair, has said consistently throughout the election campaign that whoever won the Presidential campaign to take office in January would face a financial crisis. Perhaps he will not face the “violent unwind” of the QE and bond bubble as some experts have predicted, but many more – according to Bank of America’s survey of 177 fund managers over the last six days, and controlling just under half a trillion of assets – expect a “stagflationary bond crash.”

This has major political implications. Trump is setting out to do no less than transform the economy and foreign policy of the U.S. He is doing this against a backdrop of many of the followers of the liberal élite, so angered at the election outcome, that they reject completely his electoral legitimacy (and, with the élites themselves staying mum at this rejection of the U.S. democratic process). Movements are being organized to wreck his Presidency (see here for example). If Trump does indeed experience a severe financial “unwind” at a time of such domestic anger and agitation, matters could turn quite ugly.

Alastair Crooke is a former British diplomat who was a senior figure in British intelligence and in European Union diplomacy. He is the founder and director of the Conflicts Forum, which advocates for engagement between political Islam and the West.

“Deflation in the casino: central banks play their last chips to no avail”

By David L Goldman

March 2016

rev’d 10-31-16

This is not your grandfather´s capitalism

A global $US short squeeze

Negative Interest Rate Policy (NIRP): a perverse incentive to hold non-productive yield free cash

Central banks approach end-game while fighting the last monetary war

Deflation today is a consequence of debt piled on more debt accompanied by failure to generate sufficient wealth, growth and employment resulting in an inability to service the debt. The dollar has risen against other currencies, not because it is strong, but because the lack of global economic growth has exposed the weakness of a petrodollar money-as-debt monetary system. The gaming of the monetary system by all the controlling players is the essence of 21st century capitalism. The failure of this capitalism will mark the end of the American century.

http://breskin.com/Inquiramus/2016/06/15/deflation-in-the-casino-central-banks-play-their-last-chips-to-no-avail/

Thomas Daniel Kuhn

The CCP will handle the Chinese economy just fine without Krugman´s advice. Krugman was right on one issue and that was the housing crisis in the USA that led to the financial meltdown in 2008. I read his columns religiously from 2000 right until the crash. I even have his book of columns covering that period. Since then he has not been right on a single thing. One major thing he was wrong about was his absolute certainty that Hillary Clinton would win the election. Another thing he is dead wrong about is that he does not understand that China does not have a dysfunctioning government like the US has. The Chinese government works in unity for the betterment of China. The US government is dedicated to the enrichment of a few families, the 1/10 th of 1%, nothing more. The only thing the government of the USA can agree on is that the wealth of the nation should reside in the offshore bank accounts, safe from the taxman, of that select few families and oligarchs. Oh and throwing shiploads of money into the MIC in the hopes of retaining world military domination.

If Krugman wants to fix an economy why not look closer to home and work on the American economy. The American economy has been a basket case since the early ninteen nineties. First Dr. Krugman , in other words heal thyself before looking so far afield, and predicting the collapse of the Chinese economy which is going gangbusters as compared to the extremely feeble American economy. One small note. The Chinese system of government and the state run economy has raise some 500 millions of Chinese out of poverty and into the middle class. Compare that to the USA Turbo Capitalist economy that has killed the middle class and forced a couple of hundred million people into poverty. ( The main reason for Trumps election to the Presidency) I have heard predictions of the Chinese economic collapse for the last twenty years. Instead of that we see a dynamic country, building infrastructure that the USA can´t even dream of. A country who´s military is gaining on that of the USA at a gallop. A country whos citizens are better off now than at any time in their history. Compare that to the USA which is stumbling around like a bird with a broken wing.

Bill Bodden “Has Trump ever defined when “again” was? The Gilded Age?”

Bill, here’s an excerpt of an excellent, must read think piece that directly answers your question; please open the link to read the full essay. — This is a ‘Must Read’.

::

Conservative Southern Values Revived: How a Brutal Strain of American Aristocrats Have Come to Rule America

America didn’t used to be run like an old Southern slave plantation, but we’re headed that way now. How did that happen?

By Sara Robinson / AlterNet June 28, 2012

790 COMMENTS

It’s been said that the rich are different than you and me. What most Americans don’t know is that they’re also quite different from each other, and that which faction is currently running the show ultimately makes a vast difference in the kind of country we are.

Right now, a lot of our problems stem directly from the fact that the wrong sort has finally gotten the upper hand; a particularly brutal and anti-democratic strain of American aristocrat that the other elites have mostly managed to keep away from the levers of power since the Revolution. Worse: this bunch has set a very ugly tone that’s corrupted how people with power and money behave in every corner of our culture. Here’s what happened, and how it happened, and what it means for America now.

