Looking beyond classical economic models, Vince Taylor sees vast, private fortunes that belong mostly to society at large.

By Vince Taylor

Znet

Hundreds of commentators have warned that extreme concentration of wealth threatens democracy and social stability. Not a day goes by without a new article with details on the unprecedented growth in income inequality and its dire consequences.

Hundreds of commentators have warned that extreme concentration of wealth threatens democracy and social stability. Not a day goes by without a new article with details on the unprecedented growth in income inequality and its dire consequences.

Something is missing, though. No one is proposing measures that would take away wealth from the 600 or so U.S. billionaires and the 20,000 families with hundreds of millions. Why not? Apparently, there is some tacit agreement that even the very richest earned their money, and therefore it would be immoral and un-American to take it away. Certainly, the wealthy promote this idea, but why is it so universally accepted?

One suggestion is because our economic models don’t provide any alternative explanation for wealth accumulation. The classic models view output as a function of capital, labor and technical change. There is no room in these models for gigantic, undeserved bonanzas going to the few. It follows logically from these models that those who acquire vast fortunes must have exceptional gifts. They deserve their fortunes.

When one looks beyond the classical models, one sees clearly that those who have accumulated large fortunes did not in any sense earn them. They captured for themselves wealth that mostly belongs to society at large. There is a strong, logical case for the government to tax all huge fortunes down to the level that society considers acceptable.

Potential Wealth and Surpluses

What the standard models miss is that in the real world, major economic disturbances, innovations, new resources and new markets all create huge amounts of potential wealth where the costs of transforming the potential into actual wealth are far less than the wealth produced. When these wealth surpluses are captured by individuals rather than spread widely across the population, large fortunes are created.

To clarify these concepts, consider a concrete example: an oil fieldthat contains oil worth a billion dollars on the open market. The oil field is not yet discovered. Its potential wealth is a billion dollars. Suppose the costs of exploration, drilling, and all other costs of delivering all the oil to market (actualization costs) were $400 million. The wealth surplus gained from actualizing the wealth of the oil field would be $600 million — one billion dollars (potential wealth) minus $400 million (actualization costs).

Who should get the wealth surplus? The oil field developer has no special moral or economic claim to it. The actualization costs of $400 million, which include a market rate of return on capital, fully compensate the developer for all costs incurred. If the oil field were part of a “commons,” it would belong to all members of the commons. Government would appropriately collect the wealth surplus and use it for the good of all members of the common.

Under the legal rules of capitalism as currently practiced, all the wealth surplus from the oil field goes to private interests (the developers and financiers). None goes to the public. This is neither equitable nor socially desirable.

As will be shown, the concepts used to explain the oil field example apply equally to potential wealth that is not tangible, for example, unrealized wealth opportunities in finance and technology.

There is no room in standard economic models for fortunes derived from wealth surpluses. In a world of perfect competition, where prices reflect the costs of production, there are no large wealth surpluses to be captured by an individual. The real world is very different. History shows that in times when huge wealth surpluses come into being, large portions of these often have been captured by a few individuals.

The Gilded Age

Marble House, a Gilded Age mansion in Newport, Rhode Island. (Carol M. Highsmith via Wikimedia Commons)

The Gilded Age of the 1800s exemplifies the appropriation of wealth surpluses by a few individuals — the railroad, steel, and oil monopolists, to cite the most prominent examples. They didn’t create the railroad, steel and oil refining technologies. These grew out of a large body of evolving knowledge developed by many scientists, engineers, and individuals over many years. The monopolists simply got “legal” titles to the wealth that arose from the new technologies. If these particular owners hadn’t gained these legal titles, others would have. In a more perfect society, the steel and railroad and oil refining technologies, would have been considered social assets, belonging to all of the people. The wealth that arose from their development would have been broadly distributed, not flowing disproportionately to a few.

As an example, look more closely at railroads. The introduction of railroad technology transformed transportation. Prior to the railroads, all transportation not by water was by animal-drawn wagons, which were slow and uncomfortable for people and slow and expensive for goods. Suddenly, it became possible to move goods and people incredibly faster and cheaper. This was an economic discontinuity even greater than those created by the automobile and the internet. The wealth surpluses created by the introduction of railroad technology were enormous, unprecedented in magnitude.

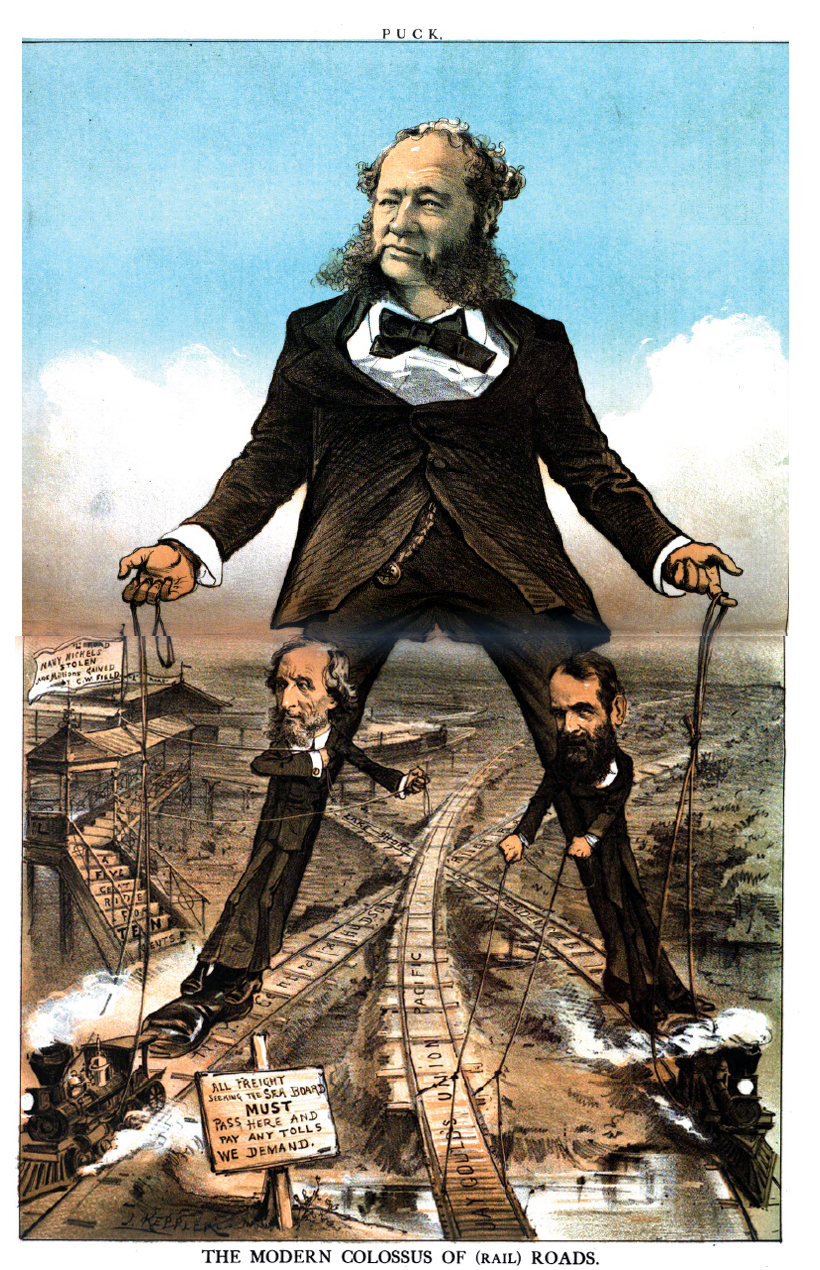

William Henry Vanderbilt, president of New York Central Railroad in center. On left, Cyrus West Field, who controlled the New York Elevated Railroad Company, on the right, Jay Gould, who controlled the Union Pacific Railroad and other western railroads. (Wikimedia Commons)

The huge wealth surpluses created by railroads attracted every major entrepreneur and speculator of the era. Railroads were the perfect vehicle for accumulating fortunes. Not only did the first railroads create large wealth surpluses, they were natural and completely unregulated monopolies. Owners could charge whatever the traffic would bear, allowing them to appropriate much of the wealth surpluses that the railroads actualized.

