Pervasive right-wing propaganda relying on false allusions to the Founding myth and bigoted illusions about non-white minorities has sucked millions of Americans into an unrealistic ideology centered on hatred of government. Lawrence Davidson encountered that reality on a vacation cruise.

By Lawrence Davidson

My wife and I have family in Barcelona, Spain, including a seven-month-old grandson. We also have a family member who is a successful artist and has a piece in this year’s famous Venice biennial art show. Thus it was that my wife and I went from Barcelona to Venice at the end of May.

We decided to travel from one city to the other by sea and so ended up on the Regent Line’s Seven Seas Mariner, a relatively small ship with only 700 passengers. This turned out to be a very odd cruise, and that is the subject of this essay.

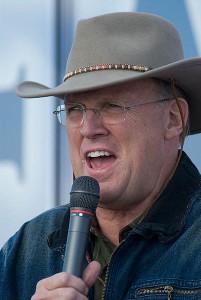

For, as it turned out, some 270 of the passengers on board were fans of the libertarian right-wing talk show host and Fox TV commentator Neal Boortz. This was Boortz’s retirement celebration cruise, and his most devoted fans were on the Seven Seas Mariner, at their own expense, to help him celebrate.

Until his recent retirement, Neal Boortz (aka The Mouth of the South, aka The Equal Opportunity Offender, aka Mighty Whitey) was the seventh most popular talk show host in the United States. His show was nationally syndicated and averaged 4.25 million listeners per week.

The positions he has taken to achieve this status are remarkably diverse and often contradictory. For instance, Boortz has a rather progressive stance on some social issues (angering most conservatives), such as abortion rights, same-sex marriage, ending the “war on drugs,” and supporting various other civil liberties. Yet at the same time he is adamant about reducing the federal government’s tax and regulatory powers (pleasing most conservatives).

When it comes to taxes, Boortz advocates doing away with income tax, payroll taxes, estate taxes and the like and replacing them with a national retail sales tax. He has written a book on the subject, co-authored with Georgia Congressman John Linder, entitled The Fair Tax Book.

Leaving aside his tax-reform idea for the moment, Boortz’s view of the regulatory powers of the federal government is dangerously naive. He seems unaware that in the United States the ability to create and protect the civil liberties he supports comes from the legislative action of a strong federal government that then oversees the implementation of those laws against historically prejudiced, racist state and local governments.

The same dangerous naivete is revealed in Boortz’s promotion of “small government” and “deregulation” of the economy so as to promote “personal responsibility.” These are typical Tea Party positions and they too betray historical ignorance.

It has become clear to the less ideologically driven economic historians that, ever since the end of World War II, the only thing that has prevented another Great Depression (and, in essence, smoothed out potential depressions into periodic economic recessions) is, once again, effective and consistent government regulation.

As the savings and loan fiasco of the 1980s and 1990s and other more recent bank crises have shown, if you start deregulating strategic parts of the economy (as happened under Ronald Reagan), the capitalists will immediately revert to acts of maximum (and self-destructive) greed.

When it comes to foreign policy, Boortz favors an aggressive, interventionist approach to “fight terrorism” and “spread freedom.” After the 9/11 attacks, Boortz repeatedly complained about the “lack of Muslim outrage” over the event. In this Boortz shares an almost universal American provincialism. He fails to realize the causal connection between traditional American foreign policy in the Middle East (and elsewhere) and the terrorist attacks the U.S. has suffered.

He is also ignorant of the fact that after the 9/11 attacks Muslims worldwide condemned terrorism and expressed sympathy for the American victims. At the local level this sympathy was expressed by thousands of mosque-based sermons declaring that the al-Qaida attacks were “un-Islamic.”

Of course, many of these expressions of outrage and sympathy were made in Arabic and, what is more important, went untranslated and unreported in the American media. Even those issued in the English language were often unreported. This explains Boortz’s ignorance, but it does not excuse it. As such a well-known critic, he should have taken the time to fact-check the issue before repeatedly focusing the attention of 4.25 million listeners upon it.

Fans of Neal Boortz

If the 270 fans of Neal Boortz traveling on Regent’s Seven Seas Mariner can be taken as a reliable sample of his listening public, we may draw the following general conclusions:

— They are mostly from the American South.

— They are generally a polite group in one-to-one situations.

— Of all the positions taken by Boortz, the one they are primarily interested in is his tax-reform scheme. I must confess that I have no idea if his tax plan would be better or “fairer” than the present arrangement. However, it should be noted that the U.S. income tax was “allowed” by the Sixteenth Amendment to the Constitution, and so to replace it with Boortz’s “Fair Tax” might necessitate a rewording of this amendment. This could be a complicated task.

The fact that almost everyone I encountered in the Boortz group fixated on the issue of taxes tells us something important about conservative Americans: they are generally suspicious of demands that they financially contribute to the upkeep of their own communities (particularly in the area of social programs).

This might sound odd, but it is an attitude rooted in history. The U.S. revolution was not made over issues of oppression and deprivation. It was made over the issue of the British Parliament’s right to impose relatively moderate taxes on their American colonial subjects. Ever since that time there has been a conservative portion of the U.S. public which sees any taxes beyond those needed for very basic services as illegitimate.