North versus South: Two Definitions of Liberty

Michael Lind first called out the existence of this conflict in his 2006 book, Made In Texas: George W. Bush and the Southern Takeover of American Politics. He argued that much of American history has been characterized by a struggle between two historical factions among the American elite — and that the election of George W. Bush was a definitive sign that the wrong side was winning.

http://www.alternet.org/story/156071/conservative_southern_values_revived%3A_how_a_brutal_strain_of_american_aristocrats_have_come_to_rule_america

I was with him until I read this “…as he hauls on the tiller of the economy”, which as near as I can tell is not in fact a sailing term. You can haul on your tiller with a tractor in a field, but you don’t haul on a tiller in a boat.

John Gardner – “A tiller or till is a lever attached to a rudder post (American terminology) or rudder stock (English terminology) of a boat that provides leverage in the form of torque for the helmsman to turn the rudder.”

Crooke probably owns a few boats.

Backwardsevolution, your posts today are better than those of Alastair Crookes, the former British diplomat.

Are you sure you are not auditioning for his job? Great posts man!

I agree with you. Lets give Trump a chance.

Herman and Dennis – thank you for your kind comments.

To Backwardsevolution: thanks for cogent comments. I really am impressed by the comments on Consortium articles. I learn a lot and am sure others do, too. Windbaggery kept to a minimum which is appreciated.

Get rid of the FED and issue your own money. That is the first thing for Mr. Trump to do.

Thanks for this excellent article Mr. Crooke.

I was confused by the charts, namely:

1. Has the Federal Reserve in 2015-2016 already started the process of allowing Treasuries on their balance sheet to run off? I had thought the Fed was replacing maturing Treasury debt on their balance sheet by “buying” new bonds.

Intuitively, I had made up my mind (until someone corrects me) that the Fed should have started the process of allowing Treasuries on their books to run off without replacing them in order to avoid an (uncontrollable) spike up in interest rates in the coming years.

On a related note:

2. Does “intragov” mean municipalities or does it include Fed buying of Treasuries which would perhaps answer the first question.

Alistair Crooke’s article covers a lot of ground and paints a comprehensive, although bleak, picture.

The transformation of a “production/consumption” economy (with Wall Street skimming maybe up to 30% of the profits) by accelerating automation (enhanced through AI) is surely worrisome. A possible solution that’ currently “in the air” is a sharing system (from the economic output of robots?) so that there is a minimum, livable stipend for all.

Of course that would require an end to Cold War thinking – which the powers that be would, I think, prefer to go to war rather than think of such a thing.

The only reason I’ve concluded that we need to maintain an Adam Smith form of capitalism – WHICH WE DO NOT HAVE!; WE HAVE AN UNFAIR, SECRETIVE, PREDATORY CAPITALIST PERVERSION, IMO! (sorry for all the capital letters but I am pretty pissed at all the lies used to frame policy positions these days)

The only reason is that, as we have learned from David Halberstam’s “The Best and the Brightest” – no one individual or group, when given endless power is smart enough or honest enough or thoughtful enough to design a controlled economy. We need transparency and fairness and regulations to keep greed wagons from perverting the economy, but we also need the “Father of Capitalism” – Adam Smith’s -“invisible hand”.

If Adam smith could come back and see what was being done in his name (to quote Woody Allen’s Frederick in “Hannah and Her Sisters) – he’d never stop throwing up.

Will try again. Refreshing to see an article not addressed to social issues which seldom can be resolved in the political arena. Among the many provocative and perceptive points in Ambassador Crooke’s article is the matter of two extant forces; the declining growth of working age people and the great potential for productivity growth even beyond what exists today. What is suggested is new ways to assure a reasonable standard of living for those moving out of the work force because of age or displacement. What we see is that a diminishing workforce can still produce enough to maintain a decent standard of living for everyone. What is required is rethinking how we distribute the benefits of production and move our thinking away from providing the benefits of production only to those we deem to have “earned” it. We have done that to some extent through social insurance where the workers now pay most of the retirement benefits for the aged. We need to go further and create systems where new ways of producing are not feared but welcomed.

Good article. Raúl Ilargi Meijer also said, prior to the election:

“I like Wikipedia’s definition of a Pyrrhic victory, couldn’t hardly have put it better myself: “A Pyrrhic victory is a victory that inflicts such a devastating toll on the victor that it is tantamount to defeat. Someone who wins a Pyrrhic victory has been victorious in some way. However, the heavy toll negates any sense of achievement or profit.”

That sounds about right. I just have the idea that Hillary would enjoy it a bit more, and more blindly, than the Donald would. But it wouldn’t make much difference regardless. Obama’s had the luck that he’s been able to hide the economic downfall on his watch behind a $10+ trillion increase in the Fed balance sheet and a multiple trillion, 50% increase in household debt.