According to standard economic models, the introduction of railroads should have increased the wealth of Midwest farmers. Suddenly, the cost of transporting their wheat and corn to market would have fallen precipitously; so their income should have risen accordingly. This did not happen. The railroads set their rates at levels far above the true costs, keeping the farmers in poverty and capturing the created wealth surpluses for themselves.

The wealth surpluses appropriated by the railroad owners made them incredibly wealthy. In a listing of the seventy-five richest people in recorded history, twelve acquired their wealth primarily through ownership of U.S. railroads.

Is anyone willing to argue that the railroad millionaires (billionaires in today’s dollars) created the wealth they accumulated? They didn’t create the technology. They didn’t do the physical labor or produce the materials needed to build the railroads. All that they did was to acquire legal title to the railroads, ownership that allowed them to transfer the wealth surpluses to themselves.

The Robber Barons of the Gilded Age were ruthless businessmen, single-minded in their pursuit of riches, without legal or moral scruples, and gifted with a political and legal environment where greed and survival of the fittest were guiding principles. In a real and concrete sense, they stole most of their fortunes from the general public by establishing monopolies that allowed them to set unfairly high prices.

Grabbing Surplus Wealth

When major innovative technologies emerge, they bring with them major wealth surpluses. What appears to be a repeating pattern is that early pioneers use their quickly generated wealth to establish market dominance, if not complete monopoly, by buying up or crushing competitors. They then are able to capture a large share of the wealth surplus for themselves. When there is a surge in wealth surpluses such as occurred in the late 1800s, a further dynamic seems to be that the courts and Congress come to reflect the interests of the rich and powerful.

In the United States in recent decades, most fortunes have arisen from micro-chip technology, globalization of trade, innovations in financial markets and, most recently, by capturing a large share of the wealth surpluses arising from the internet.

As was true in earlier eras, the recent entrepreneurs who have reaped large fortunes from wealth surpluses have no economic or inherent right to retain them.

The Internet Age

The internet provides the most compelling and significant example of fortunes arising from private appropriation of wealth surpluses. For the sake of brevity, only the internet example is examined here is detail, but examining fortunes derived from financial innovations and trade globalization would lead to similar conclusions.

From an economic viewpoint, the emergence of the internet can be compared to the discovery of a hugely valuable, virgin, unowned land. The sudden ability to transmit vast volumes of information virtually instantaneously at almost no cost created a myriad of hugely valuable wealth opportunities. The costs of transforming these potential wealth opportunities into actualized wealth have been relatively small. Huge amounts of wealth surplus have been created. Individuals, investors, and corporations, have taken title to much of the wealth surplus, creating a new generation of ultra rich.

There is no valid argument that the individuals who gained fortunes from the internet have a “right” to keep them because they “created” the wealth they gained. That internet billionaires didn’t do so is obvious when considering what would have happened, if Mark Zuckerberg and his backers hadn’t developed Facebook. Absent Zuckerberg, does anyone doubt that something essentially identical would have come into existence at about the same time? Others would be the billionaires, but the functionality would be essentially the same. It is the capitalist system of ownership that has allowed private individuals and corporations to capture the vast surplus wealth of the internet.

Why Internet Wealth Should Belong to Society

It needs to be emphasized again that wealth surplus is the excess of actualized wealth over all the actualization costs (which include a market return on invested capital). Actualization costs fully and fairly compensate the actualizers for their services. Wealth surpluses are windfalls that arise from external factors, not from the labor, capital, and other resources used to transform potential into actual wealth.

Arguably, the potential wealth of the internet should be treated as residing in a commons. No individual or company created more than a minuscule fraction of the complex web of knowledge and equipment that constitute the internet. No individual or single company developed de novo the technology of the internet. The internet is a consequence of fifty years of inventions, innovations, development and marketing carried out by innumerable individuals; private and publicly funded colleges and research institutes; and corporations.

The activities that brought into being and sustain the internet were and are inextricably interwoven into the web of our society. Society as a whole has a just claim to all of the wealth surpluses arising from the internet.

Other Fortunes However Acquired

We have only looked at the internet in detail, but the same reasoning and findings apply to major fortunes however acquired. Those that gained huge fortunes did not create their wealth. External conditions created huge wealth surpluses, and through luck, skill, or influence, certain individuals were able to transfer a major share to themselves.

Upon close examination, all wealth-generating activities are seen to be dependent on society’s infrastructure, and thus society has a just claim on all wealth surpluses privately appropriated.

Rate of Return

The rate of return on capital equals the amount of annual profit as a percentage of the amount of invested capital. In a perfectly operating, competitive free-market economy, the returns to capital wherever invested will tend to cluster around a “normal market rate of return,” adjusted for risks of individual investments. Shortages and market dislocations may raise rates of returns, but the rises will be temporary.

In contrast, investments that capture substantial wealth surplus will have rates of return on capital that are substantially greater than the normal market rate of return.

Consider Google and Facebook, two quintessential internet companies. Google’s profit in 2017 was $34.9 billion, compared to total capital invested in property and equipment of $42.3 billion, yielding a one-year rate of return of 81percent. Facebook did even better. Its 2018 profit was $24.3 billion compared to invested capital of $13.7 billion, a one-year rate of return of 177 percent.

There is room for disagreement on what constitutes a normal rate of return on capital, but there is no question that Google and Facebook had rates of return that are multiples of a normal rate of return. Arguably a normal rate of return is around 8 percent. This is the average return on investments for the very wealthy, but using a higher value would not change the conclusion that Google and Facebook are capturing huge amounts of wealth surplus.

Rates of return on capital combine the financial benefits of wealth surpluses and monopoly pricing. Google and Facebook have captured such large amounts of wealth surplus because they are unregulated monopolies. Both bought up or crushed all significant competitors.

A Progressive Tax on Excessive Profits

Rates of return on capital far above normal are concrete proof a company is transferring to itself wealth that rightfully belongs to others.

There is a strong case for a progressive tax on such excess profits. It could start at zero on profits providing a normal rate of return. Marginal rates would rise along with rates of return. For rates of return unarguably above a normal return, a marginal tax rate of 90 percent or even higher is socially and economically justified.