Indeed, they see such taxes as a form of theft. Just ask John Boehner, the Republican Majority Leader of the U.S. House of Representatives. Refusing to negotiate a reasonable budget with President Barack Obama, Mr. Boehner said that the real issue is “how much more money do we want to steal from the American people to fund more government.”

In terms of economic history, this makes Boehner and his cohort throwbacks to the dark ages of 18th-century economic theory, when it was believed that the only legitimate things for which central government could tax was national defense, the court system and the police. All other social issues were the responsibility of the individual who was “free” to become rich or to starve to death without government interference.

To say that such a point of view, applied today to a society of 300 million-plus citizens, is disastrous is an understatement. Take away the “safety net” created by the New Deal and expanded by the “welfare state,” and replace it with freewheeling, deregulated capitalism and “personal responsibility” alone, and what you have is a formula for widespread suffering and civic unrest.

Yet none of the conservatives I met on board the Seven Seas Mariner had any knowledge of economic history or theory. All they had were their personal experiences and the feelings those had produced: that the federal government was too big, too intrusive in their businesses, and that it pampered too many people, all with their tax dollars.

This is one of the consequences of what I call “natural localism.” We live our lives locally. This local existence conditions us to see the world in certain limited ways. And then, on the basis of that local conditioning, we interpret the rest of the world. However, our local experience is often a very poor basis for understanding the larger problems that confront our communities.

Neal Boortz is fond of disclaimers. Some of them are potentially useful, as when he tells his listeners “Don’t believe anything you . . . hear on The Neal Boortz Show unless it is consistent with what you already know to be true, or unless you have taken the time to research the matter to prove its accuracy to your own satisfaction.”

The problem is, as with so much of the information media, the audience is self-selected. The reason millions listened to Mr. Boortz in the first place was because what he said was already “consistent” with what they “know” to be true. But was/is it true? Believing something is true does not make it true. As to the suggestion that the listener do research, well, not many will bother if the opinion at issue sounds and feels right.

Boortz also occasionally suggests to his audience that they “take no heed nor place any credence in anything he says” because, in the last analysis, he is just an “entertainer.” However, he cannot escape responsibility so easily for the influence he has wielded weekly over an audience of more than four million.

Ours is an age of “infotainment,” and the more entertaining media personalities, politicians and even government officials are, the more their “info” is received favorably. Just think of Jon Stewart’s The Daily Show on the liberal side of the spectrum.

Conservative America is out there in many forms. Some are organized around religion, some around various forms of xenophobia, and some around the fear of government, its taxes and regulations. They are mostly white, mostly middle class, and don’t be at all surprised if you run into them on your next vacation.

Lawrence Davidson is a history professor at West Chester University in Pennsylvania. He is the author of Foreign Policy Inc.: Privatizing America’s National Interest; America’s Palestine: Popular and Official Perceptions from Balfour to Israeli Statehood; and Islamic Fundamentalism.

One of the things I have learned living in Texas for the past 14 years is that Texans are very charitable. That is they will give and give for tragedies like in West, TX. or for someone with serious disease or injuries. But ask them to spend that same money in taxes for medical care for all or anything public and they seriously balk. I am thinking this may be broadly true throughout the South.

The see the progressive sliding income tax as making them unfair and a percentage based national sales tax as fair. I have tried to explain this to many since we have a statewide 8.25% sales tax (which they hate) and they still don’t seem to understand how only the rich will benefit.

Sam, do yourself a favor and go to a more objective site for info about the FairTax. It’s a scam that only benefits the rich.

Why don’t you go ahead and suggest one?

You could read the liberal Wall Street Journal take, http://online.wsj.com/article/SB10001424052702304510704575562230737760778.html

or the radical pinkos at Forbes, http://www.forbes.com/sites/timworstall/2012/08/22/why-the-fair-tax-will-fail/

you could get really creative and go to this unknown source, http://en.wikipedia.org/wiki/Revenue_neutrality_of_the_FairTax

or try http://www.factcheck.org/taxes/unspinning_the_fairtax.html

Sales taxes create a disincentive to spend, which is bad for business. They are relatively easy to game – there is no double reporting as there is with income, so much more intrusive government enforcement is necessary. Of course, there’s the fact that for those of middle income and below, almost all your income will be subject to the tax. The very rich will be the big winners…which means even more of the tax burden will shift to the middle class.

If you want a simple, fair, low-bureaucracy tax endorsed by conservative economist Milton Friedman, the only tax that does not create “deadweight loss” in the economy as income and sales taxes do, promote Henry George’s Single Tax. http://en.wikipedia.org/wiki/Land_value_tax

I am pretty sure it was Neal Boortz who, some years ago, opined to his radio audience that every Southern boy–presumably himself included–always ever after cherished a soft-spot in their hearts for their first “stump-broke” heifer…

Professor Davidson. I am not a Neal Boortz fan. That being said when it comes to tax reform he literally wrote the book on it. I urge you to become educated on the FairTax. http://www.fairtax.org. It’s an idea whose time has come.

Sam Kemp