The next president won’t have any such gift thrown into their laps. The new president will have to empty the poisoned chalice.

Imagine being -almost- 70 years old, well-off, and still wanting that job. What’s that make a body? In urgent need of a lifetime of therapy? Mariana Trench-deep unhappy?”

Cut Trump some slack, people, and go and read the above sentence re Obama again: “$10+ trillion increase in the Fed balance sheet and a multiple trillion, 50% increase in household debt.” Obama was a corporation/banker’s delight. Corporations bought back their stocks and rolled over their debt into lower and lower interest rates (courtesy of the Fed), bankers were bailed out, assets held on their books at 100% (courtesy of FASB) when they were worth a lot less. If not for this gift, they were all insolvent. Yes, bankrupt. Bankers were not jailed when they should have been (courtesy of Eric Holder, Attorney-General appointed by Obama).

Student loans were given a government backstop. That way banks didn’t have to worry about what a student was taking or how likely it was they would even finish the first year. They just handed out the loans to anyone who breathed, knowing they weren’t going to be taking the losses. As more students were able to get loans (people who would not have been given loans previously), supply and demand dictated that education costs would rise, and they did, crushingly so. This additional government debt diluted dollars already in existence, and the $20.00 you might have saved is now worth $10.00. And now the students don’t want to pay back the debt: “Oh, Bernie is good because he wants to erase my student debt.” Children. “Why should I be responsible? Where’s my safe space?”

After the 2008 crash, bankers sold off large chunks of houses to private equity firms, who got loans for rates we could only dream of. These guys then rented the houses back to the people who just declared bankruptcy (or handed their keys back), and now house and rent prices have increased. Again, winners and losers. When the government (the taxpayers) bailed out the banks, the banks turned around and screwed the taxpayers with higher house/rent prices. See how it works? They profit, you pay. Whenever the government gets involved in picking winners (bankers) and losers (taxpayers), we end up paying through the nose.

Whenever government gets involved in anything, tries to prop things up, there are always winners (“Gee, I just bought a house for no money down, no documentation required, cash back.” It was like it was magic. “Wow, I guess I must have been lucky or something.” In order to prop up a certain segment, the government creates losers elsewhere: pensions, savers, insurance companies get creamed. Nobody sees this.

Nobody sees that this constant “money printing” causes prices to rise, but still they continue calling for more. And all on a finite planet. Globalization is naturally going to come to an end because we’ve got about ten years before getting the oil and gas out of the ground costs more than what people can pay for it. At that point we’ll all be walking.

Corporations offshored the jobs in order to pocket more of the profit. Fine. But then they implored you to buy these products from them, even though they offshored your job. Well, how are you supposed to pay for these products when you don’t have any disposable income left? China has been artificially creating bubble after bubble (that’s all they have left). It’s either that, or every single one of the Chinese elite will be swinging from lamp posts. They know this. The Chinese elite are escaping, putting their corrupt money offshore (and their families) because they know this is coming. It’s just a matter of time. They have polluted almost every square inch of China and stolen the people’s money, then they’ve fled. It is criminal what the Chinese elite have done to their people. But “greed is good”, they say.

The U.S. made China anyway. If not for the U.S. going in there, setting up businesses, providing the Chinese with technology that would have taken them decades to discover themselves, the Chinese would still be back in the stone age. The Chinese elite allowed the Americans in, the Americans used the cheap labor/no environmental controls. Each got rich; each left their citizens with the bill. It was a symbiotic relationship made in Heaven.

Of course goods should be manufactured close to home. It’s ridiculous that the average piece of fruit travels 1,500 miles to its destination. The last 30 to 40 years have absolutely wasted the remaining oil and gas reserves, and to what end? So some fat, rich boy could get richer.

They have left Trump with a terrible mess. I wouldn’t be at all surprised if they let him have it, knowing it was going to go down. They loaded up the country with debt, corporations M&A’d to their heart’s content (less competition for them). Now that the elite are stuffed with money (I believe they propped the whole edifice up and purposely set out to enrich the already wealthy), they can let it go. “Here, Trump, you take it now. We’ve got all of our money where we want it, and we’ve made a killing these past eight years. Obama bailed us out so we didn’t go bankrupt. Better the taxpayers than us. You take it now.”

And the progressives keep crying about “racism, racism” every time Trump mentions illegal immigration. People, there are no jobs. Most of the degrees are worthless. People are working two and three jobs, with no benefits, and can’t put any money aside. There’s is an over-supply of labor; wages can’t increase. I mean, why don’t you just invite in the whole of Latin America. How about you throw in Africa, Asia and the Middle East too.

Growth is dead. In fact, there never really was growth for the 99%. The last forty years has been debt, debt and more debt in order to keep up, and wages have actually declined, after inflation is factored in. The only people who saw growth were the offshorers, the rentiers. Ever since Greenspan came in, it’s been lower and lower rates just to keep the bubbles inflated.