Actual implementation of a tax on such excess profits would need to address numerous practical issues, many of which are common to any tax on company profits, but some of which are specific to this type of tax. One specific issue is setting a value for a “normal” rate of return. Various approaches will yield different values. Those affected will weigh in heavily, and the value chosen will be arrived at through negotiation. Still, history provides some guide. During World War I and World War II the U.S. and England imposed excess profits taxes based on the rate of return on investment. The values chosen were in the range of 6 percent to 10 percent, with 7 percent and 8 percent being most common.

Some other issues are: How are capital investments to be valued? How to allow for depreciation, and obsolescence? How to deal with fluctuations in profits?

While complex and challenging, issues related to implementing an excess profits tax seem no more so than those related to the existing taxation of corporate profits.

Taxation of Wealth

Because those with large fortunes did not create the wealth they hold, they have no inalienable right to keep it. When individuals gain so much wealth that their economic and political power threatens democracy or harms the general wellbeing, society is fully justified in taking away that wealth. Although an excess profits tax and a sharply progressive tax on all sources of income would greatly reduce individuals’ ability to join the ranks of the ultrawealthy, these would not affect existing fortunes.

Individual wealth in the billions of dollars (and arguably, considerably lower levels) creates a threat to social stability and to the continuation of our democracy. A way to reduce socially excessive wealth holdings is through a tax on such holdings that exceeds the return on that wealth. High wealth holders earn an average annual return of about 8 percent on their wealth; thus the tax rate on excessive wealth holdings would need to exceed 8 percent. It would need to be significantly greater than 8 percent on extreme levels of wealth in order to bring them down to an acceptable level in a reasonable period of time.

Progressive taxes for the purpose of reducing excessive wealth holdings would be revolutionary and vigorously resisted by the wealthy. Because they address a critical need, they deserve careful consideration.

Vince Taylor is an economist, entrepreneur, and activist. He is currently focused on developing public support for taxation to reduce holdings of wealth that threaten democracy. An earlier version of this article appeared on Znet.

Wonderful article. What is happening today is very similar to the guilded age. Ultra wealthy individuals pay virtually no tax and live like kings while the bottom 50% live as in a third world country. This is unconscionable and needs to be changed. Certainly under the republicans and Trump it will only get worse. Thank you to Vince for an insightful article.

Neil Linneball

Neil, thanks for the supportive comment!

So we’re all agreed! Capitalism bad, the wealth of individuals belongs to the collective, socialism is the only alternative! Count me in for the revolution!!

Let’s overthrow the government, seize the wealth and the means to production and install Workers Collectives in place of corporations. And when I say collective I’m not talking those about smoke-filled rooms. We Party Members can meet once a week (via People’s Technologies) to work out the details. Think about how wonderful it would be!

A Ministry of Wealth Creation! Looks at acts a lot like Wall Street but with left-wing intellectuals calling the shots instead of CEOs?

A Ministry of Wealth Distribution! Kinda like the Foggy Bottom, but with the lobbyists replaced with left-wing intellectuals?

A Ministry of Environmental Progress! With competition and property rights out of the way, We the People’s State can tear up the highways, seize cars and property, and build high-speed monorails across the nation. And of course call in the 7th Cavalry if those carbon-spewing red state Deplorables object.

What about a Ministry of Entertainment? Sort of like Hollywood, but without white males, and with People’s Commissions having the last say on every film released, to ensure not just proper representation, but with assurances all People’s Entertainment conform with Socialist Ideals.

And of course we can replace the Pentagon with a Ministry of Regime Change. We Americans will still be global leaders, but there will always be rogue states who cling to those backward capitalist ideals. Equality isn’t free. We can’t do this without a strong military. Any man who tells you otherwise is no true patriot, and no true socialist.

Lets do this thing!!! Who is with me?

Nobody? Fair enough. If you don’t like my ideas, let’s hear yours.

Be Careful, you make a parody out what is intended to be a constructive discussion. Do you have constructive thoughts about how do correct the obvious failings of our current economic-political-social system?

You ask for ideas. Those in this discussion chain have presented a number of considered ideas. Let us hear your constructive ideas.

One of the first things I notice in arguments about present class issues in the error of supposing that money (both putative and concrete) is considered wealth. Money is not wealth, except to a numismatist. Money is thought to represent wealth, but much of the money possessed by the rich does not represent anything. What the rich possess that counts is not money but power. Under present conditions, money (at least in the US) represents a claim on the social product, both past and present. Just taking money away from the superrich might accomplish nothing — the power it is evidence of would be transferred to other forms. The real issue is the issue of power, of a few over many. That is what needs to be equalized, and that can happen only when people in general stop supporting the existing structure of power and decide to do something else.

As you say, money instruments, such as stocks, bonds, and currency are claim on social product. The rich use these claims to buy power via campaign contributions, lobbying, and direct spending to persuade the public to support actions that benefit the wealthy.

Reducing the wealth holdings of the ultra rich to a socially reasonable level ($50 million?) will reduce their power. Do you support a progressive tax on wealth?

95% taxes. Economic power concentrated in the hands of a few.

How are you going to get there? What are you going to do afterwards? Revolution?

John Lennon called you out on it 50 years back. Now I’m doing the same. Where’s the plan?

Or do you not have one?

See other replies I have made below. This article provides a justification for taxes to reduce the wealth holdings of the ultra rich to a socially reasonable level ($50 million?). A progressive tax on wealth, as discussed at the end of my article, provides a way to accomplish this. Implementing this will take away much of the political power now held by the ultra wealthy.

How to accomplish this? The first step is to gain sufficient popular support for a serious progressive wealth tax that progressive politicians start proposing it. Then, we will need a grassroots revolution to elevate these politicians to position of power in Congress and the Presidency.

Do you support a progressive tax on wealth? If so, help spread the word.

Be careful what you call socialism. Nothing in Taylor’s article even hints at socialism. Capitalism is private ownership of the means of production. Socialism is state ownership of the means of production, distribution and exchange. The state owns everything worth owning – factories, railroads, airlines, banks, farms etc.

If you are in a discussion about an excessive profits tax you are not in a socialist country. There is no profit in socialist countries much less excessive profits. I disagree with the author only when he says the US is a democracy. If it was a democracy it would already have an excess profits tax. If it was a democratic republic it would already have an excess profits tax. Unfortunately it is an oligarchic/plutocratic republic.

Vince — the superwealthy parasitically feed off society. Time to poison out the blood-engorged ticks! You have provided a sound method here for doing so. Thank you much.

Thanks, Christopher.

Now, all of us who feel the same need to start pushing for a serious progressive wealth tax designed to reduce bloated fortunes to a reasonable level — $50 m to $100 m. Pass this article along, together with your thoughts.

Sounds like you are pretty sure about those numbers. And I’ll bet a lot of those 95% taxes will be redistributed to left-wing intellectuals.

Or maybe you have bigger ideas. Let’s hear your plan.

A progressive tax on wealth would be a good start to be certain. However I don’t believe that alone would work to even the economic playing field. We need to bring back strong antitrust regulations, Glass-Steagall, usury laws, enforce existing laws regarding fraud, and bring back all of the other regulations implemented under The New Deal that the republicans and neoliberal Clinton Democrats have systematically dismantled since Reagan and his Voodoo Economics (aka neoliberalism) made his appearance. Don’t get me wrong. I fully support a progressive tax similar to that which existed under President Eisenhower. Faced with the prospect of either use it or lose it those with excessive wealth were encouraged to invest their excess capital into research, infrastructure, education, and other things that benefitted society as a whole rather than the rich hoarding everything for themselves as they do post Reagan and the steady deregulation of business.