Aren’t there some 50 million people on food stamps? And how many are unemployed? It is absolutely ridiculous to manufacture goods halfway around the world. We are facing resource constraints, a huge world over-population, and we’re living on a finite planet. Yeah, like we need more growth!

Help Trump. He is at least trying, unlike Obama who just sat back and put the country in more and more debt.

You must understand that any hope is tempered by natural skepticism. You paint an accurate picture of the “Managerial Elite” and their globaloney “smash & grab & run” operation upon the world’s 99%ers. What if Trump says “eff it. I’ll take mine and run too” like his fellow members of the Managerial Elite? THAT’s the fear. Turning to Tulsi is a good sign though. He can cure this 2nd Great Depression by simply turning to Webster G. Tarpley, and his “Emergency Program Stop the Depression” right up there at the top of his website, inside a red rectangle. Been there for 7 years. Still pertinent. Still the very medicine that’s needed. In fact, Trump should make Webster the Fed Chairman. If Trump did this, he would become one of the Presidential greats, like Lincoln and FDR. We’ll see how it unfolds (he won’t get anywhere relying on R-Party apparatchiks…or D-Party hacks either, for that matter).

His battle cry of wanting to make “America Great Again”,,,

Has Trump ever defined when “again” was? The Gilded Age? Promulgation of the Monroe Doctrine? Expansion of the nascent empire at the expense of the indigenous peoples? Making Central America safe for Wall Street? The Reagan era that replaced the national credo of “All men have a right to life, liberty, and the pursuit of happiness” with “greed is good”?

Bill – good question, but I’ll take a stab. I believe Trump is referring to the period where people actually had good-paying jobs, where they were manufacturing products themselves and then turning around and buying them. When workers had some rights and a say. When central banks were not in control. When families could get by on one person working and still have a happy life. When the average worker wasn’t swimming against the tide and was able to hold his head above water, instead of the treadmill that he’s on now with trying to keep up with artificially-created inflation. Where prices did not go up every time you turned around. Where having a baby didn’t cost you an arm and a leg. Where contracts were honored. Where excess labor wasn’t allowed in in order to keep wages down. When corporations didn’t rule the government, when Glass-Steagall was still in force, when the government was held to the gold standard so they couldn’t keep incurring more and more debt. Before the age of derivatives, excessive leverage; you know, when banks were private corporations and their losses were their losses, not passed off to the taxpayers. I’ll stop now.

I kind of think he means that.

backwards: I hope you are right, but we will need to wait and see.

C.H. Douglas’s ideas on “Social Credit” offer the solution for the problems addressed by this article. They are mirrored by Richard C. Cook’s ideas on “Credit as a Public Utility” (American author found on Global Research’s author index). It will solve the “problem” of fewer workers, pounds of material, ergs of energy needed to produce a given amount of “Products”. The work force will mirror the progress made in the military forces, wherein, in ancient times, every male of the tribe had to carry a spear and shield for “national security”. In modern times a very small percentage of people are needed for National security. In future, the vast majority will be sustained by having a share in the productive economy that may only need 10% of the available population in a Nation. The return of “gentlemen gardener/farmers” and “hobbyists” will be seen, with hobbyists perhaps producing useful “prototypes”, from time-to-time, for automated mass production.

END OF GROWTH BY ALASTAIR CROOKE

This is an excellent c ontribution but is enmeshed in circumstances

revolving around the current election. Its perceptions are very

much to the point.

My perspective is that they cannot be truly comprehended without

having first read ” ‘THE END OF GROWTH’ SPARKS WIDE

DISCONTENT”, an required essay also by someone named

Alastair Crooke.(perhapsw a relation?) It was dated October 14,

2016 and was published in Consortiumnews. It was written

prior to the recent US election but its analysis holds.

Incidentally, the truths of this article are equally applicable

to the programs of both major political parties. Neither

one has been able to produce “growth” and neither

stands a chance. For years these bandaids have

failed and failed again.

For am excellent analysis of layoffs, THE DISPOSEABLE

AMERICAN” by Ichiotelle is a must. I do not recall his

first name but there aren’t many titles beginning

with “U”.

For a historical review, a serious review of Gabriel

Kolko’s landmark book MAIN CURRENTS IN MODERN

AMERICAN HISTORY provides bases for analysis that

Americans hate to confront. Such views tarnish

their illusions and myths. Among other things, Kolko

documents that the Great Dpression was not solves

by the “New Deal” but by World War II. She shows

this with details of unemployment figures etc. prior

to the war and after the US Federal Budget of

1941.

Thanks for your article.

—Peter Loeb, Boston, MA, US