“The superwealthy parasitically feed off society.”

Ok, fair enough. But cheap assertions are just that. Cheap assertions. One could just as easily assert that left-wing intellectuals parasitically feed off society. 6-figure incomes, tenure, air travel expenses, pensions, all that sort of thing.

Let assume you get your way. 95% tax rates and full state control of the economy.

What would you do differently? What is your socialist utopia like?

Again Be Careful, you criticize a straw man. No one else in this discussion thread is proposing full state control of the economy.

Please answer this question: Do you feel that extremely large holdings of wealth threaten democracy and social stability?

If you don’t agree, then the entire positive discussion in this thread is irrelevant to you and your comments are irrelevant to those who do agree.

If you do agree and don’t support a progressive tax on extreme levels of wealth to reduce them to a socially acceptable level, what alternatives do you propose?

[War]lords Enclosed the Commons. Granted Charters to Subjects, for example Britain’s King Charles (or James?) and Massachusets Bay Colony. A condition of receiving a share of the colony – a settlement – was improving it, each parcel of land – and providing benefits to the settlement as a whole and to the “owner” (still the king). Bloody US independence seized these returns and directed them to The People through a new system of govt that served The People as sovereign. A colony, a state, a municipality: these are all corporations. Their charters require them to “behave” in the interests of the permit-granting authority: the sovereign (on this side of The Pond that is now – or was – The People.) A representative govt can condition and even revoke the charters of corporations that do not serve our interests. But first we must return to representative govt and stop the diversion to select private interests: our new [war]lords. And rip out all the laws that subvert our sovereignity. Wikipedia is our friend: research these terms.

My deep appreciation to Vince Taylor, both for this article which surely discomfits many of my generation who have, life long, been instructed to view capitalism, especially of the U$ variety as sacrosanct, and “socialism” as criminsl government interference and central planning, but also, and especially, for returning to discuss ideas and perspectives with commenters.

Because the comments have discussed railroads, as does another article, here at Consortium News, I think it might be useful to consider how money power also can affect law and the rule of law.

Under current U$ capitalism, and the law, corporations are regarded as “persons”.

This was not always so.

The means by which it became so arise from a cas known as Santa Clara County v. Southern Pacific Railroad.

Adam Winkler, a professor of law wrote a most interesting article about this subject entitled “‘Corporations Are People’ Is Built on an Incredible Lie”.

It is a most sordid tale, and Winkler’s is the best accounting of it that I have yet encountered over the last fifty odd years.

I highly recommend it to all who appreciate history, especially a history that names nefarious names and digs below the surface gloss and mythological depictions far too often encountered in a field of study among the most loathed, because of its dry, hagiographic and myth-based shallowness, of all subjects to which the young in the nation are “subjected”.

The wealthy may, indeed, face some claw-back of the wealth gained, as Vince points out, through appropriations of innovation, but also by such means as off-shoring manufacturing to areas or lands where labor cost are minimal without any sense of loyalty to the people who will lose employment or to societies degraded to precarity. In passing, it ought also be recalled that certain corporations were “bailed out” of difficulty, as was GM, by federal loans and massive employee concessions, only to leave and set up shop in China and in other places where labor and environmental restrictions were minimal or non-existent.

One might also consider the pervasive austerity that the neoliberal financial class has shifted onto the many so that they, the few, could also be bailed out, even as their criminal actions continue unabated and unpunished.

As well, it is very clear that if the “law” becomes servant of corporations, the military, or the intelligence agencies, by whatever means, none of which are now under effective civil control, then the rule of law is perverted, at great and continuing cost to civil society, to the whims of squalid ambition, hegemonic dominance, and psychological manipulations and constant surveillance.

We see the world very similarly. An important purpose and result of taxing down wealth to a socially acceptable level would be to reduce the power of the wealthy to control the political system. This will not, in itself, restore to the people the power that has been taken by banks and corporations. Breaking up the big banks, restoring Glass-Steagall, real anti-trust enforcement, restoring laws to keep media independently owned and fragmented, etc. are all needed. Still, a serious progressive tax on wealth, together with restoring Ike’s tax table, will go a long way toward stopping our headlong rush toward climate and social disaster.

All of us who feel the same need to start pushing for a serious progressive wealth tax designed to reduce bloated fortunes to a reasonable level — $50 m to $100 m.

Completely agree with you, Vince, and appreciate that you expanded your response to my comment to include political acquiesce, of the sort demonstrated most blatantly with the repeal of Glass-Steagal and the abject refusal to hold financial elites to any account whatever, even instead referring to them, as did Obama, as “astute”.

Certainly, they were clever in taking advantage of the moment and of the many when they could have been held to proper and deserved account, which is way it is extremely unlikely that the political process, beholden and in thrall to wealth and corporate power as it now is, will be of much assistance in educating the public understanding around the critical importance of developing an economic system that serves a global humanity in sane, humane, and sustainable fashion.

Frankly, what I term the legacy parties, a term that Bill Black much appreciated when I shared it with him, cannot and will not change their behavior, long practiced and ingrained, and so must be swept away, most likely by their own ponderous incompetence, before anything that you, Richard Wolff (who DID manage to become our preeminent Marxist Economist, in a culture that you, and many of the rest of us, found to be rudely inimical to economic thought outside of mainstream orthodoxy), Bill Black, or Mark Blythe might imagine or envision.

I happen to clearly recall the indifference heaped upon E. F. Schumacher’s “Buddhist Economics” as well as the lusty enthusiasm that greeted the “Greed is Good” mantra when Bussiness schools, such as at Harvard.

Honest economists, as well as honest historians, must acknowledge that brutality has accompanied what was to develop into “modern” capitalism even before that system came to be, from the Doctrine of Discovery, to the beginnings of the formation of this nation’s initial wealth premised upon genocide and the brutal slavery that created this nation’s money-wealth that permitted this nation to “steal” the “intellectual property” of Great Britain and beat the Brits and others at the game of empire.

A game and a lifestyle we are most reluctant to relinquish, even those who would deny that we are a military empire and determined that we would take, to support our hegemony and lifestyle, as a mere six percent of the world’s human population, fifty percent of the world’s resources, regardless of the cost to others and, though we did not care to know it at the time or for decades to come, at a huge and growing cost to the planet’s capacity to support human existence.

By the end of WWII, that was official U$ policy as delineated by George F. Kennan rather bluntly and quite explicitly, even though most U$ians, to this very day, believe myths that profess a very different “explanation”, that paint a pretty picture of kindly intervention, of democracy and “free enterprise” as partners in goodness and all things wonderful.

I used to annoy my professors of Economics with my continued suggestion that, in fact, “free enterprise”, or the capitalism which many of them practiced when serving, in extra-curricular endeavors, where they often made much more money than they did teaching, as advisors to the political elite, was inimical TO democracy, for the very reasons clearly evident today in so very many ways.

Again, I thank you for taking the time and interest to interact with commenters, it marks you as a human being willing to engage, and not an aloof, elite wisdom far distant above hoi paloi

Engagement, sharing AND listening, must serve as best means of connection and building a viable future.

That the people will, themselves, have to imagine and then create that future, without the “help” or “direction” of the elite must become the essential foundation upon which any future worth having shall have to be built

You have obviously been thinking about the failures of our present society for a long time. I would enjoy reading more of what you have written. You can message me through twitter. I’m not allowed to post my twitter handle, but you can search for Vince Taylor.

It is a very short step from this thesis to the “you didn’t build that” philosophy of the socialists that believe “govt” should control all means of production. Then inevitably follows a Venuesula or USSR and decay and chaos and “old school” poverty ( which includes starvation btw).Where is the surplus in a Bill Gates created Microsoft? Why have entraprenures at all? The socialists can cook up any crazy idea to justify their power and wealth grab by guns and jails, (called ” taxation”), Semper Fi! Capitalists!

Crumb, did you read the article? Bill Gates is a classic example of appropriating wealth surpluses belonging to society at large. Microsoft got their early and used the vast wealth surpluses generated by the introduction of microcomputers to monopolize business and personal software, illegally crushing all competitors.

If you truly believe in free enterprise, you would be for vigorously breaking up monopolies.

This goes well beyond the appropriation of unearned income due to ‘market failures’ and the like. We are dealing with a social system that has exploitation of the many by the few inscribed in its very DNA. Classical economists like Adam Smith and David Ricardo saw the value of a commodity as proportional to the labour involved in its production. While emphasizing the role of supply and demand, their role in a properly functioning market is to push the market price towards the ‘natural price’ determined by the labour embodied in the commodity.

Marx was the first to grasp the revolutionary implications of this ‘labour theory of value’. You would expect that under such a system that a worker’s wages would converge with the value of the commodities produced by that worker. But because labour is itself a commodity under capitalism, wages are determined by the value of ‘producing’ said labour (rent, food, enough distractions to keep workers in their place etc).

The value we receive in wages has no relation to the value we produce at work, as long as the former is always less than the latter. The gap between the two, which Marx called ‘surplus value’, is appropriated by the employer and is the source of profit in a capitalist economy. After all, if capitalists were simply buying low to sell high among themselves, an economy would be a zero-sum game where winners and losers would cancel each other out.

So we are not dealing with a fair or unfair rate of return on capital. What we call ‘capital’ is simply a relation of exploitation, a license to practice Vampirism. The maintenance of, or resistance against, this exploitative relation is what we used to call ‘class struggle’. What to replace capitalist exploitation with is of course the big question. Worker owned Cooperatives and/or state owned companies producing for the market? Central Planning? Participatory Planning? A successful non-capitalist economy would probably involve a mixture of all of the above.

What could go wrong about letting Psychopaths rule the world, everything

What the hell are you smoking?

Mr. Bezos !! So nice of you to stop by !

Much of what the author says here could be summed up as, “Tax ’em like it’s 1955!”

Under Republican president Dwight Eisenhower, America’s top marginal income tax rate was 91 percent.

Here we’re talking about reclaiming accumulated extreme wealth, not just income. But still. “Tax ’em like it’s 1955!”

Thanks for your comment. It is a tribute to the power of the capitalist system that I have a PhD in Economics and never had to read Marx; so I can’t respond as well as I would like to your comment.

To me, physical and intellectual capital are the fruits of labor. If the labor is to be paid for its work, such capital needs to earn some return, but when the rate of return greatly exceeds the average productivity of capital, something is wrong. What is wrong is that the owners of the capital have monopolized a market, and if they are appropriating major wealth surpluses, they will be effectively stealing big time from society at large.

Something went wrong with the posting mechanism. The above comment was intended for an earlier comment reflecting Socialist though. I couldn’t include the poster’s name, and when I took it out, my post went several places further along.

Mr. Taylor’s program is not unlike the “Share the Wealth” program proposed by Sen. Huey Long (D-La), in the 1934, at the depths of the depression. Details of Huey Long and his program are found here:

https://www.hueylong.com/programs/share-our-wealth.php

Sen. Long, hated by the wealthy of his day and their propagandists in the media, died at the hands of an assassin.

It is well past time for the rise of a new Huey Long and enactment his economic program before the irreversible consolidation of a neo-feudal era of globalism that will make the middle ages look like a semi-utopia.

The problem here–and I am much in sympathy with the author’s ideas–is defining the problem clearly enough to get through the thick clouds of smoke that blow immediately in associating these ideas with “socialism.” It is interesting that the young today are taking a second look at “socialism,” and even suggesting application of the term to the very rich due to government favoritism.

Aside from all that, in itself a discussion full of complexity, America has continually nurtured a vision of materialism as a kind of birth-rite, and the more of it the merrier. Therefore, by default, “being rich” is conceived as a basic good by the society in general. Then follows the simplification: socialism = evil (with corresponding images of demons with pitch forks and tails from the communist party of 100 years ago).

The idea of a “social compact” (wherein the entire society is obligated to care for and protect the entire society) is an idealism too far against the vested interests, with the unfortunate damages of blind allegiance to “wealth,” and that includes “obscene bloated wealth.”

But what happens if the governing regulation system (as pointed out once at taxation at 91% for the very rich decades ago) becomes corrupted into (for example) “whatever goes and makes money is good,” including wars and sales of munitions?

And correspondingly comes a drive to eliminate unions, reduce the middle class, and create a new sharecropper society, which must work so many jobs to pay the rent etc they have little choice but to be uninformed and exhausted?

I submit this perception of “something rotten” is at a grass roots level at this time, with a growing roar toward an indeterminate “change!” that we could discuss more extensively.

Hetro, you identify crucial obstacles to change — primarily the capitalist worldview that is infused into almost everyone from the time they are old enough to talk. I take some hope from the results of a talk on wealth I gave to folks in a retirement community. After giving information on the extent of income and wealth inequality, and on how big is a million dollars, almost everyone voted to 1) reinstitute Ike’s tax table (with 91% marginal tax above $3.4 m 2018 dollars), 2) tax all forms of income (capital gains, dividend, wages) at the same rate, and 3) increase IRS staff to review a substantial portion of return above $1 million and to audit all such returns found to be questionable, and 4) use US power to shut down all tax havens. I didn’t get to a tax on extreme levels of wealth, but they seem likely to have supported that, too. Education in all its forms (didactic, novels, movies, grassroots, etc.) is needed to open peoples’ eyes.

Thanks, Vince, for this reply and the discussion, as well as your efforts to educate on this matter.

Fantastic. Idea! I hope someone finds a way to make the very rich pay their fair share. Get rid of most of their tax shelters, tax the heck out of them. Perhaps then the very necessary assistance for the failing safety net safeguards that are quickly disappearing might survive and become better. I don’t underststand how these filthy rich people live with themselves as we are sinking closer and closer to becoming a 3rd world country.

Thanks for your comment. We obviously share similar feelings about unreasonable amounts of income and wealth. I am hoping to get the idea of a substantial, progressive tax on wealth into mainstream discussion.

Hmmm. Unimpressive. The author argues for a socialistic and/or communistic approach to business. Aside from being an absolute non-starter in a country like the US, he descends into a quagmire when he says “Rates of return on capital far above normal are concrete proof a company is transferring to itself wealth that rightfully belongs to others”. Aside from the impossibility of determining what a “normal” rate of return is, who the hell are these “others” to whom it rightfully belongs?

Let me offer a somewhat different take on this. What the author is really talking about are called economic profits by an economist, i.e. profits above and beyond those necessary for the enterprise to remain in business. Economic profits are not determined by a rate nor are they fixed, i.e. constant year after year. My observation is that economic profits arise from (a) dumb luck, (b) chicanery, and (c) cheating. Determining economic profits can be tricky. You’d think all you had to do was to see how much of the company’s profits (revenues minus cost of goods sold, minus return on investment to the company’s investors, minus taxes) were retained year on year. You’d be wrong. For example, Apple a few years back dropped something like $450M on the executive suits. I took the number and divided it by the number of employees that Apple claimed to have in the US. It came out to be something like $10k for each employee. That would have raised the average Apple wage (as published by Apple) from ~$20K/employee to ~$30K/employee. This is by no means the only example of theft of company earnings by the Captains of Industry. A number of years back Caterpillar had a spectacular year and the union clamored for raises. Management said no but they made sure to line their own pockets with multi-million dollar bonuses. Businesses don’t really care because salaries, regardless of how outrageous, are fully deductible. That has to stop. It should be that if salaries of the the executive suits become excessive, I don’t know, say 25X the median wage, the difference between actual salary and maximum non-excessive salary is taxed at the top marginal rate for personal income. I imagine that management would be reluctant to explain that to investors.

The other thing that can (and does) distort the meaning of economic profits is the tax code. How is it that valuable companies like GE, Amazon, and the like can make billions of dollars and pay squat for taxes if they pay any taxes at all? I have three words for you: Lobbyists, Tax Lawyers. The Republicans whine that the business tax rate is (or was) 30% but the only businesses that paid that were small business that couldn’t afford tax lawyers and lobbyists. The author wants an excess profits tax on business. Pfui. Businesses don’t have excess profits. Any “excess” profits will vanish into executive pockets or tax favored business and be magically deducted from revenues. If you took the the crap out of the tax code that provides breaks and favorable treatment, I think that your “excess profits” would also vanish. While I’m at it… one of the tax breaks that businesses get is not paying taxes on profits from overseas operations as long as the money is not repatriated to the US. That’s odd. If you live and work overseas, the US insists that you pay US tax on any money you earn and, they want your spouse’s income as well, even if he or she is not a US citizen. They aren’t going to do squat for that tax money. Trust me, I know. Do you have any clue how much tax money would flow into the treasury if US businesses had to pay normal or even reduced taxes on their foreign earnings?

On the personal side of the ledger, bring back the 91% top marginal tax rate. It has to only apply at ridiculous income levels but we certainly have plenty of examples that pop to mind – Jeff Bezos, the Walton family, that notorious monopolist Bill Gates, and many others. In one of the Nero Wolfe novels that Rex Stout wrote back in the late 40s or early 50s, Stout has Wolfe declining a job because as he said, my fee would be $10,000. I am already at an income level that I could only keep $1,000 and your case isn’t that interesting. I’m sure that Republicans reading this would say, see? executives won’t do their best with that kind of tax rate. But executives are not paid by the job. They’re paid by the year. I see it as a disincentive to seek some of these insane payouts and if it doesn’t halt the insane payouts, at least it will redirect most of them to the Treasury.

Of course, if the government was actually of, by, and for the people, this sort of thing would be a good thing. Unfortunately, the government is run by people who could care less about the people or the country. They wouldn’t spend the money on eliminating the deficit and reducing the debt, funding infrastructure investments around the country, and rebuilding the towns and cities ravaged by decades which has had the consequence of draining American manufacturing jobs and sending them overseas to other lower cost countries. They’d spend it on shiny military toys and wars.

Really, we’re just screwed, people.

Jeff, we are actually very much on the same page. You seem to have misunderstood the core of the article: showing that those with huge fortunes have no right to them. This justifies high rates of taxation on extreme levels of wealth, rates high enough reduce the levels to a socially acceptable level. Everyone has their own idea of what is that level. A good argument can be made that it is not higher than $50 million. More about this in a future paper.

You shouldn’t be concerned that the tax revenue from a wealth tax would be spent on all the wrong things. There is no way such a wealth tax could be enacted unless we have a grassroots revolution that throws out most of the current members of Congress, Democrat and Republican alike, and replace them with people like AOC, Ro Khanna, Ilhan Omar, …

Oh, no, I understood. I’ve had to live with managements that really had no clue what they were doing but, hey, they could play corporate politics and game the system that they couldn’t have created themselves if they had to. We differed on how you determine what an unreasonable level is and what the deal with taxes is. Nominally speaking, taxes are in place to fund the government but anyone who’s done macro knows that there are other functions for taxes. Personally, I view one function of taxes is as a method to make excess accumulation of capital by individuals and businesses painful. You seem to think that ROIs should be controlled and profits limited by rates. I simply don’t think that works. I think that certain behaviors by the executive suits need to be made either impossible or extremely painful to prevent outrageous accumulation of wealth.

At the end of the day, a very good piece.

Jeff, I agree that the concept of a “normal” rate of return on invested capital is somewhat amorphous, but governments of the US and Britain set such rates in WW I and II (around 7-8%) and used them to calculate excess profits to be taxed.

When Google earns 71% return in a year, and Facebook 177%, their returns indisputably exceed any reasonable value of a normal return. My proposal is to have a graduated excess profits tax; so the excess profits tax rate would be zero on a normal return, say 8%, but when the return begins to exceed, for example, 20%, there would be a significant tax on the 12% of profit above the normal return of 8%. The marginal rate of taxation would continue to rise with higher rates of return. Again, just to clarify, not to propose, the marginal rate of taxation could be at 90% on returns above 40% per year.

Having said this, I agree with you that this would not solve the problems created by corporate governance that is divorced from from it workers and communities in which they exist.

Bravo, Jeff!

The more wealth, the more power. They just keep feeding each other. Get rid of CITIZENS UNITED. High income inequality leads to violence.

No, not even the richest earned their money. They either inherited it or, as is clearly the case today, stole it off of the backs of poorly paid workers.

I agree. Go into any business and observe how the low-payed employees do most all the work for shrinking benefits and stagnant wages. Employees being devalued as virtual slaves who work hard to get from paycheck to paycheck. The amount of stress from the situation we are in I personally believe contributes greatly to road rage, mass killings, suicides, etc. All the while the CEOs and other bosses sit on their asses doing very little if any of the real work that supports the business. In my experience, I’ve witnessed promotions only go to suck ups who help run the politics of a business, large or small. What is even worse is the trend of companys hiring from outside instead of promoting from within. This completely devastates the morale and belief that the real workers can ever get ahead. It seems to me is the rich control all of us like puppets deciding for us what THEY think we deserve, which is VERY little. There are no morals in the rich man’s heart and this is causing our country to crumble. I think it is ironic that Mexicans are trying like crazy to get into our messed up country while they have all the jobs that the rich people sold out the American public to them. Many born US citizens are leaving and finding more peaceful and happier lives in some 3rd world countries. If that doesn’t prove our country is almost beyond repair I don’t know what else does.

Vera, I agree the richest didn’t earn their money, but it wasn’t stolen from their workers. They appropriated wealth surpluses arising from innovations such at micro chips and the internet — or in the case of the financial sector, using their special status to extract undue fees from their customers and in many cases, outright stealing it (Madoff). Then, of course, there is inherited wealth.

> Then, of course, there is inherited wealth.

Which you should have devoted much more space to. Then (the First Gilded Age) as now, the great majority of the filthy rich you describe accumulated their fortunes on a foundation of inherited wealth (either their own, or made available to them by others).

Yet the “neoliberal” capitalists, their political stooges, and the brainwashed masses who vote for them have actually succeeded in abolishing inheritance taxes in some countries!

Bring back 1955? Hell, bring back the generally-accepted economic insights of 1914!

TS, if I had my way, wealth passed on to heirs would be limited to something like $1 million each. There is no capitalist, free market economic rationale for allowing any wealth to be passed on to heirs.

In America, we’ve been taught to believe the stock market IS the economy. Funny how the big stock holders get fatter and the average person gets poorer during this Wall St boom just as it has been for the last 4 decades, isn’t it? Somebody lied…

http://opensociet.org/2019/06/04/trumps-economic-boom-is-a-scam

I think that the author overstates his case.

There are indeed unique people who deserve unique benefits for their innovation, hard work and genius.

On the other hand, there is a great deal of luck involved in being at the right place at the right time.

I have seen enormously talented people get rich and I have also seen enormously talented people do only “okay” since they did not get the breaks that others received.

Even worse, I have seen people who were little more than con men get rich at the expense of society as a whole.

It is a far more nuanced issue than the author indicates.

That being said the current level of wealth inequality is damaging the social fabric of this county. I’ll give just one example. I know one young man who was denied entry to Ivy League schools despite being way, way over their average entry requirements – not just in terms of grades and test scores but in extracurriculars and recommendations as well. It didn’t make sense to me. I believed – at the time – that this was because some rich parents had “bought entry” for their undeserving children diminishing the number of slots available to truly talented people. Later, news reports indicated that such things were indeed going on. That is simply not good for a society and that type “bought influence” has become far too pervasive in contemporary America.

“There are indeed unique people who deserve unique benefits for their innovation, hard work and genius.” I agree. The salient question is how large a benefit? When it goes into the hundreds of millions, the geniuses are taking wealth from the commons. No one, no matter how talented could “create” a hundred million dollars of wealth if was on a desert island.

I generally agree with that. But I am beginning to think that the problem is more one of personal character than it is a problem of “laws.”

How can we justify entertainers and athletes making millions of dollars a year? Is anyone – no matter who they are – really justified in acquiring a billion dollars? And, most importantly, why aren’t more people questioning this state of affairs?

What I am saying is that I think that this is a question of values. We seem to have lost our way as a culture. And getting back our bearings will not be as easy as writing a law.

It is more than a question of values, it is a question of power. Beyond a certain point of accumulation, money is about power. I think taxing similar to the Eisenhower years is the answer. A tax rate of 90% on income above a certain threshold (say 5,000,000/yr) would force the super wealthy to pay more to their employees, or lose it to taxation. The revenue could be used to rebuild infrastructure and provide for more educated and healthy citizenry. 5,000,000/yr is an obscene amount of money. Even a greedy capitalist can live comfortably and have plenty left over.

Thank you, Scott. I agree entirely with all that you say. Ike’s tax table will stop in its tracks the ongoing explosion of billionaires, but a serious progressive tax on wealth is still needed to deal with the existing population of ultra wealthy and the “residual” after-tax wealth of new multi-billionaires.

All of us who feel the same need to start pushing for fundamental tax reform, including a serious progressive wealth tax designed to reduce bloated fortunes to a reasonable level — $50 m to $100 m. Pass this article along, together with your thoughts.

I certainly agree with you, Scott. But I doubt a single member of the Major League Players’ Association does. And all the Hollywood moguls and their stars probably stop bellyaching about Russia stealing Hillary’s presidency (as if) only long enough to count their latest box office returns. In this exceptional place called America, the more ya got, the more ya want.

Amazing stupidity. This guy actually recommends that government be authorized to steal even more wealth from people. He apparently fails to recognize that government will simply turn around and use those resources against us. They will employ even more government agents to send against us, such as government school teachers. They will impose more government programs. This is madness and would certainly lead to the downfall of western civilization.

the Amazing stupidity is that you apparently don’t comprehend what the article is about

Seems that capitalizing has its benefits in that stimulates risk taking and innovation, i.e., it creates the energy to use resources. There should be an acknowledgement of the benefits of the dynamic it creates. At the same time we do not want obscene accumulations of wealth nor the creations of a class of royalty.

So how do you capture the energy of capitalism and a just sharing of our wealth and output at the same time. The answer that seems the best is to use taxation to create a fairer distribution of wealth. We had very high rates of taxation in the 1950’s and the economy did very well. We had high rates of taxation on inherited wealth.

The a storm of propaganda on deregulation and lower rates of taxation(on the people who created the wealth?) we have transformed our society.

Ever notice how the media stars cringe when the word socialism appears like it is some kind of curse. It is a dirty word and being labeled as a supporter of socialism is about as bad as it gets. That public investment (socialism) drove much of our innovation gets ignored as though that is not really socialism.

“So how do you capture the energy of capitalism and a just sharing of our wealth and output at the same time. The answer that seems the best is to use taxation to create a fairer distribution of wealth. We had very high rates of taxation in the 1950’s and the economy did very well. We had high rates of taxation on inherited wealth.”

Exactly!

“If you’ve got a business—you didn’t build that…”

This statement of fact by an otherwise clueless and hypocritical Barack Obama nearly cost him the presidential election of 2012. In a rare moment of lucidity, he realised the importance of society, of the aggregate of all human genius and hard work in the slow, laborious accretion of knowledge, progress and advanced culture that might benefit all people. Like Isaac Newton recognised earlier, when he claimed to have seen farther only by standing on the shoulders of giants–learned men who had preceded him, sometimes on the order of centuries–Obama was admitting that our “greatness,” or lack of it, has never been limited to the work or visions of just a handful of “exceptional” individuals whom we see fit to reward with both fame in the textbooks and fortune in their pocketbooks.

No matter whose successful business you care to discuss, whether Romney’s during that election or Mr. Trump’s presently (to say nothing of the men, like Bezos, Gates and Soros who make them look like pikers by comparison), a key component of that success has been not only the physical infrastructure bought, paid for and built with the labor of the collective (not them personally), but also the legal infrastructure which codified the notion that virtually limitless swaths of natural resources created over billions of years within Mother Earth could, through simple manipulation of laws and statutes and being in the right place at the right time consign all ownership of such to at most just a handful of incredibly privileged individuals, the rest of society and its needs by damned.

Examined logically, from the perspective of a society interested in providing the best possible quality of life for the largest percentage of its membership, this is insane folly. Even worse, it is evil and perverse! What we have, in its stead, is a system that maximizes human suffering of those near the bottom of the societal pyramid, so the minute fraction at the top can lay claim to more riches, luxuries and prerogatives than they can ever actually realise in a dozen lifetimes. Right now the system is structured so those few lucky creatures can “theoretically” enjoy limitless rewards carved out at the expense of the vast majority. What’s maddening is that the populations at both extremes (both the wealthy dispensers and the impoverished recipients of the sustaining propaganda), at least in the United States, seem to think this is perfectly natural and morally acceptable, in fact, ordained by invisible deities who speak through scriptures written by an unending chain of privileged priesthoods protecting the interests of whatever power elites ruled in their own times.

The name of this false religion is “capitalism.” Capitalism has now come to dominate the economics of nearly the entire planet, having eventually vanquished the last bastions of “socialism” in the Soviet Union and the People’s Republic of China. Socialism was primarily focussed upon maximizing the well-being of society, i.e., striving to attain the greatest good for the great number. That never meant equal compensation for every member of society irrespective of their contribution or no right to own personal property, as we were taught in American schools. It never meant lack of recognition or reward for genius and hard work, as the critics of socialist countries claimed. The crumbling European Union still displays remnants of a workable system of socialism where the citizens are far more richly rewarded than any workers in the United States.

Capitalism reigns everywhere now: throughout the West, in Russia (where it was rammed through creating an instant filthy-rich oligarchy of former political insiders), in China, and even in the countries the USA most wants to destroy, Iran and Venezuela. Perhaps only North Korea still eschews capitalism. Who or what does capitalism serve? Once again, the answer lies in the word itself. Capitalism strives to maximize the accretion of capital, i.e., the accumulation of money, by maximizing profit in every possible business transaction. In fact, every object, every molecule or class of molecules in nature or in human possession is monetized–rendered as some dollar equivalent–and the auditors and accountants let loose to predict ultimate gains and losses of potential scenarios which are carefully chosen to maximize profit. The choices will take little account of the benefits or misery caused to the human collateral.

Just as long as the populace shows no signs of breaking out the torches and pitchforks, whether we are speaking of the USA, the RF or the People’s Republic, the respective oligarchs will squeeze their underclasses as hard as possible to extract every last penny, kopek, or fen, because the fat cats will always need that loose change more, the size of their bank accounts equating to their self worth. Unfortunately, even though capitalism prevails the world over and there is no great ideological struggle, American capitalists still want to beat the snot out of Russian and Chinese capitalists (and our European vassals as well, it seems to me), so the latest Cold War is no longer over political ideology or even moral posturing (where the other side seems to have the higher ground, if baseless economic sanctions and endless armed threats mean anything) but rather based in pure greed and acquisition.

What Mr. Obama got right in theory back in 2012, he seems to have forgotten or conveniently dispatched down the memory hole in 2019. The man recently collected a $600,000 stipend from a marketing group in Colombia to basically refute the policy of his administration to block a free trade agreement with that country at the time–something to do with the alleged mistreatment of union organizers. No doubt Obama thinks of himself as having done something constructive to deserve that 600 large and not just receiving a payday for dispensing contemporary right wing propaganda for some local oligarchs. He’s just as much a free rider now as the business owners he pilloried during that campaign.

Realist, I apologize for not replying sooner. Your comment is excellent — incisive, very well written, and with a great grasp of what is and has been happening in our world.

I am a supporter of Bernie Sanders, and I agree that the only hope for positive change is a grassroots revolution. If the people are able to assert their power, high on the agenda should be fundamental and far-reaching tax reform to take down the oligarchs. If this is not done, they will soon be back in control.

Vince-

I agree with your proposals, and I was a fan of Bernie’s up until the Democratic Convention. When Bernie caved to the Clinton machine, despite the Wikileaks revelations that he was cheated, I lost my faith in him. I fear that he will play the role of sheepdog again in 2020, and attempt to round up all the progressives only to deliver them to “warmonger from column B”, probably Joe Biden. I am hoping Tulsi Gabbard is the “real deal”, but I think she will have to abandon the DNC controlled democratic party at some point with an eye to making the 15% mark for the televised debates in the run up to the general election. It is time for a major 3rd party to start the revolution.

O.K. Sir: Butter after they acquired the title to the land to build the railroads road, who paid the creators of technology, the labor to build and the materials necessary the build the railroads.???? Where do those expenses come from??????

From other people’s investment, mostly through railroad bonds. Many of the bonds defaulted and plenty of investors, especially in Britain, lost their shirts.

To this and the article above, which doesn’t actually mention it (?), I shall only add: From whence came the steel and railroad technologies on which such as Carnegie built their vast fortunes?

Both rail and steel technologies of the time came from Britain. Whether they were, like the chain intellectual property theft of the cotton industry – first taken from India -> England -> USA via Samuel Smith and the spinning mills and Lowell via his and his mates’ visit to Manchester’s cotton mills wherein they made note, carefully, it already being illegal to steal the “plans” of such technologies – or not, don’t know. But it used to be, during the early decades of the first and second industrial revolutions (of the UK) that Brits who knew the technologies of greatest British benefit were forbidden to emigrate to the US. (Doubtful that stopped them.)

But all of these industries – large scale – destroyed the small producers (as they did in India), the semi-independent workers. As they themselves well understood – hence the Luddites, Captain Swing and so on.

Anne, I tried to capture your excellent thoughts in my article here:

“When major innovative technologies emerge, they bring with them major wealth surpluses. What appears to be a repeating pattern is that early pioneers use their quickly generated wealth to establish market dominance, if not complete monopoly, by buying up or crushing competitors. They then are able to capture a large share of the wealth surplus for themselves. When there is a surge in wealth surpluses such as occurred in the late Eighteen Hundreds, a further dynamic seems to be that the courts and Congress come to reflect the interests of the rich and powerful.

If you read again the article, you’ll see he explains that.

If you gain 1B by your oil field and it cost you 400M to install and run it (all the time you need to gain the 1B) then capturing 400M from this 1B is justified, as it is your costs. And, in a reasonable way, some of the 600M, like for example 8 or 10% (of the 1B total, the 400M you already owed, or the 600M left), giving you between 50 and 100M more, roughly, to make your investment profitable and simply motivates you to continue to invest (and cover risks and potential future failures and so on). Every penny you capture off this should have been divided between at least every person involved in the field exploitation (partners, miners, inventors, supporting families, security guards, geologists, and so on) and at best the whole society, notably because this society helps you live and therefore exploit the oil field.

Why would your gardener, your hairdresser, the fireman or the policeman protecting you, the road employee keeping your house road clean and practicable, even the clerk that checks your taxes (and that of the others) not profit from the wealth you got from, basically, the land they help you to live on? They technically get some by your taxes or your payment for their services, but this nowhere near just in the current system. If the nurse hadn’t help your mother, you wouldn’t be here, so shouldn’t she/he earn every penny you gain? After all, why would you earn any money when you wouldn’t even be alive without her/him?

In the end, for better or worse we’re in this all together and it’s not just we don’t profit all together from wealth we create or own together, as a society.

Lucid, helpful comment to add to the article. Reminded me of a philosophical concept related to development of an advanced/enlightened society:

social contract or social compact

WORD ORIGIN

social compact

noun

the voluntary agreement among individuals by which, according to any of various theories, as of Hobbes, Locke, or Rousseau, organized society is brought into being and invested with the right to secure mutual protection and welfare or to regulate the relations among its members.

an agreement for mutual benefit between an individual or group and the government or community as a whole.

Maxime, thank you for summarizing my concept of wealth surpluses and that such surpluses rightfully belong to society as a whole.